The skyline of Marina Bay stands as a breathtaking testament to Singapore’s ambition, showcasing the striking silhouette of Marina Bay Sands, the lush vibrancy of Gardens by the Bay, and a waterfront that exudes prestige. However, recent transaction data from 2024 to 2025 unveils a surprising trend: many condominiums are being sold at a loss.

Three key factors contribute to this disconcerting situation:

- A hefty 60% Additional Buyer’s Stamp Duty (ABSD) that significantly deters foreign buyers.

- A dearth of family-friendly amenities leaves Marina Bay feeling eerily quiet after dark.

- A historical focus on oversized or investor-targeted units has made homeownership unattainable for many locals.

In response to these challenges, One Marina Gardens is pioneering a new vision for the Marina South district, catering specifically to local families. This remarkable development offers exquisite three-bedroom units priced at $2.45 million, thoughtfully designed for the needs of family living. Despite the uncertainties stemming from global trade tensions, including U.S.-China tariffs, One Marina Gardens has made a notable impact, selling 38% of its 937 units by April 2025 at an impressive average price of $2,953 per square foot. This article delves into the underlying causes of these financial losses, celebrates the resilience of Marina Bay, and highlights how the family-centred future of Marina South by 2030 presents exciting opportunities for both homebuyers and savvy investors.

Why Losses Are Happening: ABSD, Amenities, and Unit Mix

Marina Bay was once an attractive destination for foreign investors, with one-bedroom units at Marina One Residences selling for $2,300 per square foot (psf) and four-bedroom suites at Marina Bay Suites fetching $2,800 psf. However, the introduction of a 60% Additional Buyer’s Stamp Duty (ABSD) for foreigners, aimed at curbing speculative investment and preventing price inflation in Singapore’s limited market, has significantly reduced foreign demand.

Additionally, Marina Bay lacks family-friendly amenities, such as playgrounds and community spaces, resulting in a quiet atmosphere at night when office workers leave the Central Business District (CBD). This has contributed to a perception of the area as a “quiet town.” Previous developments have also discouraged local families due to the availability of disproportionately large three, four, or five-bedroom units that are priced far beyond the reach of most locals (for example, four-bedroom units at Marina Bay Residences range from $4 million to $19.35 million) or a high percentage of one- or two-bedroom units (priced between $1.26 million and $1.82 million) targeting investors seeking rental income.

Transaction data from 2024 to 2025 highlights these trends:

- The Sail at Marina: 67.6% of 139 transactions were profitable, while 32.4% incurred losses. The average annualized return for three-bedroom units is a modest 0.04%, indicating a cautious market.

- Marina Bay Residences: 77.3% of 44 transactions resulted in profits, with 22.7% resulting in losses, supported by its central location.

- Marina One Residences: Only 25% of the 40 transactions were profitable, with 72.5% incurring losses and 2.5% breaking even, largely affected by high entry prices in 2017.

- Marina Bay Suites: Only 7.3% of 41 transactions were profitable, with a staggering 92.7% resulting in losses, as larger luxury units struggle to attract family buyers.

The ABSD, the lack of suitable amenities, and the mismatched unit mix have created a market disconnect: condominiums built for foreign investors or large families do not cater well to local families seeking affordable, practical homes. However, the profitability of The Sail and Marina Bay Residences suggests a market floor where local buyers can find value, reinforced by the ABSD’s role in keeping prices accessible. One Marina Gardens addresses this issue by offering a balanced unit mix and lower price points, which resonate with local families, as demonstrated by its strong sales.

Market Resilience Amid Trade War Challenges

Global trade wars, particularly the tariffs between the U.S. and China, have raised concerns about supply chain disruptions and inflation, creating uncertainty in property markets. Despite these challenges, Singapore’s prime districts, including Marina Bay, have shown remarkable stability. The sales performance of One Marina Gardens is particularly noteworthy, with 38% of the 937 units sold by April 2025 at an average price of $2,953 per square foot. This reflects strong local demand, driven by families and investors who are confident in Singapore’s stability.

This resilience highlights Marina Bay’s appeal as a safe haven, as local buyers prioritize long-term value over global volatility. The project’s three-bedroom units, priced at $2.45 million and designed for family living, have resonated well with buyers, indicating a market that continues to thrive despite external pressures.

Pricing That Appeals to Local Families

One Marina Gardens, developed by Kingsford Development, features pricing designed for local families: –

- One-bedroom unit: $1.18 million (420 sqft, $2,810 per sqft)

- Two-bedroom unit: $1.8 million (646 sqft, $2,786 per sqft)

- Three-bedroom unit: $2.45 million (904 sqft, $2,710 per sqft)

- Four-bedroom unit: $4.45 million (1,647 sqft, $2,702 per sqft)

Unlike earlier developments that offered high prices for large units or focused on one- and two-bedroom units for investors, One Marina Gardens’ three-bedroom unit at $2.45 million is affordable for local families. This pricing is notably lower than the resale prices in Marina Bay. The table below compares the quantum prices of One Marina Gardens with market averages and maxima, demonstrating buyers’ willingness to pay more for comparable units.

Buyers have paid as much as $4.85 million for three-bedroom units at Marina Bay Residences and $3.9 million at The Sail, with prices averaging between $2.7 million and $4 million. This is significantly higher than the $2.45 million for One Marina Gardens. The high prices of earlier projects, ranging from $10 million to $19.35 million for four-bedroom units, have discouraged local buyers. In contrast, the more balanced pricing of One Marina Gardens appeals to families. Additionally, smaller units, like the one-bedroom priced at $1.18 million, compete with resale maximums of $1.82 million, attracting young families and investors. The project’s sales figures, showing 38% sold by April 2025, indicate its suitability for local demand, addressing Marina Bay’s nighttime quietness with a vision designed for families.

Marina South: Revitalizing a Quiet Town

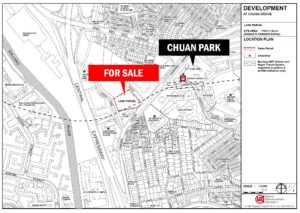

By 2030, Marina South aims to revitalize Marina Bay, transforming it from a quiet nighttime area into a lively, family-focused precinct with limited car traffic. Urban plans include the creation of a 10-minute neighborhood that allows residents and visitors to easily access mixed-use developments. These will feature green spaces in Marina South Park, vibrant retail hubs, and pedestrian-friendly corridors, all within a short walking distance. This design fosters a strong sense of community.

The plans emphasize a curated mix of amenities tailored to the needs of families, including community spaces, healthcare, childcare, fresh food groceries, and play areas, as illustrated in the conceptual map of Marina South’s future layout. Additionally, land around One Marina Gardens will be designated for residential developments that cater to families, along with community spaces and amenities. This addresses the historical lack of family-friendly facilities in the area.

One Marina Gardens, featuring 937 units, is at the heart of the revitalisation effort in Marina South. The development will offer spacious three-bedroom units measuring 904 square feet, along with family-oriented amenities, including:

- Family-Friendly Design: The three-bedroom layouts are complemented by playgrounds, family pools, and communal gardens, all of which aim to foster family bonding.

- Fresh 99-Year Lease: Starting in 2025, the lease will extend beyond that of The Sail (2002) and Marina Bay Residences (2005).

- Waterfront Views: Residents will enjoy unobstructed vistas of Marina Bay Sands & Gardens by the Bay, enhancing the family living experience.

- Seamless Connectivity: Direct access to the Marina South MRT station will make commuting easy.

- Sustainable Amenities: The development will feature smart technology, an infinity pool, and sky gardens, catering to modern family lifestyles.

By introducing family-oriented amenities and leveraging the surrounding land for new residential and community developments, One Marina Gardens is poised to transform Marina South into a vibrant, cohesive community, addressing the current nighttime lull in Marina Bay.

Investment and Lifestyle: Opportunities and Risks

The Marina Bay market demonstrates a support price where demand continues despite potential losses. The Sail has achieved a 67.6% profit rate on its sales, with only a minimal return of 0.04% for three-bedroom units. This indicates that buyers are securing value, with average purchases for family-sized units around $2.7 million, reinforcing the appeal of One Marina Gardens’ three-bedroom offerings at $2.45 million.

For instance, a 1,500 sqft three-bedroom unit at The Sail sold for $2.7 million, illustrating that families are willing to invest in the prestige of Marina Bay at accessible price points. The rental yields further strengthen this case, with Marina Bay projected to offer average yields between 3.7% and 4.0%. Specifically, The Sail boasts a yield of 4.0% at $6.88 per square foot per month, while Marina Bay Residences comes in at 3.9% with a rate of $7.39 per square foot per month. These figures outpace yields in other prime districts, which range from 2.5% to 3.5%.

Additionally, a 900 sqft three-bedroom unit at Marina Bay Residences can rent for between $7,500 and $9,000 monthly, providing a reliable income stream. The anticipated transformation of Marina South by 2030, featuring new residential projects, retail options, and community spaces, promises significant capital growth, making it attractive for both families and investors.

However, potential risks such as the global trade war and tariff-driven inflation should be approached with caution. Nevertheless, Singapore’s market stability helps mitigate these concerns, as discussed in our meeting on April 9, 2025.

FAQs: Navigating Marina Bay’s Market

Based on reader inquiries from our discussions on March 11 and April 12, 2025, here are answers to some common questions:

How has the 60% ABSD reshaped Marina Bay?

The 60% Additional Buyer’s Stamp Duty (ABSD) has deterred foreign buyers, reducing speculative capital. This has helped stabilise prices for local families and increased demand for family-oriented projects, such as One Marina Gardens, upcoming launches like W Residences at Marina View and more.

Why was Marina Bay less appealing for families?

Marina Bay was previously less attractive to families due to a lack of amenities like playgrounds and community spaces. Additionally, the area experienced a quiet nighttime scene as CBD (Central Business District) workers left for the day. Earlier projects focused on oversized or investor-centric units, making it less suitable for families. However, these issues have been addressed by One Marina Gardens, which offers balanced pricing and design.

Is buying during trade wars risky?

One Marina Gardens’ 38% sales indicate local confidence in the market. However, buyers should consider global risks alongside Singapore’s stability and long-term growth potential.

What makes One Marina Gardens a good investment?

With three-bedroom units priced at $2.45 million and projected yields of 3.7% to 4.0%, One Marina Gardens offers strong rental income and appreciation potential. Additionally, the development benefits from a fresh lease and the anticipated growth of Marina South by 2030.

What are the risks of buying now?

While losses in older projects indicate market volatility, One Marina Gardens’s market-supported pricing and family appeal, along with its 38% sales, help mitigate risks for potential buyers. Here’s a guide to navigate uncertainties and prepare for your upcoming real estate commitment: Navigating Tariff Uncertainty in the Singapore Property Market: A Practical Guide for Buyers and Investors

Marina Bay’s Family-Focused Future

Marina Bay is experiencing resale losses due to the 60% Additional Buyer’s Stamp Duty (ABSD), a lack of amenities for families, and an unsuitable unit mix in earlier developments. However, this signals a shift towards a family-oriented approach in the area. The previously quiet nighttime atmosphere is being revitalised by the Marina South 2030 vision, which aims to introduce vibrant parks, retail spaces, and new developments tailored for families.

One Marina Gardens, featuring three-bedroom units priced at $2.45 million, is at the forefront of this transformation. Despite uncertainties from the trade war, it had already achieved 38% sales. With competitive pricing and expected yields of 3.7% to 4.0%, along with strong growth potential, it presents an appealing opportunity for families and investors alike.

For more insights into this evolving market, visit PropertyNet.SG’s insights or join our WhatsApp and Telegram channels for updates.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.