Published on Apr 6, 2016.

“How to fully utilize your CPF/cash before your monies get locked up upon reaching 55 years of age.

The golden question that most property owners in Singapore are concerned about would be addressed in this article. Some definitions of the most used terms would be specified before we show you the sums and calculations based on past experiences that had helped our client achieve their desired property portfolios.

WHAT IS THE RETIREMENT SUM?

The amount of retirement savings which you have planned to set aside in your CPF Retirement Account to provide you with the monthly payouts from your payout eligibility age, which is currently at age 65.

As the retirement sum differs amongst individuals (i.e. depending on the year in which they turned 55), you may refer to the following Full Retirement Sum for those who have turned 55 from 1 July 2003 to 2015:

Table1.1

| 55th birthday on or after | Full Retirement Sum |

| 1 July 2003 | $80,000 |

| 1 July 2004 | $84,500 |

| 1 July 2005 | $90,000 |

| 1 July 2006 | $94,600 |

| 1 July 2007 | $99,600 |

| 1 July 2008 | $106,000 |

| 1 July 2009 | $117,000 |

| 1 July 2010 | $123,000 |

| 1 July 2011 | $131, 000 |

| 1 July 2012 | $139,000 |

| 1 July 2013 | $148,000 |

| 1 July 2014 | $155,000 |

| 1 July 2015 | $161,000 |

What are the different types of Retirement Schemes?

Currently, there are two levels of retirement sum to set aside in your Retirement Account – Basic or Full Retirement Sum. From January 2016, there is one more option to choose from – Enhanced Retirement Sum. The table below will be showing you how each scheme works.

Basic Retirement Sum: 50% of the Full Retirement Sum (FRS)

Figures are based on Retirement sum of $161,000:

Table 1.2

| Your monthly payout* for life from 65 | Retirement Account savings required at 55 | |

| If you own a property and choose to withdraw your Retirement Account savings above your Basic Retirement Sum (subject to sufficient CPF property charge/pledge) | $660 – $720 |

Basic Retirement Sum (BRS) $80,500 |

| If you do not own a property or choose not to withdraw your Retirement Account savings above your Basic Retirement Sum | $1,220 – $1,320 |

Full Retirement Sum (FRS) $161,000 The FRS is 2 x BRS. |

| If you wish to put more savings in CPF LIFE | $1,770 – $1,920 |

Enhanced Retirement Sum (ERS)# $241,500 The ERS is 3 x BRS. |

Payouts are estimates based on CPF LIFE Standard Plan parameters in 2016

#Available from January 2016

How is the retirement sum set aside?

When you reach 55 years old, your Special and/or Ordinary Accounts savings will be transferred to your Retirement Account (RA) to form your retirement sum. Your retirement sum can be used to join CPF LIFE which provides you with life-long monthly payout or the Retirement Sum Scheme which provides you with a monthly payout of about 20 years.

After setting aside either the Full Retirement Sum or Basic Retirement Sum with sufficient property charge/pledge, you can choose to withdraw remaining cash balances in your Ordinary and Special Accounts, or continue to keep your savings in CPF to earn attractive interest.

How much can I withdraw from my CPF Account (from SA and OA account) when I turn 55 years old and intending to make a purchase of a property( if and only if I do not own a property at the point of purchase ) ?

Table 1.3

| The Year You Turn 55 | Amount you can withdraw at age 55 |

| Before 2009 |

Highest of

|

| 2009 |

Highest of

|

| 2010 |

Highest of

|

| 2011 |

Highest of

|

| 2012 |

Highest of

|

| From 2013 to 2015 |

Higher of

|

| 2016 and onwards |

Higher of

|

What is my payout eligibility age (PEA)?

|

Table 1.4: Please refer to the table below for your applicable PEA.

|

CASE STUDIES

What is a CPF property charge and when is the CPF property charge considered sufficient for me to withdraw my Retirement Account savings above the Basic Retirement Sum?

A CPF property charge is created on your property when you use your CPF savings to buy the property. The value of the charge is the total amount of CPF savings you used for the property, plus the interest you would have earned on those savings (i.e. P+I). You have sufficient CPF property charge if it can restore your Retirement Account to your Full Retirement Sum when you sell/transfer your property.

EXAMPLE 1: Where CPF Property Charge is sufficient

| A. | Initial RA balance | $161,000 |

| B. | Amount that member wishes to withdraw from RA | $ 80,500 |

| C. | Remaining RA balance after withdrawal [i.e. A – B] | $ 80,500 |

| D. | Total CPF used for property plus accrued interest at point of RA withdrawal [i.e. P+I] | $100,000 |

| E. | Remaining RA balance after withdrawal + (P+I) [i.e. C + D] | $180,500, is more than his Full Retirement Sum |

Member has $80,500 remaining in his RA if he withdraws $80,500. As the P+I of $100,000 refundable upon the sale/transfer of the property is enough to restore his RA to his Full Retirement Sum of $161,000*, his property charge is considered to be sufficient for him to withdraw the $80,500. * The Basic Retirement Sum and Full Retirement Sum for members who turn 55 between July 2015 and December 2016 are $80,500 and $161,000 respectively.

EXAMPLE 2: Where CPF Property Charge is insufficient

| A. | Initial RA balance | $161,000 |

| B. | Amount that member wishes to withdraw from RA | $ 80,500 |

| C. | Remaining RA balance after withdrawal [i.e. A – B] | $ 80,500 |

| D. | Total CPF used for property plus accrued interest at point of RA withdrawal [i.e. P+I] | $ 70,000 |

| E. | Remaining RA balance after withdrawal + (P+I) [i.e. C + D] | $150,500, is less than his Full Retirement Sum |

Retirement Sum Member has $80,500 remaining in his RA if he withdraws $80,500. As the P+I of $70,000 refundable upon the sale/transfer of the property is not enough to restore his RA to his Full Retirement Sum of $161,000, his property charge is considered to be insufficient. Hence, he needs to pledge his property to withdraw up to $80,500 and this withdrawal is subject to a few conditions including current value of the property, outstanding loan(s) on the property and owner(s)’ share in the property. Alternatively, he can choose to withdraw only $70,000 without pledging his property.

EXAMPLE 3: Where CPF Property Charge is sufficient

Scenario which will be beneficial to clients who withdraw their CPF to pay for the housing before they turn 55:

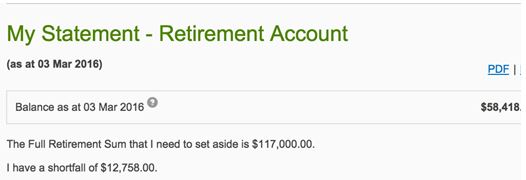

- Client A is born in November 1954 (i.e current age is 62 ) . His CPF Details are as per below:

With accordance to the table 1.1, he can withdraw 40% of the total Retirement Sum and 60% will make up his retirement account or he can choose to keep 100% which is $117,000 and withdraw monthly when he hits 65 years old (Table1.4).

| A. | Initial RA balance | $117,000.00 |

| B. | Amount that member wishes to withdraw from RA | $ 58,500.00 |

| C. | Remaining RA balance after withdrawal [i.e. A – B] | $ 58,418.40 |

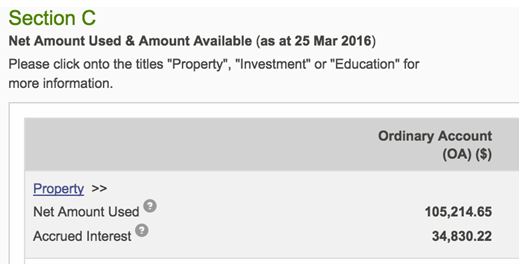

| D. | Total CPF used for property plus accrued interest at point of RA withdrawal [i.e. P+I] | $ 140,044.87 |

| E. | Remaining RA balance after withdrawal + (P+I) [i.e. C + D] | $198,463.27, is more than his Full Retirement Sum |

Retirement Sum Member has $58,418.40 remaining in his RA if he withdraws $58,500.00. As the P+I of $140,044.87 refundable upon the sale/transfer of the property is enough to restore his RA to his Full Retirement Sum of $117,000, his property charge is considered to be sufficient at the point when he turned 55. Hence, he does not need to pledge his property to withdraw up to $58,500.

Amount he can withdraw to use for next housing = $198,463.27 – $58,500 = $139,963.27

Referring to table 1.3, for clients who just turned 55 years old, they are NO LONGER able to withdraw or set aside a certain amount from the Basic Retirement amount in the CPF. They are required to put in the Full Retirement Amount and maximum withdrawal is $5,000. For clients who want to cash out from their property, they should do it before they turn 55.

Financial Calculation for clients who want to cash out their CPF

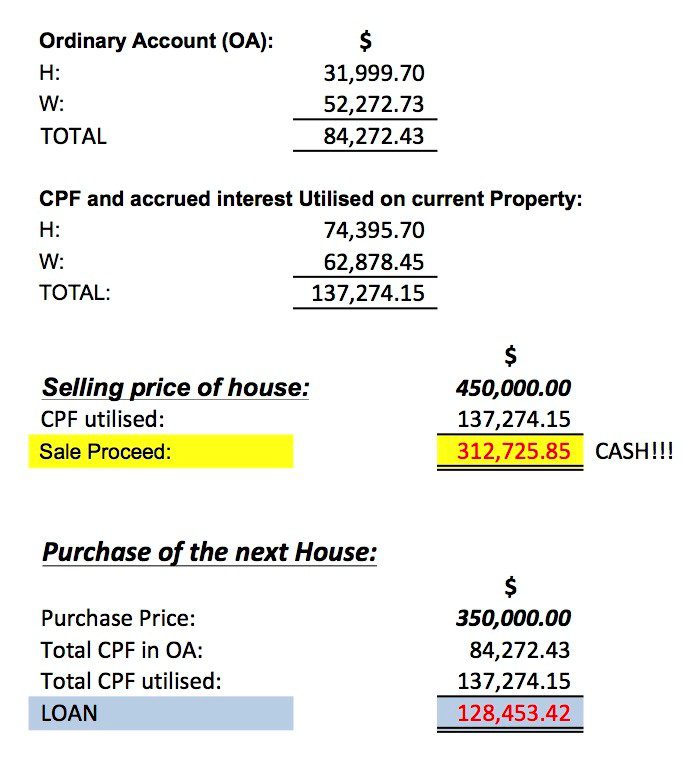

e.g Husband (H) is 54 and wife (W) is 48. They are staying in a 4 Room flat and their children have grown up. They are planning to sell their 4 room flat at $450,000 and downgrade to a 3 Room flat at $350,000.

With the above scenarios illustrated, we hope property owners could be savvier in understanding how they could fully utilize their CPF or cash out to do their next purchase comfortably.

Many of our clients have sought professional advice and assistance from us to attain their financial dreams or boost their property portfolio on hand. Feel free to drop us a call at +65 9834 3222. Our experiences will be able to enrich you.

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.