Why Are Singaporeans Investing in Overseas Property?

With the rising Additional Buyer’s Stamp Duty (ABSD) rates for owning multiple properties in Singapore, many Singaporeans are exploring investment opportunities beyond local borders. For some, it’s a way to diversify their portfolios, while others seek better rental yields or access to more affordable properties. Overseas properties can also serve as holiday homes or a way to secure future residences in countries with more favourable living conditions.

Pros and Cons of Investing in Overseas Property

Before jumping into an overseas property purchase, weighing the potential benefits against the risks is crucial. Here’s a quick look at the advantages and disadvantages:

Pros:

- Diversification: Investing in different countries helps spread risk, reducing reliance on Singapore’s property market.

- Potential for Higher Returns: Certain markets, especially emerging ones, offer higher rental yields and capital appreciation than Singapore.

- Lifestyle Benefits: Purchasing a holiday home or securing a retirement spot can be an attractive option, especially in countries with a lower cost of living.

Cons:

- Complex Regulations: Each country has property laws and restrictions for foreign buyers, which can be confusing.

- Currency Risks: Exchange rate fluctuations can impact the value of your investment and rental returns.

- Management Challenges: Managing a property remotely involves logistical issues, from dealing with tenants to handling repairs and maintenance.

If You’re Serious About Investing Overseas, Here’s What You Need to Know

If the idea of owning an overseas property still appeals to you after considering the pros and cons, it’s essential to prepare yourself. Below are some crucial pointers to ensure you make a well-informed decision:

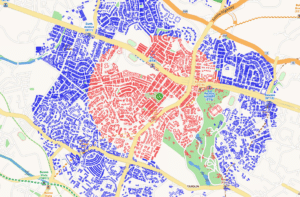

Understand the Local Market

- Every property market is different, and what works in Singapore might not work elsewhere. For example, some countries have booming property markets driven by tourism or foreign investment, while others struggle with oversupply and falling prices. Studying your target country’s market trends, rental demand and economic factors is essential.

Tip: Engage local real estate professionals or analysts who can offer insights into current trends and potential risks. Websites, forums, and online real estate communities specialising in international real estate can also be a great starting point for understanding market nuances.

Check Legal Restrictions for Foreign Buyers

- Many countries impose restrictions on foreigners purchasing property. These rules can range from outright bans to additional taxes or limitations on the type of property you can buy. For example, in Australia, non-residents can only buy new properties, while in Thailand, foreigners can’t own land directly.

Suggestion: Before you start, consult with a local lawyer to understand the ownership rules, property laws, and any potential loopholes that could affect your purchase.

Factor in Currency Risks

- Currency fluctuations can significantly impact your investment returns. Exchange rate changes could erode your gains if you’re earning rental income in a foreign currency but plan to spend it back home. On the flip side, a favourable exchange rate could boost your returns.

Advice: To manage currency risk better, consider hedging options or opening a local bank account. A financial advisor can help you navigate the complexities of currency risks.

Plan for Property Management and Maintenance

- Managing a property from thousands of miles away can be challenging. Things like collecting rent, handling repairs, and ensuring tenant satisfaction are more complicated when you’re not on the ground.

Tip: Hiring a local property management company can save time and hassle, but it comes at a cost. Ensure you include these fees when calculating your expected returns. Choose a company with a strong reputation and transparent fees.

Look Into Financing Options

- Financing overseas properties can be tricky, as banks often consider them riskier investments. You may need to provide a larger down payment, face higher interest rates, or even struggle to secure a loan from a local bank.

Insight: Consider whether you can afford to purchase the property outright or if you need to rely on financing. It might be worth exploring international banks that offer cross-border mortgage services, as they could provide better terms.

Understand Tax Implications

- Taxes can eat into your rental income or resale profits if you’re not careful. Every country has different tax rules for foreign property owners, including income tax, capital gains tax, and property taxes. In some cases, you might also have to pay taxes both in the country where the property is located and in your home country.

Suggestion: Consult a tax advisor who understands the tax laws in both your home country and the country where you’re buying property. They can help you structure your investment in a tax-efficient way.

Assess Political and Economic Stability

- A country’s political climate and economic outlook can dramatically affect its property market. Countries facing political turmoil or economic challenges might seem like a bargain, but they also come with higher risks.

Tip: Keep an eye on news about your target country and look for red flags like government instability, currency volatility, or sudden changes in property laws. Remember, a stable environment is crucial for long-term investment success.

Plan for the Long Term

- Investing overseas isn’t typically a short-term play. To recoup your initial investment and earn substantial returns, you’ll need time for property values to appreciate and rental income to accumulate. If you’re hoping for a quick turnaround, you might be disappointed.

Advice: Consider overseas property investment as part of your long-term portfolio. Be patient and focus on markets with a solid growth trajectory.

Final Thoughts: Be Prepared, Be Patient

Investing in overseas property can be rewarding, but it’s not challenging. Take time to understand the market, weigh the risks, and seek professional advice when necessary. Doing so will increase your chances of making a sound investment that meets your financial goals.

Not keen on investing overseas?

No problem! Check out our library of new condo launches in Singapore, where you might find a perfect opportunity right at home. Explore the latest developments and discover options tailored to your needs.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.