When purchasing property in Singapore, the most significant decision is between leasehold and freehold. This debate has been ongoing for generations, with many people, especially older generations, traditionally favouring freehold properties due to their infinite ownership. But in today’s market, this decision should be based on facts and data, not just sentiment.

Understanding the advantages and drawbacks of leasehold and freehold properties is essential for making an informed decision. Whether you’re an investor or looking for a home, this article will list the key factors that should guide your choice.

Leasehold vs. Freehold: What’s the Real Difference?

At first glance, the primary distinction between leasehold and freehold is in ownership tenure. A freehold property allows you to own it indefinitely, while a leasehold property comes with a lease period, typically 99 years, in Singapore. But beyond that, there are several layers to consider.

A common belief is that freehold properties hold more value and, therefore, are guaranteed to yield higher financial returns. But is that truly the case? Let’s take a closer look at the data and performance of both properties in recent years to uncover the real story.

Why Leasehold Properties May Be the Better Choice

1. Affordability

One of the most obvious advantages of leasehold properties is affordability. Freehold properties are sold at a 15-20% premium compared to their leasehold counterparts. This has been consistent over the past decade. This price difference is significant for many buyers, especially those entering the property market for the first time or those with a limited budget.

Purchasing a leasehold property means owning a home in a prime location at a more affordable rate. This affordability also extends to larger properties, which would be far out of reach in the freehold market. Use our affordability calculator to find out the maximum property price that aligns with your budget

2. Higher Capital Appreciation in the Short-Term

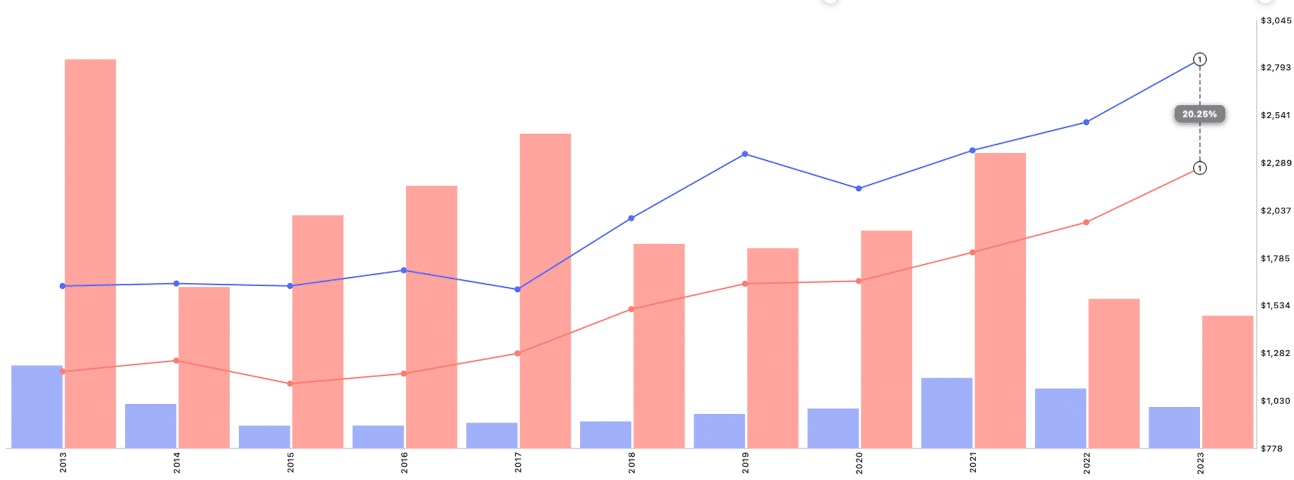

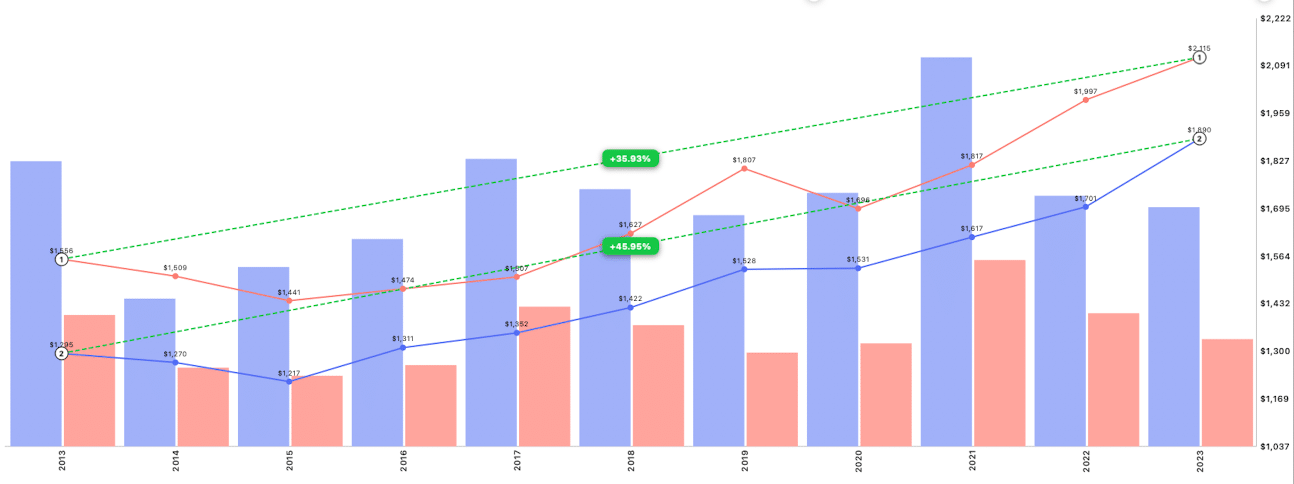

Leasehold properties have outpaced freehold properties in terms of capital appreciation over the past decade. Data shows that leasehold condos in Singapore have grown by approximately 45.9% in the last ten years, while freehold properties have increased by only 35.9%. This 10% gap suggests that leasehold properties can perform better in the short to medium term.

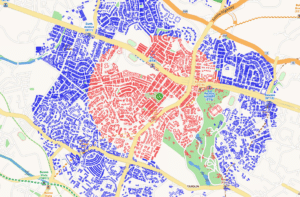

One reason for this is the strategic location of many leasehold properties. Developers launch leasehold projects in more accessible and desirable locations, fueling higher demand and, thus, greater capital appreciation.

3. Better Rental Yield

Leasehold properties often deliver better returns for those looking to invest in property for rental income. Tenants typically care less about the tenure of the property they are renting and more about location, condition, and rent price. This means you can charge similar rental prices for a leasehold property compared to a freehold one. Your rental yield is higher because the leasehold property was more affordable.

Rental yield is calculated by dividing the annual rental income by the total cost of the property. Investors focusing on rental income may find leasehold properties more appealing due to this higher yield.

The Impact of Lease Decay

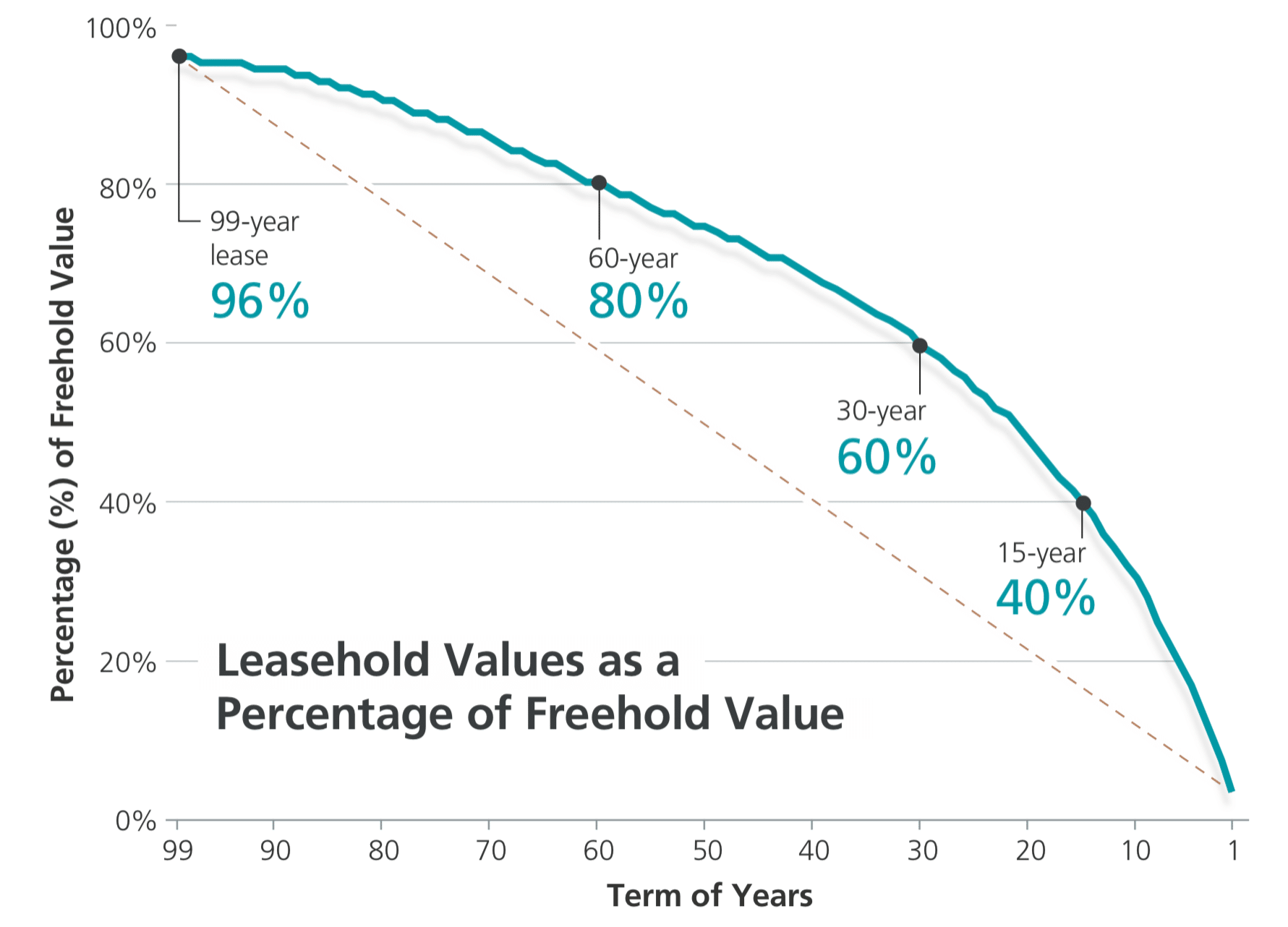

One concern with owning a leasehold property is lease decay—the gradual depreciation of property value as the lease approaches expiration. The widely referenced Bala’s Curve offers a rough guideline on how property values drop as the lease runs down.

However, the reality is not always as straightforward. Many older leasehold properties, such as Mandarin Gardens or Neptune Court, have managed to maintain their value despite lease decay concerns, thanks to their excellent maintenance and prime locations. Nevertheless, buyers must be aware that as the lease nears its end, financing options like mortgages become more difficult to secure, potentially complicating future resale.

The En Bloc Advantage

Interestingly, leasehold properties often have an edge in en bloc sales. Developers are more likely to purchase leasehold properties for redevelopment because they are cheaper than freehold properties. This makes the en bloc process smoother for leasehold owners looking for a profitable exit strategy.

In contrast, while freehold properties can also be sold en bloc, the process is typically slower and may involve more complex negotiations since owners expect a higher premium due to the property’s infinite tenure.

But What About Freehold?

While this article has laid out several compelling reasons to consider leasehold properties, it’s essential to remember that freehold properties have their own set of advantages. For one, freehold properties might be more suitable if your goal is to pass down the property to future generations or you’re planning for legacy wealth. Owning a property indefinitely offers long-term security that leasehold properties cannot provide.

Some older freehold properties have been meticulously maintained and can stand toe-to-toe with newer leasehold developments regarding build quality and aesthetic appeal. For example, some freehold condos in Singapore put new developments to shame in terms of their upkeep and spacious layouts.

Furthermore, freehold properties often fare better regarding long-term capital preservation, especially in areas with strong demand and limited freehold supply. This can be particularly important for buyers who see their home as a place to live and a long-term investment for future generations.

Dive Deeper: How Do Freehold and Leasehold Perform Over Time?

For readers keen to explore how freehold and leasehold properties have performed over time, especially regarding capital appreciation, an insightful article delves into the data from the past five years. It examines how the age and tenure of properties affect their value in Singapore’s dynamic real estate market. You can read the full article here: How Does Age and Tenure (Freehold and Leasehold) Affect the Capital Appreciation of Private Condominiums in the Past Five Years?

What’s Your Decision?

Ultimately, the choice between leasehold and freehold depends on your financial goals, lifestyle needs, and plans. If you’re looking for affordability, potential short-term capital appreciation, or a strong rental yield, leasehold properties may be the way to go. On the other hand, if legacy planning, long-term security, or passing the property down to your children is your priority, freehold may be the better option.

Before making any decision, it’s essential to carefully consider your objectives, research thoroughly, and seek expert advice. Real estate is a significant investment, and understanding your options is key to making the right choice for your future.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.