In Singapore, many couples jointly own private property and later consider purchasing a second property for investment or family planning. However, with the Additional Buyer’s Stamp Duty (ABSD) currently at 20% or higher, this can become costly.

One effective legal strategy to avoid ABSD is the Part Sale, often informally referred to as decoupling. This guide explains the full process, timeline, and key considerations involved in a Part Sale — using the correct legal framework.

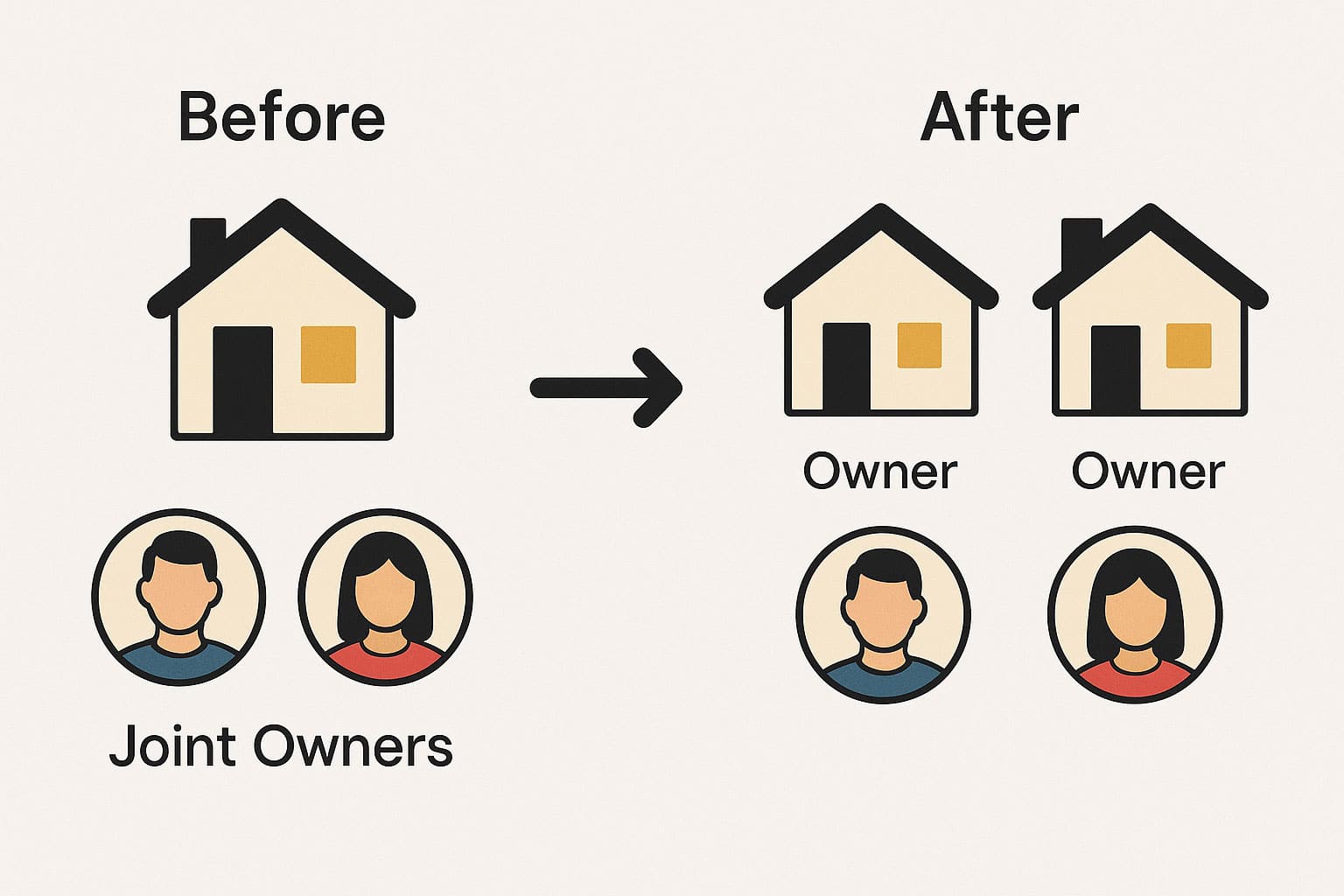

What is a Part Sale?

Part Sale is when one co-owner of a property (usually a spouse) sells their share of the jointly owned private property to the other co-owner. Once completed:

- The buyer becomes the sole owner.

- The seller is no longer tied to any property.

- The seller can now purchase another property as a first-time buyer and avoid ABSD.

Note: IRAS treats this as a legitimate sale, and Buyer’s Stamp Duty (BSD) is payable.

Who is Eligible?

- Couples who jointly own a private residential property

- Looking to purchase a second property

- Wanting to avoid ABSD

- Able to refinance or qualify for the full mortgage under one name

Buyer’s Stamp Duty (BSD) Rates (2025)

- BSD is calculated based on the higher of the market value or purchase price (independent valuation required):

Portion of Property Value BSD Rate First S$180,000 1% Next S$180,000 2% Next S$640,000 3% Next S$500,000 4% Next S$1,500,000 5% Amount above S$3,000,000 6% Payable by the buyer (the spouse acquiring full ownership). You may use our stamp duty calculator to calculate the buyer’s stamp duty payable.

Legal and Professional Fees

| Item | Estimated Cost |

| Legal Conveyancing (incl. CPF) | S$5,000 – S$8,000 |

| Independent Property Valuation | S$500 – S$800 (estimated) |

Step-by-Step Part Sale Process (with Timeline)

Step 1: Feasibility Assessment (Day 1–3)

- Engage a lawyer to assess:

- Eligibility of the buyer to take over mortgage

- CPF refund implications for seller

- Property ownership structure (Joint Tenancy or Tenancy-in-Common)

- Discuss intent to proceed with Part Sale

📄 Required Documents:

- NRICs & marriage certificate

- Title deed

- Outstanding loan statements

- CPF property usage history

Step 2: CPF Refund & Financial Planning (Day 3–7)

- Lawyer calculates CPF + accrued interest used by the seller

- Bank checks loan eligibility for buyer to assume full mortgage or refinance

- Buyer plans funds for:

- BSD

- Legal fees

- CPF shortfall (if any)

Step 3: Independent Valuation & Sale Agreement (S&P) (Day 7–14)

- Appoint a licensed valuer to conduct independent valuation

- Lawyer prepares the Sale & Purchase Agreement based on this valuation

- Both parties sign the S&P under legal witness

✅ This is a real sale transaction — BSD applies accordingly.

Step 4: BSD Submission to IRAS (Day 14–21)

- BSD is computed based on the share value (from independent valuation)

- Buyer pays BSD within 14 days of S&P date

- IRAS issues stamp certificate after payment

Step 5: CPF Refund & Mortgage Restructuring (Day 21–35)

- Seller’s CPF is refunded in full with interest

- Buyer:

- Takes over mortgage in sole name, or

- Refinances if required

📌 CPF Board and bank need time for processing and disbursement.

Step 6: Lodgement of Transfer with SLA (Day 35–45)

- Lawyer submits ownership transfer to Singapore Land Authority

- Title deed updated to reflect buyer as sole owner

Step 7: Completion (Day 45–60)

- Legal completion takes place

- Buyer now owns 100% of the property

- Seller is no longer a property owner and can buy another as a first-timer (ABSD-free)

Key Considerations

| Topic | Details |

| IRAS Treatment | Treated as actual sale; BSD payable |

| CPF Handling | Full refund + accrued interest to seller’s CPF |

| ABSD Status | No ABSD for buyer (already owner); seller can buy ABSD-free as a first-timer |

| Loan Considerations | Bank approval required for full loan transfer or refinance |

Summary Timeline

| Stage | Duration |

| Feasibility & Planning | Day 1–7 |

| S&P & Valuation | Day 7–21 |

| CPF Refund & Loan Takeover | Day 21–35 |

| SLA Transfer & Completion | Day 35–60 |

⏳ Total Timeframe: ~6 to 8 weeks

Final Thoughts

A Part Sale is a highly effective, legally sound way for private property owners to restructure ownership and plan for the purchase of another property — without incurring ABSD. With rising property prices and cooling measures in place, this method continues to be a popular asset progression strategy for savvy homeowners and investors.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.