To work out the sales proceeds (or cash) you will receive from the sales of your HDB, you will need the following information:

- Estimated Sales Price of Your Property

- Outstanding Mortgage Loan Amount

- CPF Monies Utilised

- Property Agent Commission

- Legal Fees

- Mortgage Loan Pre-Payment Penalties

- Other

Estimated Sales Price of Your Property

You can work out the estimated sales price of your property by reference to the past transacted prices and past transactions can be found at https://services2.hdb.gov.sg/webapp/BB33RTIS/.

Alternatively, you may use our Check your Property Value service to get an estimate of your property prices. Please do provide the full address when submitting the request, the request will be rejected for submission without a full address.

Outstanding Mortgage Loan Amount

If you are taking a bank loan, you can check the outstanding mortgage loan amount by giving your banker a call.

If you have taken an HDB loan, you can visit www.hdb.gov.sg to find out the outstanding mortgage loan amount.

Here are the steps to find out how much outstanding mortgage loan you have with HDB:

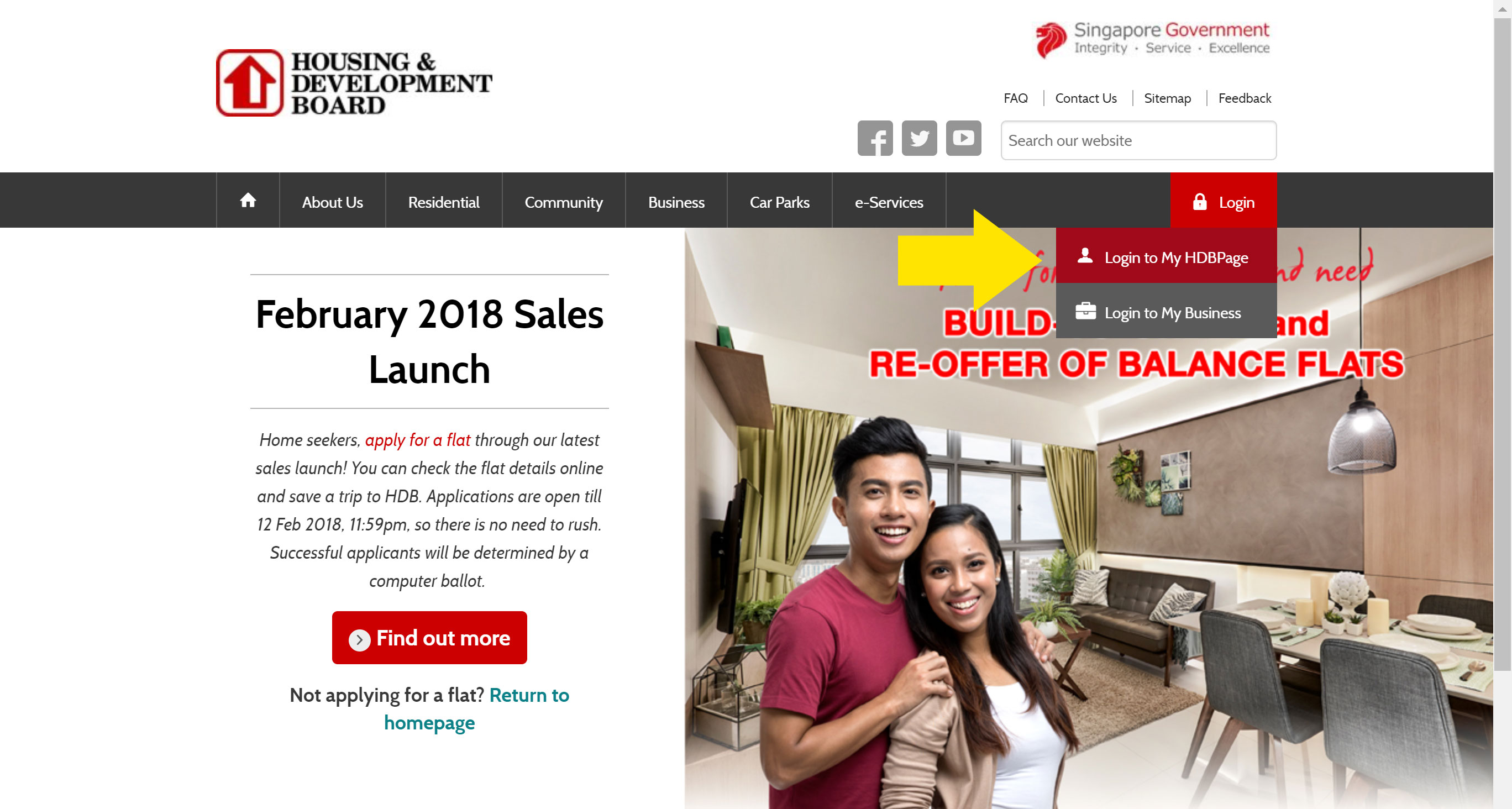

Step 1: Go to www.hdb.gov.sg. After you have reached the page, mouse over “Login” and click on “Login to My HDBPage”, right after, sign in using your Singpass ID and password.

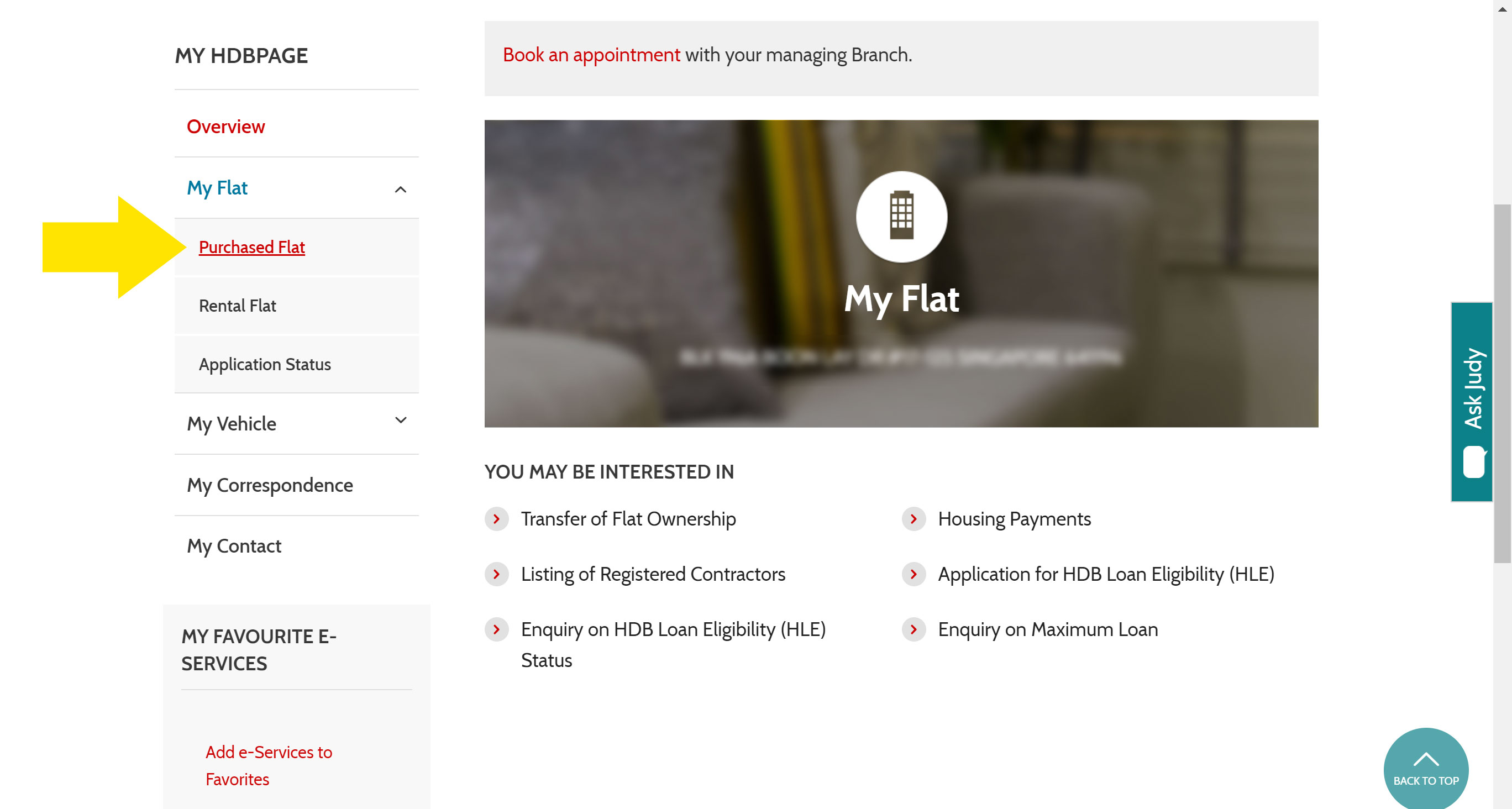

Step 2: Scroll down, click on “My Flat”. After the menu has expanded, click on “Purchased Flat”.

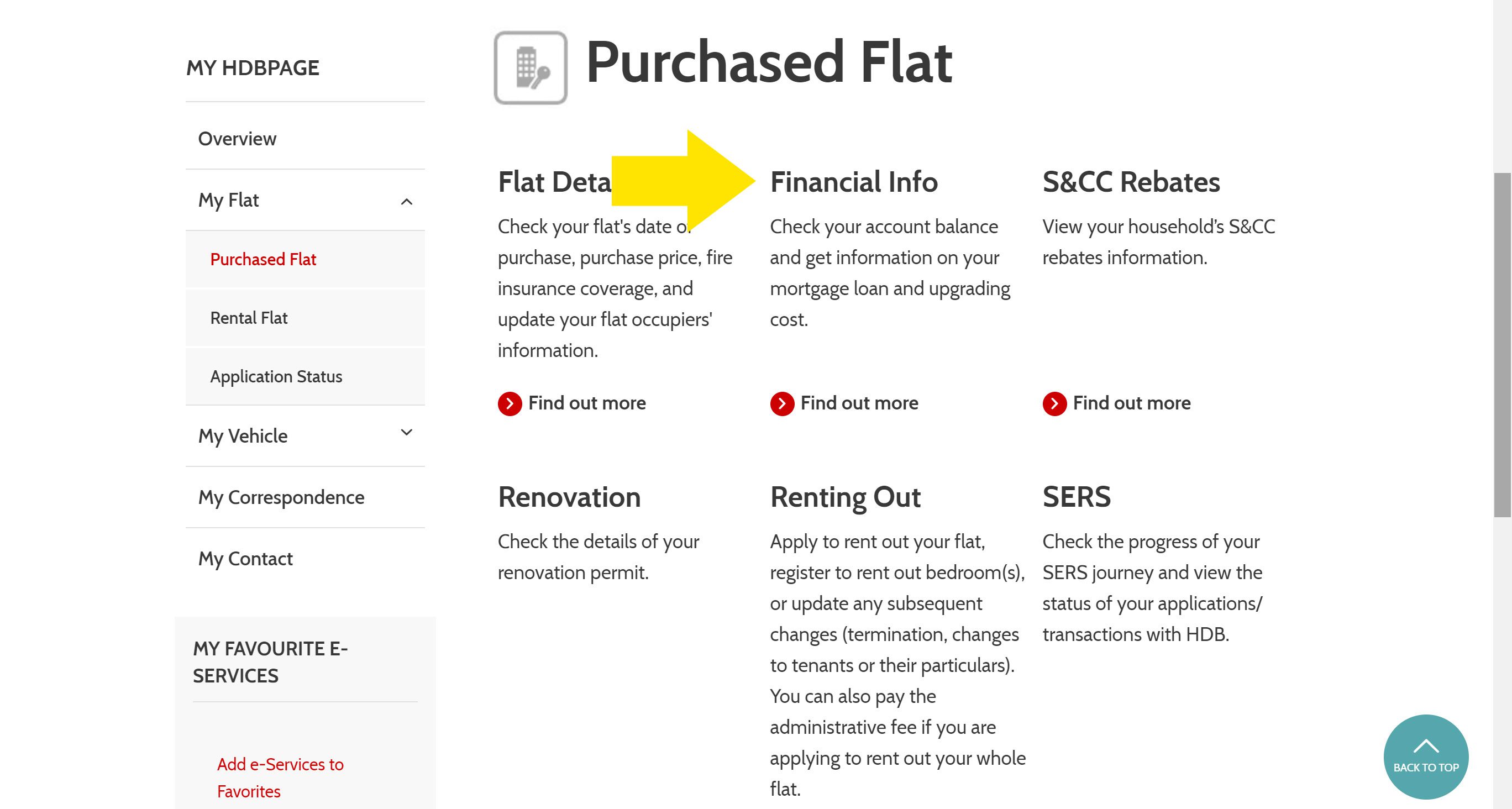

Step 3: Click on “Financial Info”.

Step 4: You will be able to find your outstanding balance at this page.

CPF Monies Utilised

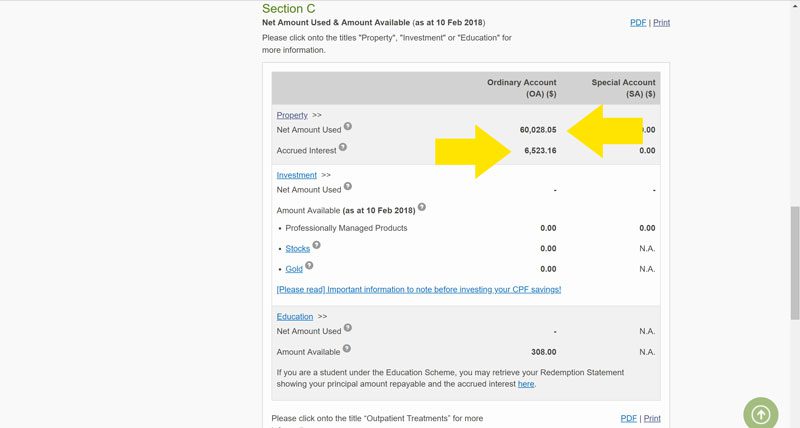

The amount of CPF monies used to pay for your property have to be returned to your CPF Ordinary Account after the sales of your property, including the accrued interest.

Here are the steps to find out how much CPF monies, including, accrued interest has to be returned to CPF after selling your property:

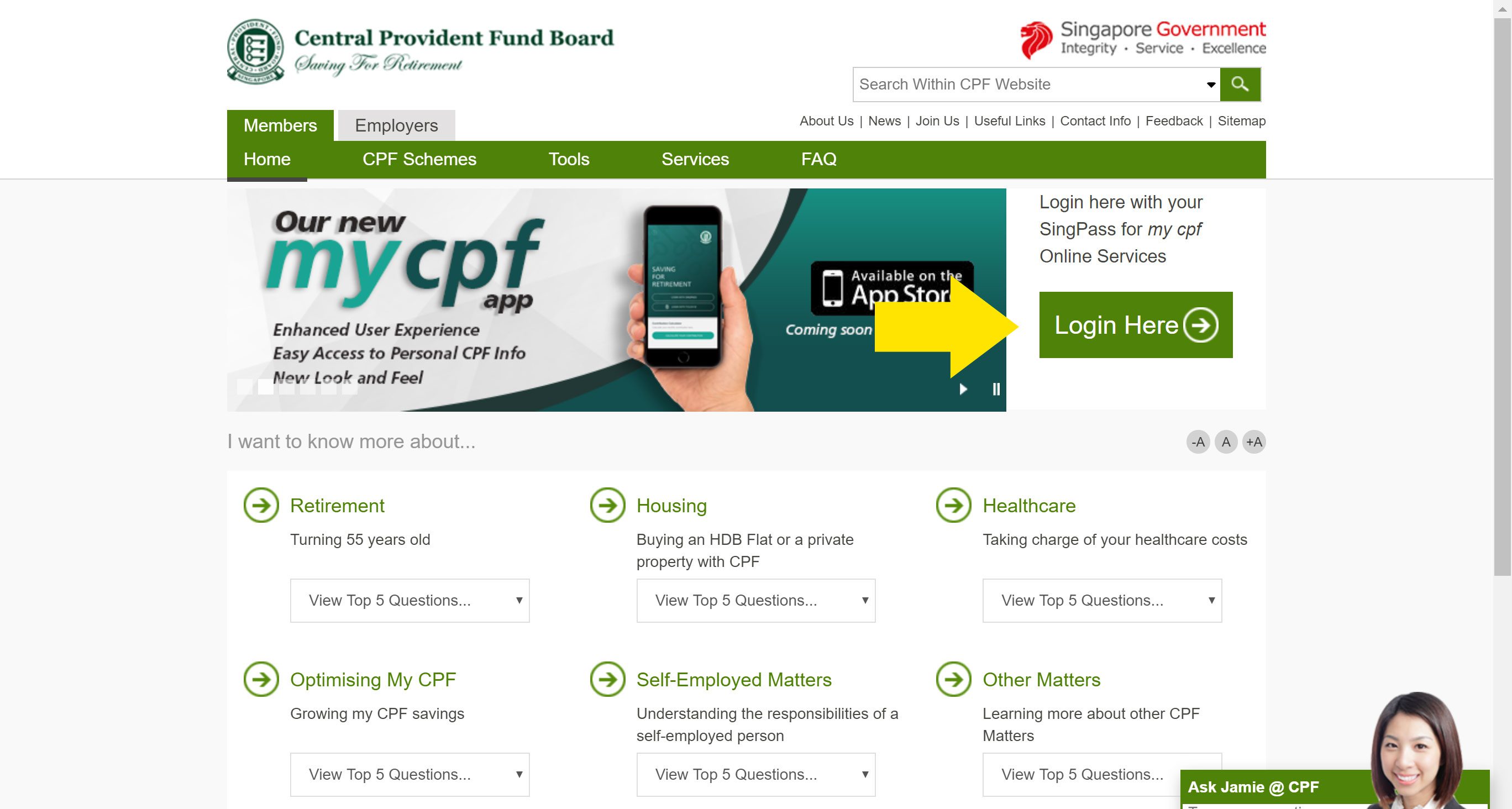

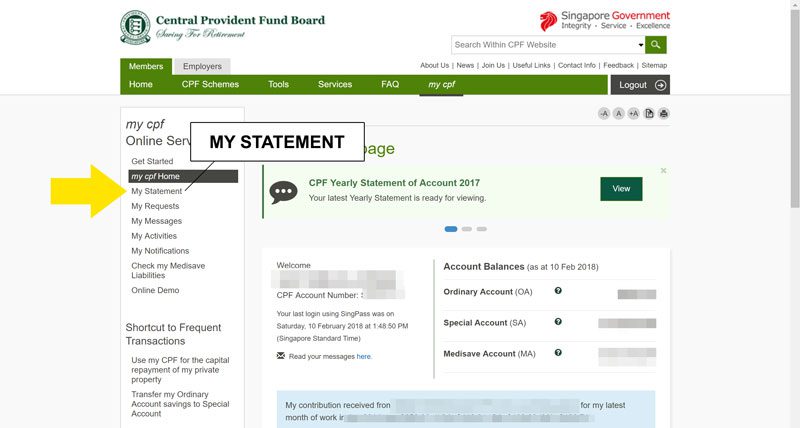

Step 1: Go to www.cpf.gov.sg. After the page is loaded, click on “Login here” and sign in using your Singpass ID & password.

Step 2: After logging in, click on “My Statement”

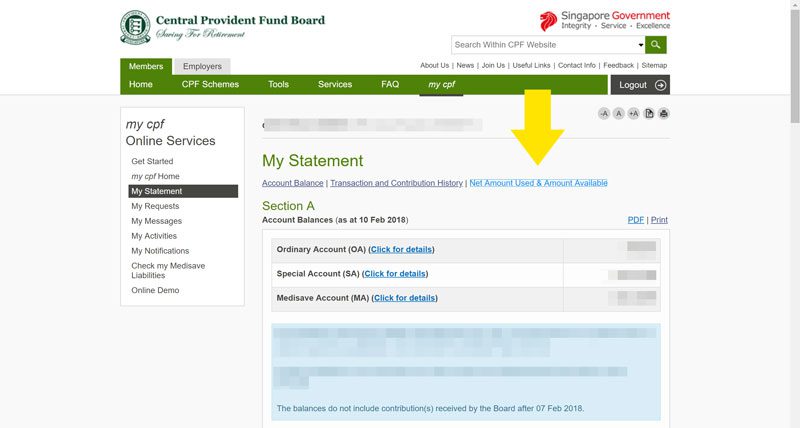

Step 3: Click on “Net Amount Used & Amount Available”.

Step 4: You will be able to find the amount of CPF used for your property purchase and accrued interest.

Property Agent Commission

If you have used the service of a property agent to sell your property, typically, you would have to pay 1 to 2% of the sales price + prevailing GST.

Legal Fees

To complete the transaction, the service of a lawyer is required and the fees payable is between S$2,000 to S3,000.

Mortgage Loan Pre-Payment Penalties

In the event that you sell your property before the expiration of the lock-in period of your home loan, you will have to pay a penalty fee that usually amounts to 1.5 percent of your outstanding loan. That means if you have S$500,000 remaining on your loan, you may have to pay a S$7,500 penalty.

Other Cost

You will have to pay up the outstanding property tax, maintenance fees etc.

Case Studies

John has bought a property more 3 years back and decided to sell his property at an estimated price of S$600,000 with the agreement to pay a property agent a commission of 2%. He has checked that he has to refund his CPF with accrued interest of around S$150,000 and has an outstanding loan of S$300,000 with refinancing done in less than 1 year. His sales proceeds will be $130,660.

Calculations are shown in the table below:

| Sales Price | S$ 600,000 |

| Less | |

| Outstanding Loan | S$ 300,000 |

| CPF Monies + Accrued Interest | S$ 150,000 |

| Property Agent Commission + 7% GST | S$ 12,840 |

| Legal Fees | S$ 2,000 |

| Mortgage Loan Pre-Payment Penalties | S$ 4,500 |

| Others | S$ 0 |

| Estimated Cash Proceeds | S$ 130,660 |

Do hope the above article helped you in working out the estimated sales proceed from the sales of your property.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.

Edwin Goh

With his love for numbers and data, Edwin has provided valuable insights to his clients and readers to empower them to make better-informed real estate decisions.

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.