Singapore’s housing landscape has always been carefully managed to keep public housing affordable and accessible. To balance this need with the growing demand for homes in prime areas, the Housing & Development Board (HDB) recently introduced a new policy: the BTO subsidy clawback for prime and plus flats.

This means that if you purchase a prime or plus flat, you’ll need to return 6% to 9% of your resale price to HDB when you decide to sell. This clawback is intended to help maintain the affordability of flats in desirable areas while preventing homeowners from profiting excessively from their resale.

But what does this mean for you as a buyer? Let’s break it down.

What Are Prime and Plus Flats?

Prime flats are located in high-demand, central locations, such as the city center or near key transport hubs. These homes come with extra subsidies to make them more affordable, but as you might expect, the government wants to keep these flats within reach for future buyers. That’s where the subsidy clawback comes in.

Plus flats, on the other hand, are in areas with high growth potential or excellent connectivity, though not quite as central as prime flats. They receive slightly less subsidy, and the clawback is also lower, at 6%.

How Does the Subsidy Clawback Work?

When you sell your prime or plus flat after fulfilling the Minimum Occupation Period (MOP), you must return a percentage of the resale price to HDB. The clawback amounts are:

- Prime flats: 9% of the resale price

- Plus flats: 6% of the resale price

This percentage is based on your flat’s selling price, not the amount you initially paid for it. So, if you sell a prime flat for $1 million, you must return $90,000 to HDB.

Here’s a quick look at the clawback structure:

How Does the Clawback Affect Buyers and Sellers?

This clawback affects both buyers and sellers of prime and plus flats:

For Sellers: You’ll have to consider the clawback when pricing your flat for resale. For example, if you’re selling a prime flat for $1 million, you’ll need to return $90,000 to HDB. This reduces your net profit compared to selling a standard BTO flat, where no clawback applies.

For Buyers: While prime and plus flats are in desirable areas and come with more government subsidies, you’ll need to consider the long-term implications of the clawback. If you plan to sell the flat, you won’t be able to keep the full resale price, as a portion goes back to HDB. However, these flats may still offer value if you plan to stay long-term, thanks to their ideal locations.

Why Was the Clawback Introduced?

The subsidy clawback aims to maintain fairness in the public housing market. Without this clawback, owners of prime and plus flats could benefit from the significant government subsidies and later sell their flats at a much higher price, pocketing a huge profit. This policy ensures that the benefits of the subsidies are passed on to future buyers rather than just the first batch of owners.

By clawing back a portion of the resale price, HDB moderates the financial gain from selling prime and plus flats, which helps keep housing prices more stable and fair across the board.

Comparing Prime, Plus, and Standard Flats

Let’s take a closer look at the differences in subsidy clawback across the various flat types and how it impacts the resale price:

As you can see, for a prime flat sold at $1 million, the seller will return $90,000 to HDB. The same flat under the plus scheme will require $60,000, while standard flat sellers keep the full resale amount.

Price Table for Recent Prime and Plus BTO Launches

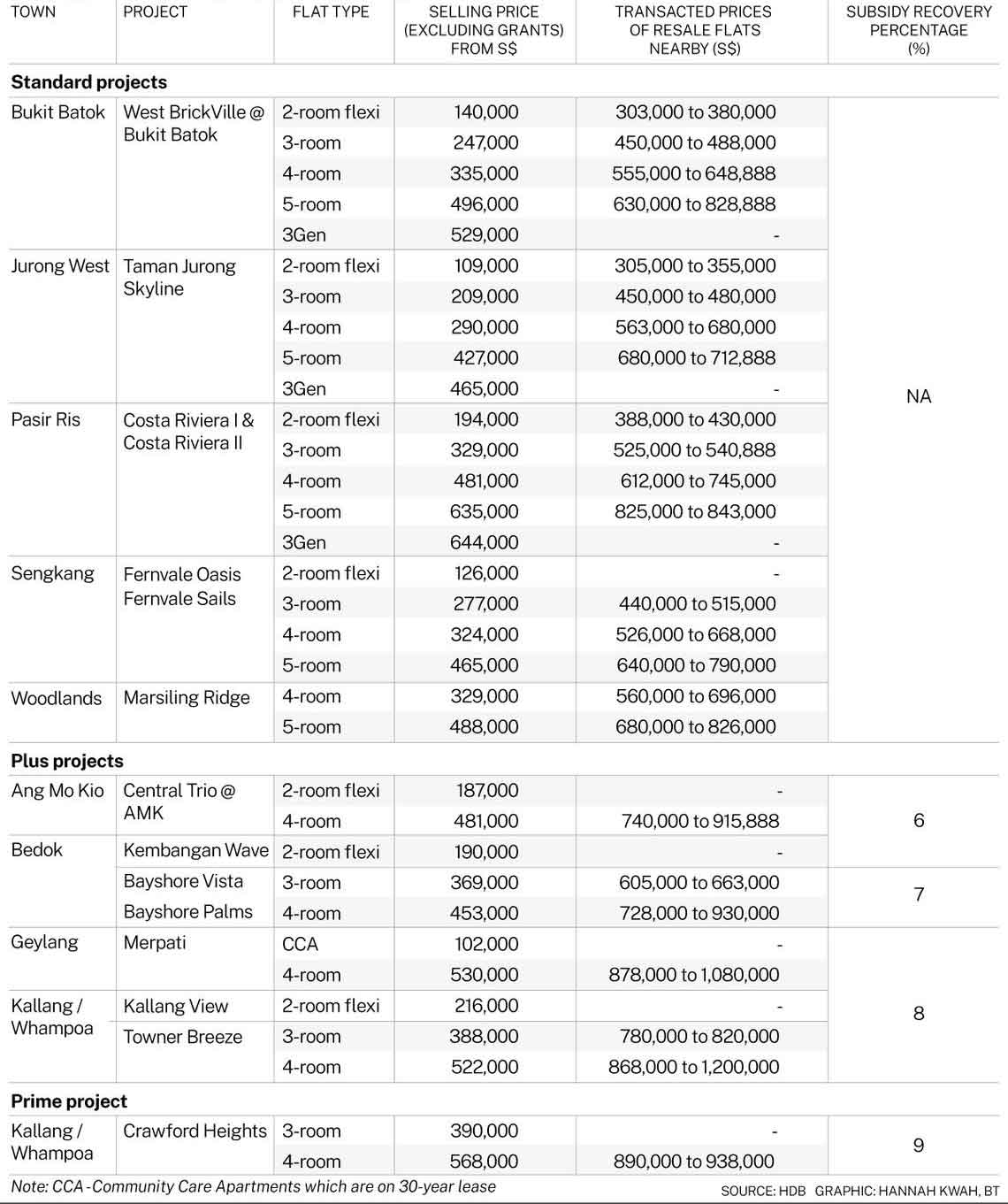

Here’s an overview of recent prime and plus BTO launches in Oct 2024, highlighting the price ranges buyers can expect:

These prices are highly competitive, considering the prime and plus locations, but buyers should remember to account for the eventual clawback.

What Should Buyers Consider?

When considering buying a prime or plus flat, it’s important to weigh the advantages of location and subsidies against the long-term impact of the clawback. If you plan to stay in your flat for many years, the clawback may not be a significant concern, as the location benefits and subsidies can outweigh it.

However, if you’re looking for a home without resale restrictions or clawbacks, consider a standard BTO flat or even explore resale flats, which offer more immediate control over the full resale price.

Explore More Options

If you’re exploring new developments, visit our new condo launches page on PropertyNet.sg to see the latest projects and exciting opportunities in the market.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.