Singapore’s property market witnessed an unprecedented surge, setting a new record with over 1,500 new homes sold in a single weekend. This remarkable feat was achieved across three major launches — Emerald of Katong, Nava Grove, and Novo Place. The numbers speak for themselves: over 1,500 units were swiftly snapped up, potentially marking November 2024 as the month with the highest new home sales since March 2013.

This unprecedented weekend isn’t just a headline — it reflects shifting market dynamics, changing buyer behaviour, and renewed confidence in Singapore’s real estate sector. Let’s break down what made this weekend historic, analyse the trends driving these sales, and, most importantly, offer actionable insights for those looking to make their mark in the market.

Weekend Highlights: What Made This Weekend Special?

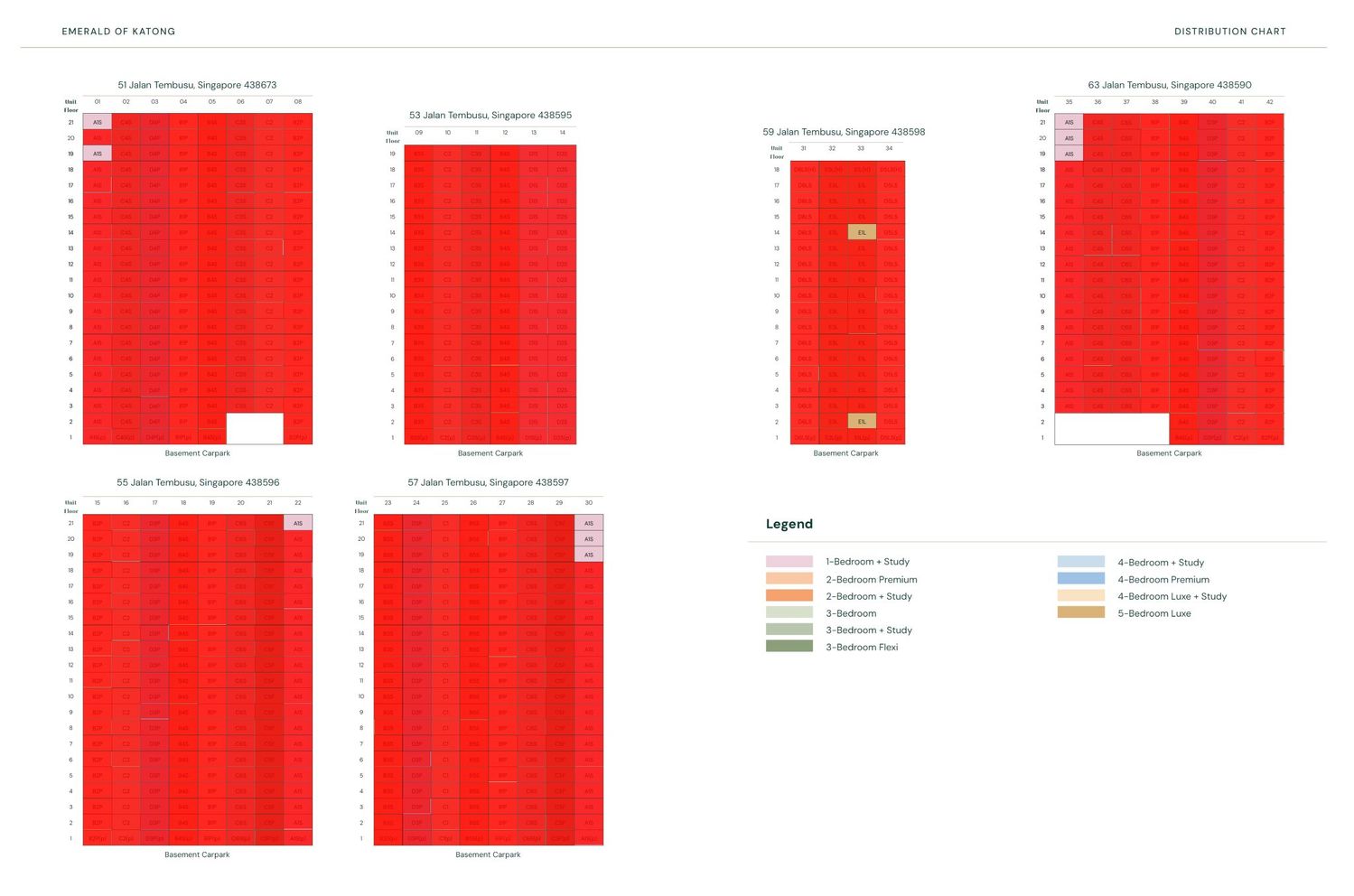

1. Emerald of Katong: A Record-Setting Performance

- Units Sold: 835 out of 846 units (98.7% take-up rate).

- Average Price: S$2,621 psf.

- Price Range: S$1.2 million for a one-bedroom-plus-study to S$3.5 million for a five-bedroom luxe unit.

- Buyer Appeal: Located on the East Coast, competitive pricing and vibrant lifestyle amenities.

Emerald of Katong emerged as the weekend’s star. With a competitive launch price of S$2,423 psf (starting), this project attracted overwhelming interest. The developer’s decision to hold prices steady reassured buyers, resulting in a near sell-out on launch day. Buyers who missed out turned to nearby projects like Tembusu Grand and The Continuum, which recorded additional sales over the weekend.

2. Nava Grove: Nature Meets Urban Living

- Units Sold: 359 out of 552 units (65% take-up rate).

- Average Price: S$2,448 psf.

- Unit Mix: Two- to five-bedroom units.

- Price Range: From S$1.4 million for two-bedroom units to S$4 million for five-bedroom units with private lifts.

Nava Grove is located in District 21 and combines modern luxury with a nature-inspired design. Its expansive green spaces, efficient layouts, and proximity to employment hubs like Jurong Lake District made it a magnet for professionals and families. Buyers favoured premium units, reflecting a growing appetite for well-designed, larger homes.

3. Novo Place: ECs Prove Their Appeal

- Units Sold: 286 out of 504 units (57% take-up rate).

- Average Price: S$1,654 psf.

- Buyer Profile: HDB upgraders taking advantage of deferred payment schemes.

Novo Place capitalised on its strategic location as one of the few executive condominiums (ECs) near an MRT station. The project’s deferred payment scheme proved especially popular, easing financial strain for families transitioning from HDB flats to private housing. With four-bedroom units fully sold, Novo Place underscored the demand for spacious, affordable homes.

Key Trends Driving the Surge

1. Strategic Launch Timing

November saw six new launches offering over 3,500 units. This condensed schedule was strategically timed, creating a sense of urgency among buyers, who acted quickly to secure their preferred units before year-end price adjustments.

2. Favourable Market Conditions

Lower interest rates and a softening in private home prices rejuvenated buyer confidence. Many buyers saw this as an opportunity to lock in properties before future price hikes or government cooling measures.

3. FOMO and Investment Opportunities

Fear of missing out (FOMO) played a significant role, particularly among parents purchasing homes for their children as long-term investments. Trust structures were frequently employed to facilitate these purchases, reflecting the rising wealth of local families and an influx of overseas funds.

4. Buyer Demographics

- Singaporeans: Most buyers were locals, including young professionals, families, and HDB upgraders.

- Investors: Increasingly, affluent investors turn to real estate as a stable asset class amid fluctuating global markets.

What This Means for the Market

A Return to Confidence

The weekend’s robust sales figures highlight renewed confidence in the real estate market. Buyers are viewing properties not only as homes but also as resilient investments.

Potential Cooling Measures

Anticipating Potential Cooling Measures If the current sales momentum continues, the government may step in with cooling measures. For buyers, making informed decisions now could mean avoiding stricter regulations or higher costs in the future.

Shift Toward Larger Units

The demand for two- and three-bedroom units and premium configurations with flexible layouts reflects a growing preference for spacious homes that accommodate lifestyle changes.

Actionable Insights: How to Navigate the Current Market

For those looking to enter Singapore’s dynamic property market or make their next move, here are practical tips to guide you:

1. Research Upcoming Projects

The recent surge shows that timing and preparation are everything. Start researching upcoming launches now to secure your spot. Explore hidden opportunities at PropertyNet.sg for a curated list of new developments.

2. Subscribe to Alerts

Stay ahead of the curve by joining mailing lists or bookmarking resources like this page for timely updates on future launches. Being informed about projects before they hit the market gives you a competitive edge.

3. Consider ECs for Affordability

Executive Condominiums (ECs), such as Novo Place, provide a rare opportunity for eligible buyers, blending affordability with an elevated lifestyle. They are especially attractive to HDB upgraders, thanks to the Deferred Payment Scheme (DPS), which allows them to defer a significant portion of the payment until the EC is ready for occupation.

HDB upgraders also enjoy the flexibility of staying in their HDB flats while waiting for the EC to be completed. Once their new home is ready, they can move into the EC and sell their HDB flat, ensuring a seamless transition without needing temporary housing.

Additionally, HDB upgraders benefit from exemptions from Additional Buyer’s Stamp Duty (ABSD) when purchasing an EC, and the Loan-to-Value (LTV) ratio remains calculated based on a single loan. These advantages make ECs an excellent option for HDB upgraders, offering financial ease and a smoother upgrade path to their dream home.

4. Analyse Pricing with GFA Harmonization

Comparing your chosen project’s price per square foot (psf) to district medians is smart, but remember the impact of the recently introduced GFA Harmonization. For instance, projects like Emerald of Katong, developed under the new GFA rules, naturally reflect a higher PSF. However, it was still priced below the RCR median, making it exceptional. Additionally, remember to evaluate factors like accessibility to amenities, MRT stations, and employment hubs, which can significantly enhance a property’s appeal.

5. Be Ready to Act

In a competitive market, hesitation can cost you. Here’s how to stay ready:

- Pre-Qualify for Loans: Get your mortgage pre-approval to ensure a smooth buying process.

- Prepare Financials: Ensure you are prepared for your down payment, which includes Buyer’s Stamp Duty (BSD) and, if applicable, Additional Buyer’s Stamp Duty (ABSD). These duties constitute a significant portion of the total purchase cost. To calculate the exact amount, you can use our Buyer’s Stamp Duty calculator for a detailed breakdown of the duties payable for your purchase.

- Engage an Agent: A property agent with a strong track record can guide you through launches and negotiations.

6. Think Long-Term

Rising land and construction costs mean that future launches will likely be priced higher. Buying now, especially in competitive-priced projects, benefits you from future appreciation.

7. Network and Gather Insights

Join property forums, attend webinars, and consult experts. Understanding market sentiment can help you make informed decisions.

Extra Tips for Pure Investors

- Explore Undervalued Prime Districts with Potential for a Comeback: Districts 1, 2, 9, 10, and 11 have underperformed in recent years, partly due to the absence of foreign buyers and the perception that properties in these areas are beyond the reach of most Singaporeans. However, as sales in these districts remain subdued, property prices in mass-market areas have started to close the gap. With their abundant amenities, centralised locations, and excellent connectivity, these prime districts may become attractive again once buyers recognise their value. By reviewing these areas now, you can stay ahead of the curve and seize opportunities before the market turns its attention back to them.

- Diversify Your Portfolio for Balanced Risk and Returns: Incorporate a mix of residential, industrial, and commercial properties into your portfolio to achieve a well-rounded investment strategy. Industrial and commercial properties offer the advantage of more stable rental income and potentially higher returns. Additionally, these asset types are exempt from Additional Buyer’s Stamp Duty (ABSD) and often attract interest from international buyers, which can further enhance their value and growth potential. Use our ROI calculator to estimate the ROI of your investment and make informed decisions.

Looking Ahead: What’s Next for 2025?

The extraordinary sales numbers of this weekend are a strong indication that Singapore’s property market is entering a new phase of growth. While developers celebrate a triumphant close to 2024, buyers and investors must navigate the opportunities and challenges ahead.

For those who missed out, the journey isn’t over. Keep exploring, stay informed, and seize the right opportunities. With careful planning, your dream home—or investment—can become a reality.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.