One Marina Gardens and Aurelle EC Shine, While Bloomsbury Takes a Cautious Step

One Marina Gardens: A Bold Start in Marina South

Kingsford Group’s One Marina Gardens has made a significant impact as Singapore’s first private residential launch in the Marina South precinct. Unlike previous launches in the area, such as Marina One Residences and Marina Bay Residences, which struggled to attract buyers and saw owners incurring losses, One Marina Gardens has defied this trend. During its debut weekend, 37% of its 937 units were sold, indicating strong interest and confidence in the area’s potential.

This positive reception reflects the ongoing transformation of Marina South, driven by the government’s vision to develop a vibrant, sustainable, and community-focused district as part of the Greater Southern Waterfront initiative. This presents a promising investment opportunity for savvy investors who can recognise the upcoming changes that will turn the Marina South district into a lively community for families. For more insights on the potential of the Marina South district, you can refer to our article, “Marina Bay Condos Are Making Losses: Why and What’s Next.”

Buyers are drawn to the project’s unblocked sea views, direct access to the future Marina South MRT station, and proximity to iconic landmarks like Gardens by the Bay. With prices starting at approximately S$1.16 million for a one-bedroom unit and an average of S$2,953 psf, One Marina Gardens is positioning itself as a premium investment for those looking to capitalize on the area’s long-term potential. One property analyst noted, “The upcoming developments in Marina South are set to change the course of this precinct, and smart investors are taking the first-mover advantage.”

For those considering a similar investment, our affordability calculator can help you assess what fits your budget in this evolving landscape.

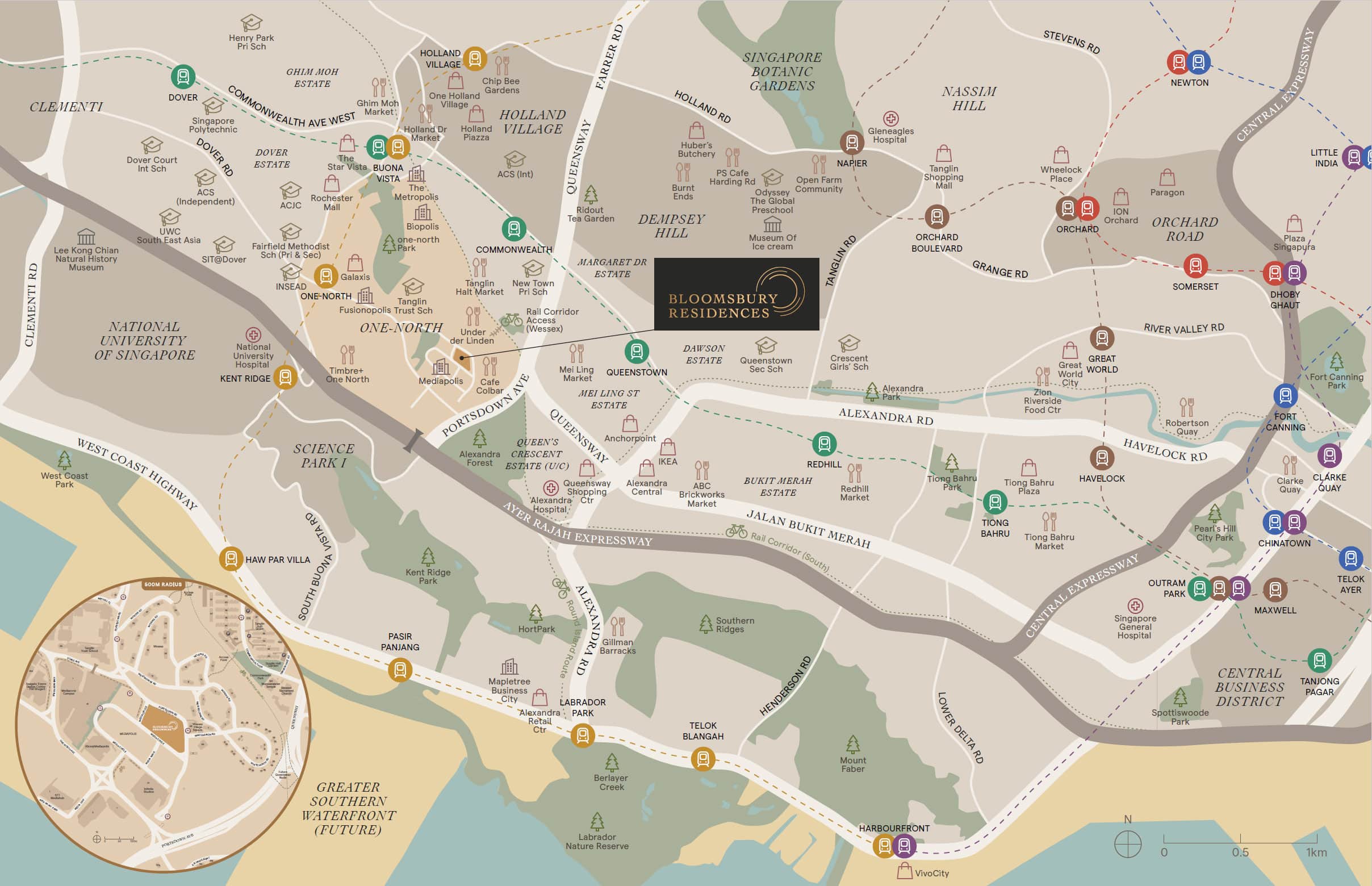

Bloomsbury Residences: A Cautious Step in One-North

In contrast, Bloomsbury Residences at Media Circle has seen a more measured response, with 25% of its 358 units sold during its launch weekend. Developed by Forsea Residence and Qingjian Realty, this project is located in the heart of One-North, a hub for tech, media, and biomedical professionals. While its modern design and thoughtful layouts have attracted interest—particularly for its two-bedroom premium + study and three-bedroom premium units—the take-up rate pales compared to the 75% sold at the nearby Blossoms by the Park during its launch.

This cautious approach from buyers may reflect broader economic concerns, including the ongoing trade war, which has made some investors hesitant to commit. However, with prices averaging S$2,474 psf and a prime location near key employment centres, Bloomsbury Residences remains an attractive option for professionals seeking convenience and connectivity. One industry expert observed, “The slower sales at Bloomsbury highlight a more discerning market, where buyers are weighing global uncertainties against long-term value.”

For a deeper understanding of how global trade tensions might impact property decisions, check out our guide on navigating tariff uncertainty.

Aurelle of Tampines EC: A Resounding Success

Meanwhile, Aurelle of Tampines EC has emerged as the show’s star, achieving a remarkable 100% sell-out within hours of opening its remaining units to HDB upgraders. Developed by Sim Lian Group, this 760-unit executive condominium (EC) in the mature Tampines estate was snapped up at an average price of S$1,500 psf, underscoring the enduring appeal of ECs in Singapore.

Buyers were drawn to Aurelle’s strategic location near the future Tampines North MRT station, its practical layouts, and its affordability compared to private condos. The project’s success also reflects EC buyers’ confidence in the asset class, with many sitting on substantial paper gains or having profited handsomely from previous EC investments. One recent buyer shared that “ECs offer the best of both worlds—affordability and the potential for strong capital appreciation.”

For those still searching for an EC, explore our list of executive condominiums with unsold units to find your ideal home before it’s too late.

Market Insights: Navigating Uncertainty

The contrasting performances of these three launches offer valuable insights into the current state of Singapore’s property market. While global trade tensions have undeniably created a climate of caution—evident in Bloomsbury’s slower sales—certain segments remain robust. One Marina Gardens’ strong debut suggests buyers are willing to invest in projects with clear long-term potential, particularly in areas earmarked for transformation. Meanwhile, Aurelle’s rapid sell-out highlights the unwavering demand for well-located, affordable homes, especially among HDB upgraders.

As the trade war unfolds, buyers and investors must stay informed and strategic. To keep up with the latest insights and market updates, join our mailing list or connect with us on our WhatsApp or Telegram channels for timely advice and strategies.

What’s Next? Your Turn to Predict

With these launches setting the stage, all eyes are now on the upcoming W Residences at Marina View and Arina East Residences. Will they follow in the footsteps of One Marina Gardens and Aurelle, or will buyer caution prevail? We’d love to hear your thoughts—guess the take-up rates for these two projects in the comments below!

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.