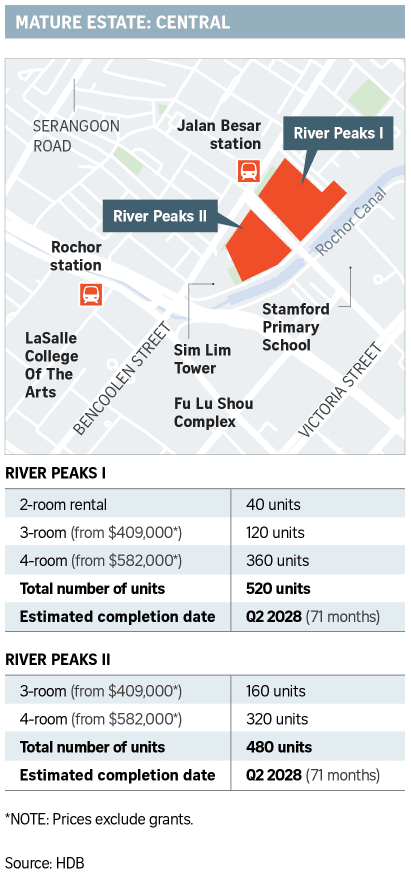

The Rochor projects – River Peaks I and II – have a waiting time of about six years and are expected to be completed in the second quarter of 2028. Given a longer MOP of 10 years, owners will be able to sell only from the year 2038. Four-room flats are priced from $582,000 upwards.

PLH BTO 4-room Central (Rochor)

Purchase Price $688,000*

*Note: Based on 4-rm BTO price of River Peaks I & II in Nov 2021

Purchase Price $302,000**

**Note: Based on Sun Sails 4-rm BTO price in Nov 2020

Upon MOP, an HDB under the PLH scheme would be eligible to be sold back to the secondary market, with an income ceiling on the potential buyer. Using the maximum prevailing monthly income ceiling of $14,000, it is estimated that potential buyers have to fork out significant cash and/or CPF for the down payment.

[1] Singapore Department of Statistics | Press Release – Key Household Income Trends, 2020 (singstat.gov.sg)

The new PLH model aims to ensure that new public housing built in prime and central locations will remain affordable, accessible and inclusive for Singaporeans. Therefore, it does not position itself to be an investment vehicle. However, in the event that the flat owner wish to sell off his HDB, being able to enjoy a higher sales proceed will still add more to his or her eventual retirement saving.

Using the same example again, the following simulation show how much would the flat owner get back in sales proceeds between the PLH and BTO model.

Assuming flat owners sell their flat after reaching MOP, owners under the BTO model would get back much more sales proceeds compared to owners under the PLH model. Because the owners under the BTO model can get back the sales proceed at a shorter time frame, the sales proceed may provide the additional capital to ballot for another BTO or an executive condominium, or upgrade to private property.

Owners under the PLH model will need to wait longer. Given that real estate is usually correlated to inflation, there will be a good chance that houses will also be more expensive by the time they wish to sell off their HDB flats.

The convenience offered by the PLH flats prime location might be difficult to measure quantitatively but with the growing infrastructure that is happening across Singapore, there is also a good chance that BTO flats in the non-prime estate may also offer similar convenience.

There are several key considerations towards applying for a PLH HDB new launch. From this analysis, one has to be prepared for a larger initial cash/CPF outlay as a down payment. If the PLH HDB are to be sold after MOP, the pool of eligible resale buyers is likely to be smaller and the proceeds of the resale would probably be lesser compared to BTO HDB.

Can’t decide which is better for you? Or if there’s something better? Reach out to Mark for personalized asset progression planning.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.

Mark Lim

Decisions are best made with reliable data. With his passion for numbers and data, Mark strives to provide insights to his clients and reader to make better decisions. If you are looking just for advice, he will always be available. Talk to Mark today!