Introduction

This is an all-time golden question that most investors ask. Obviously so because buying a home is the most emotional and expensive decision for any buyer. Anyone would want to know that the home they are investing in, will it give returns in the future. If they are going to be investing a major chunk of their salaries in real estate, then they want to know if the real estate property they are investing in will keep yielding good returns over the long term.

Singapore has been the favourite investment destination not only for local people but also for foreigners especially from China, Indonesia and Malaysia. In the past, Singapore property prices have appreciated quite a lot.

To Buy or Not To Buy

But the real question is, is there still room for appreciation?

HDB resale prices rose 3% in the quarter of 2021. Only in one quarter, it has gone up 3%.

Hypothetically if every single quarter it goes up by 3%, in a year it would have gone up by 12%!!

Of course, that won’t happen if it happens, because then the cooling measures will kick in.

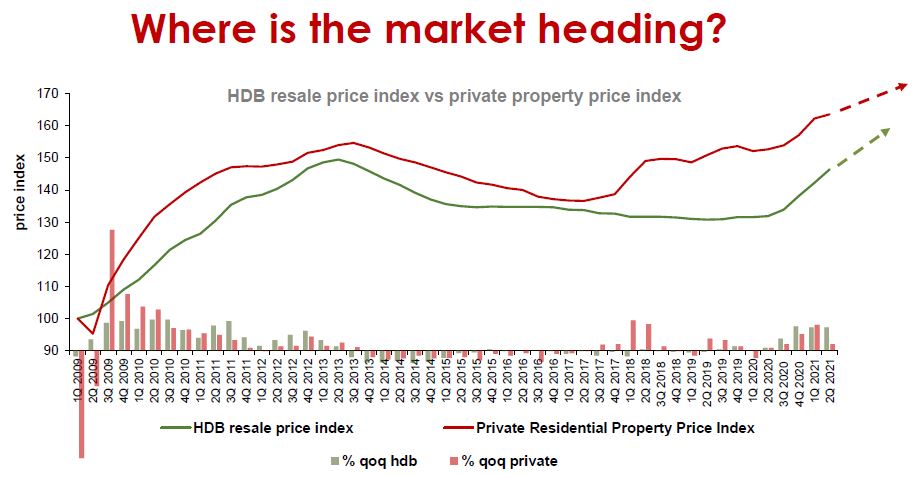

So, where are the resale prices heading?

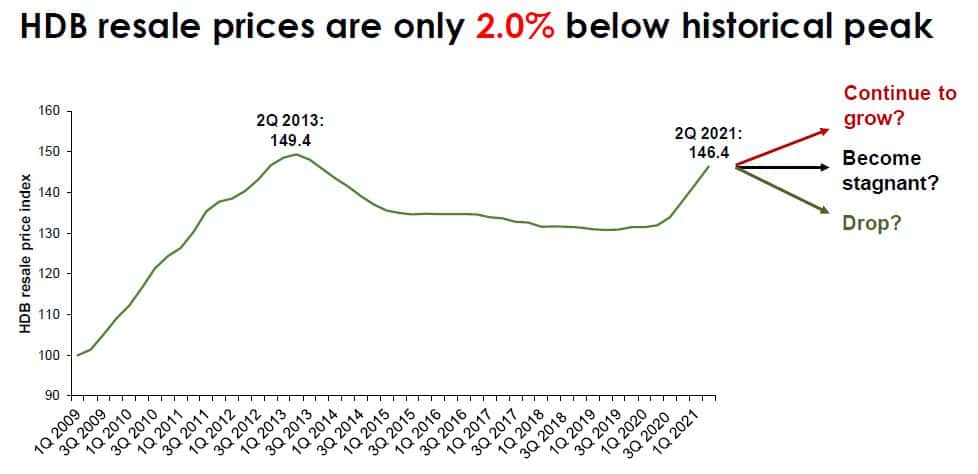

Since most Singaporeans stay in HDB flats, the current HDB prices, it has an index of 146.4 in the 2nd quarter of 2021.

Now, this is only 2% below the historical high in comparison to 2nd quarter of 2013.

So at where we are right now, will HDB resale price continue to grow or become stagnant or even draw?

Let us take a look at the private property price. It rose 0.8% in the 2nd quarter of 2021, despite the heightened alert. Of course, private home prices are rising at a slower pace at the present moment and thank goodness because cooling measures are not something that the government has in the pipeline, right now.

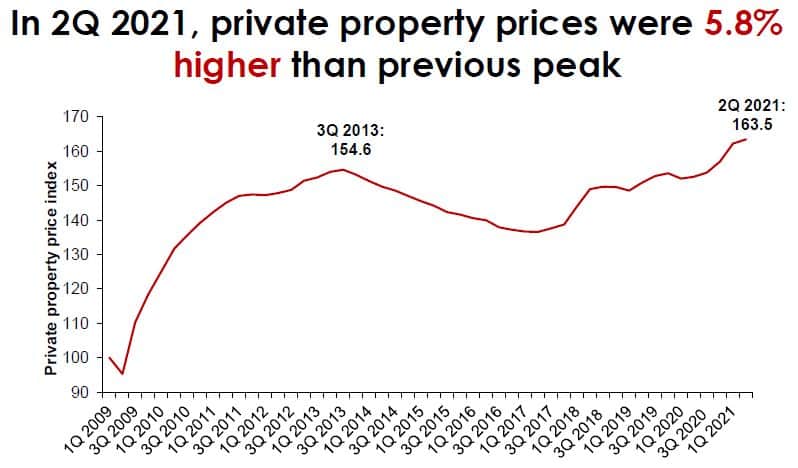

So in the 2nd quarter of 2021, private property prices were 5.8% higher than the previous high.

It looks like we have gone to uncharted territory.

So the way to go is either up, stagnant or down. That’s the golden question. Is property still an appreciating asset?

To answer these questions, there are two main factors that contribute towards home price growth.

Household Income Growth and Economy Growth

Household Income Growth

Let’s talk about the income growth since 2010 as compared to property price growth.

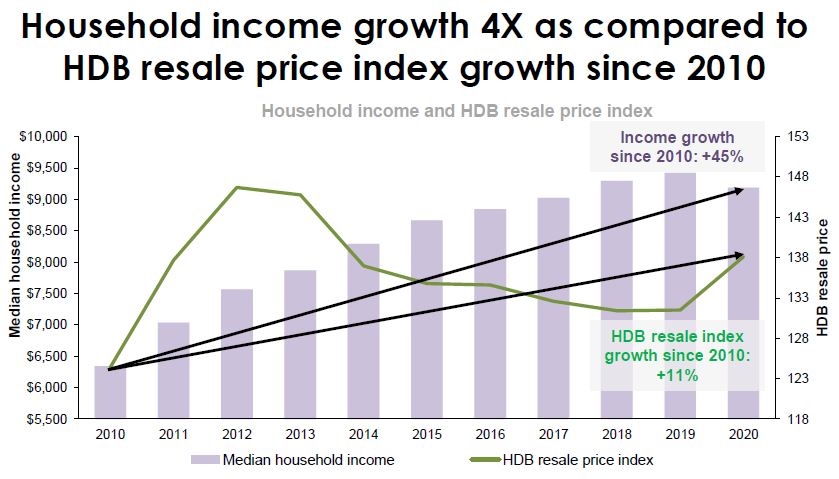

The chart above shows household income growth as compared to the HDB resale Price Index growth.

The household income growth is as much as four times. So household income is presented in this chart by the purple bars. As you can see, the household income is moving upwards over the years from 2010 to 2020.

From the statistics that we got, we have also superimposed into this chart, the HDB resale price index. The green line shows you the HDB price index. It can be seen that from 2010 to 2020, the HDB resale price index has grown by 11% whereas the income growth is 45%.

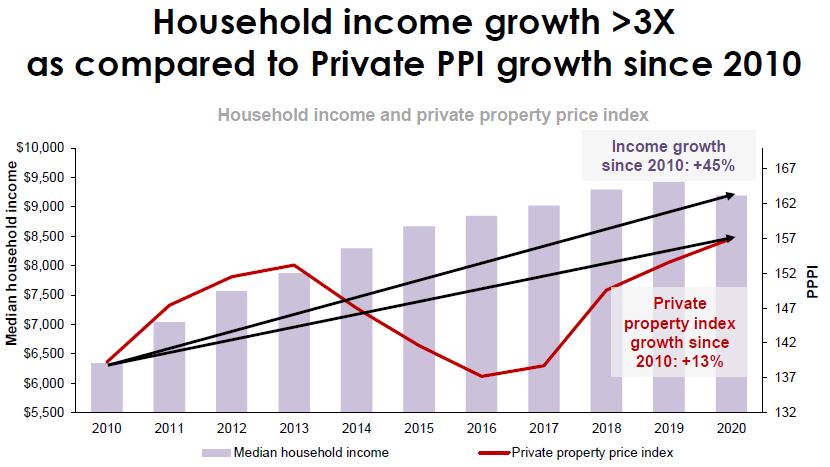

Similarly, let’s look at household income as compared to the private property Price Index.

The analysis shows that the private property index actually lags at 13% behind the income growth which is 45%.

So, apparently, there is still lots of room for growth for the HDB and the Private Price Index.

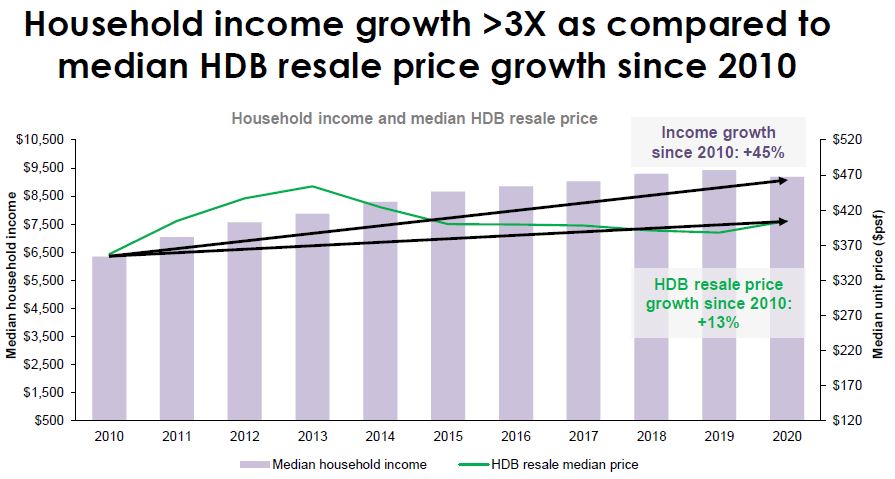

Let’s work with per square foot median price instead of Property Price Index because property price index is a composite calculation based on various factors such as new home or resale home, non-landed or landed, also the different regions of properties like OCR, RCR and CCR, which makes it a very complicated index.

Let’s zoom into the median price of properties in Singapore. That means the residential non-landed, median price.

If we take a look at the household income growth versus the median HDB resale price, it is still leading. So income growth is still very strong as compared to HDB resale price growth.

Hence, there is still a big margin for growth for HDB resale property.

So, if you are thinking about buying an HDB resale flat then you must go ahead because from this income growth of 45%, it is as much as three times the current median HDB, resale price growth since 2010.

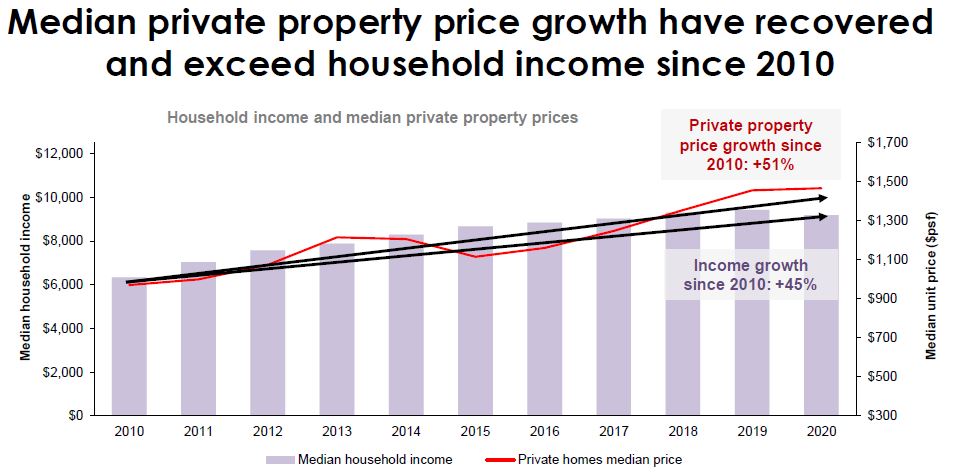

Now, let’s look at the median unit price for private residential price comparison for private property price growth.

The private property price growth has recovered and even exceeded household income since 2010 for the household income. The average is as much as 51% growth for property price growth and income growth is 45%.

So, what this means is that in that median income category, private property price growth has actually exceeded the income growth.

For that top income category earner, the income growth may be more than 45%. Maybe 100%, or 200%, or even 300%. So that means that it depends on the income of the individual.

Now, this doesn’t mean that because of this, you cannot buy property. It’s all about financial prudence. Whether there is room for precision will also depend on who is buying the property.

Economic Growth

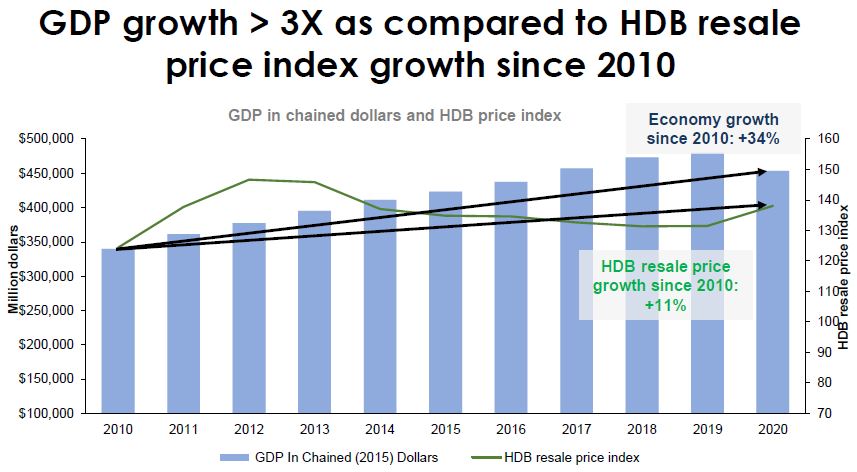

Let’s look at the economic growth since 2010, as compared to the property price growth. The GDP has grown in monetary terms as compared to HDB resale Price Index since 2010.

It has grown more than three times. HDB resale price index went up by 11% and economic growth grew by 34%, from 2010, to now 2020.

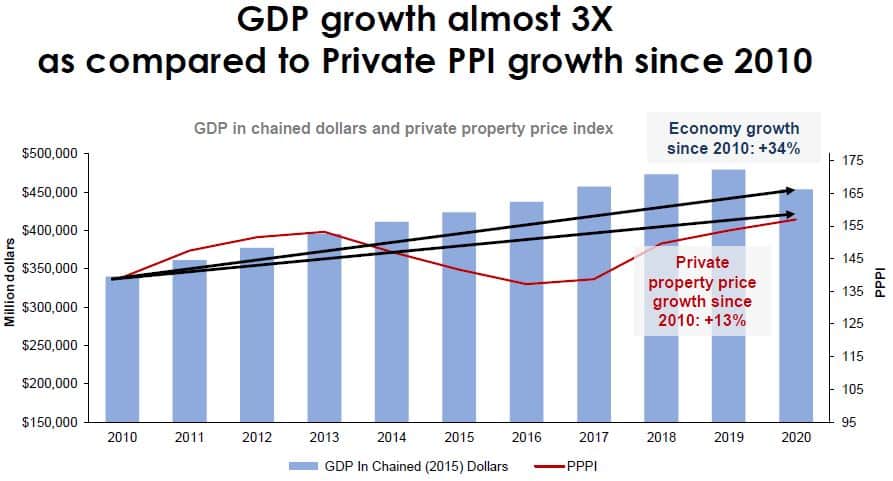

GDP growth is almost 3% or so as compared to private property price index growth. +13% property price growth since 2010 and economic growth of +34%.

So there’s still room for growth easily if you compare that with GDP.

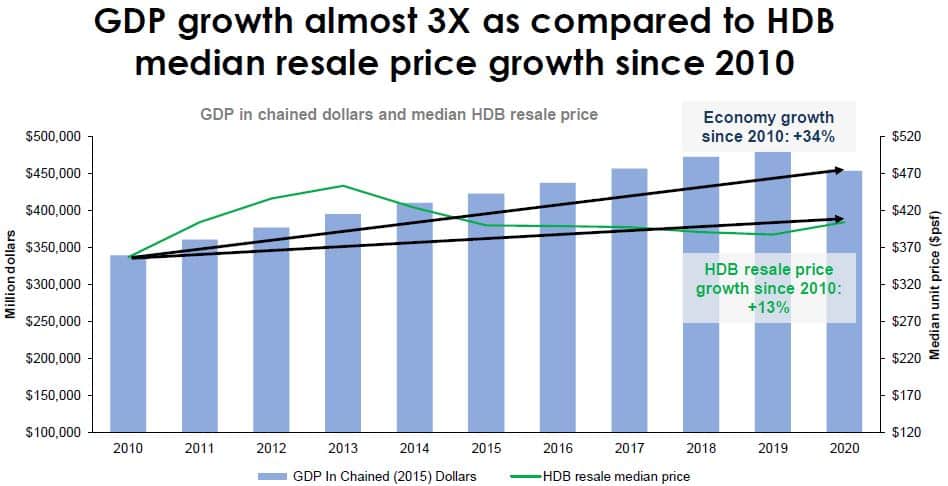

Let’s take a look at the median unit price again, for HDB. As can be seen from the chart below, HDB median price growth is 13%.

The economic growth in the same period is 34%.

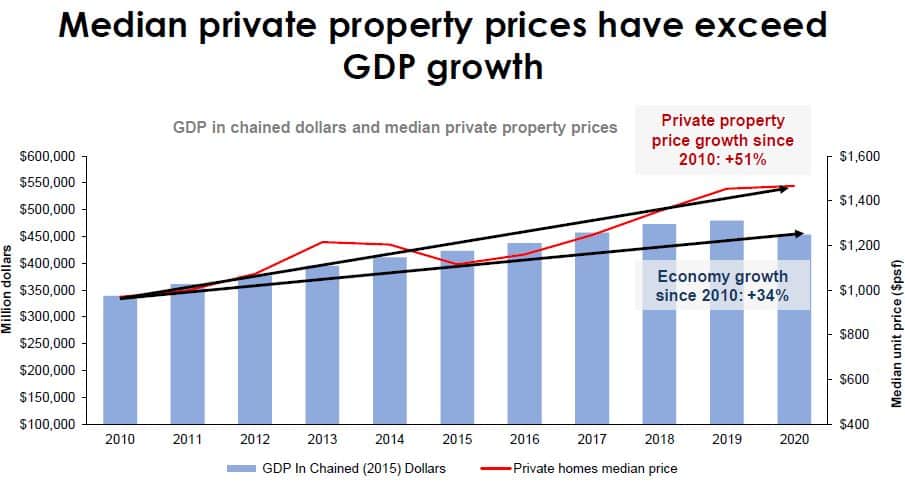

Since the economic growth is three times more, there is room for growth, for HDB resale, but for median private property price, it has exceeded the GDP growth.

The median property price as can be seen in the chart above now stands at about $1200psf and economic growth is 34%. The private properties price growth since 2010 is 51% and it is much higher than the economic growth of 34%.

All In All

In a nutshell, the private residential property price and HDB resale price indices growth are fundamentally supported by household income and economic growth.

However, home buyers have to exercise careful and prudent financial approaches.

Foreign Demand

And that’s not all, foreign demand may be coming back.

How close are we to get the foreign demand back?

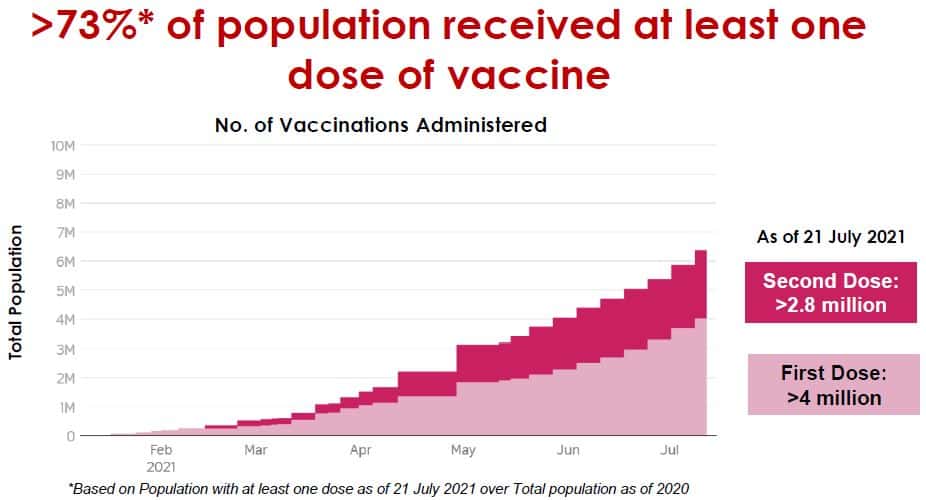

In Singapore, the vaccination has already reached more than 73% of the population as of the 21st of July 2021. The first doses have been given to 4 million residents, and the second doses have been given to more than 2.8 million.

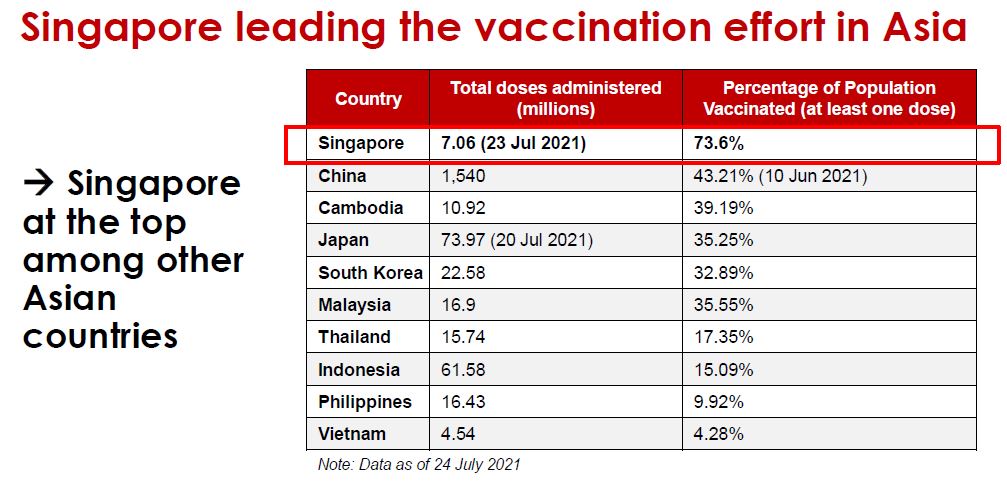

Among all the countries in the Asia Pacific, Singapore is leading the vaccination effort in Asia. We have the highest percentage of vaccinations.

Vaccination is the key to resume travel. It will definitely reignite travel and also property transactions by foreigners.

This means that the more people get vaccinated, the border will reopen and that will lead to stronger foreign demand for private homes.

Home prices will be well supported by both local plus additional foreign demands.

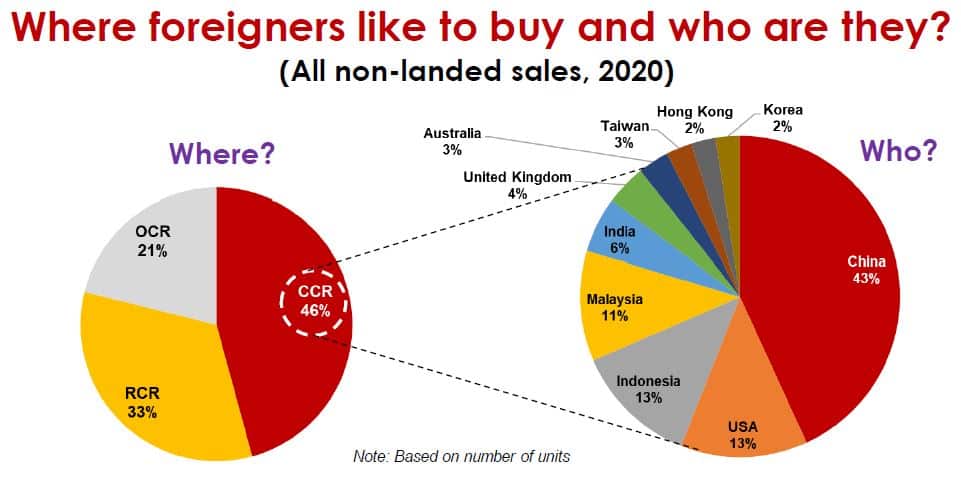

Most of the foreigners are buying CCR.

If you are working on CCR projects, part of your demand comes from our foreign strength. A lot of the foreigners are from China, USA. I say USA because Chinese who become US citizens come to buy properties in Singapore. Then foreigners come from Indonesia, and also Malaysia.

Chinese are quite smart that when they become US citizens, they don’t have to pay ABSD.

This forms 46% of CCR. Most foreigners buy into CCR development.

And bear in mind right now that in the global equity market, it is affecting the fund managers and also investors who are in the China tech stocks, China education stocks or even China real estate stocks. It is a time when the China crackdown has made everyone worry about political stability, and also whether they are investing in the right stuff.

Conclusion

So for all brick and mortar, we all know that properties are something that will give a very stable return over a long period of time. And even with volatile equity markets like the current China stocks that are listed overseas, that has crashed, it didn’t crash the property market in China, it also didn’t crash the property market in Singapore.

So what this means is that we are on our way to experience an influx of foreign demand soon, okay, both from the increase in vaccination and also from the volatile equity market coming into this way into the real estate market.

So overall is it a good time to invest in real estate properties?

The answer is of course Yes!

Let us all stay positive.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.

Enjoy what you have been reading? Join our mailing to get the latest insight delivered to your inbox.