Singapore’s property market has been a hot topic for years, with prices climbing steadily despite multiple rounds of cooling measures. As we step into 2025, the big question on everyone’s mind is: Will the government roll out new policies to tame the market this year?

In this article, we’ll explore the current state of Singapore’s real estate, revisit past cooling measures, and speculate on what might come next. Plus, we’ll spotlight some recent property launches that have defied the odds and smashed sales records. Whether you’re a homebuyer, investor, or just curious, read on to get the full scoop!

Current State of the Property Market

As of 2025, Singapore’s property market is holding strong, especially in prime districts where new launches are snapped up quickly. What’s driving this resilience? Here are the key factors:

- High liquidity and wealth: Affluent buyers have cash to splash.

- Foreign investor appeal: Even with hefty taxes, Singapore remains a global hotspot.

- Limited land supply: Fewer new plots mean higher competition for what’s available.

- HDB upgraders: More Singaporeans are moving into private properties.

That said, transaction volumes have dipped slightly, thanks to past measures like higher Additional Buyer’s Stamp Duty (ABSD) and stricter Loan-to-Value (LTV) limits. Yet, prices? They’re still climbing. Curious about the latest blockbuster launches like Elta, The Orie, Parktown Residences? Check out our post on Q1 2025: All Launches Smash Records – Unlock the Secrets to Singapore’s Top Condo Deals.

Review of Past Cooling Measures

Singapore’s government isn’t shy about stepping in when the property market heats up. Over the years, they’ve rolled out a toolkit of measures to keep prices in check and ensure affordability. Let’s break down the big ones:

1. Additional Buyer’s Stamp Duty (ABSD)

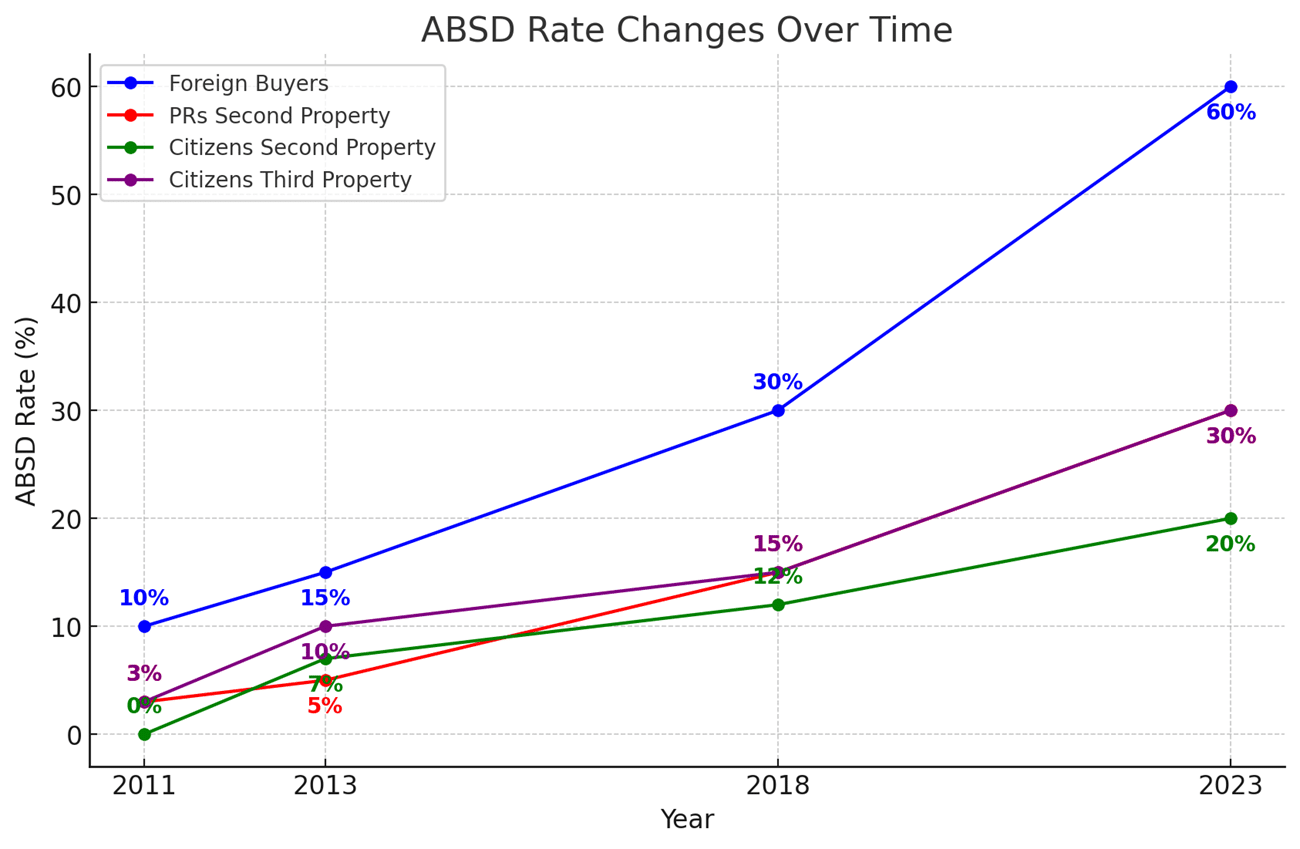

Since its debut in 2011, ABSD has been tweaked repeatedly to cool speculative buying. The latest update in April 2023 hit hard:

- Foreign buyers: 30% → 60%

- Singaporeans (2nd property): 17% → 20%

- Singaporeans (3rd+ property): 25% → 30%

- PRs (2nd property): 25% → 30%

- Trust purchases: 65%

The goal? Prioritize local homeownership over investment frenzy. Want to understand ABSD better? Dive into our guide on What is Stamp Duty. Or, you can check out our Stamp Duty Calculator to quickly estimate your BSD and ABSD.

2. Loan-to-Value (LTV) Limits

To stop buyers from over-borrowing, LTV limits were tightened:

- First-time buyers: 90% → 75% (bank loans)

- Second property: 80% → 45%

- Third+ property: 60% → 35%

- Loans past 30 years or age 65: Max 55%

This keeps debt levels manageable and borrowing sensible.

3. Total Debt Servicing Ratio (TDSR)

Introduced in 2013, TDSR caps loan repayments at 55% of your gross monthly income. It’s a safety net to prevent financial overstretch. For a deeper look at how TDSR and LTV shape your buying power, see our post on TDSR & LTV: How They Impact Your Property Loan.

4. Seller’s Stamp Duty (SSD)

To crack down on flipping, SSD taxes quick resales:

- Within 1 year: 12%

- Within 2 years: 8%

- Within 3 years: 4%

- After 3 years: 0%

It’s a clear message: Buy to live or hold, not to flip.

5. Higher Property Taxes

In 2023, property taxes spiked to target luxury homes:

- Owner-occupied (above $1.5M annual value): 6% – 32%

- Non-owner-occupied: 12% – 36%

This hits speculators and hoarders where it hurts.

What Might Trigger New Cooling Measures?

No official word yet, but certain red flags could push the government to act in 2025:

- Skyrocketing Prices

If property prices keep outpacing incomes, affordability could take a hit, prompting intervention. - Foreign Buying Boom

Singapore’s allure for wealthy foreigners is strong. A surge might mean even higher ABSD rates. - Flipping Frenzy

More short-term resales could lead to tougher SSD rules or lending caps. Recent reports highlight how savvy investors are capitalizing on quick turnarounds in the condo market, driving up prices and raising concerns among policymakers. Should this trend intensify, the government might tighten regulations to maintain market stability. - Debt Creep

Rising household debt might force tighter LTV or TDSR restrictions.

Possible Cooling Measures in 2025

So, what could be on the table? Here’s our take:

- Bigger ABSD Bites

Foreigners and investors might face steeper rates to cool speculative demand. - Tougher Loan Rules

- Lower LTV caps for second or third homes.

- Stricter TDSR enforcement to curb borrowing.

- Luxury Tax Hikes

Higher property taxes on high-end homes to balance the market. - Developer Crackdowns

- Penalties for unsold units past deadlines.

- Higher land costs to stop hoarding.

Conclusion: Cooling Measures on the Horizon?

Will new cooling measures be implemented in 2025? It’s uncertain until the government makes an announcement. If prices continue to rise and affordability declines, expect some action. For now, stay alert—monitor market trends, keep track of launches using our highly visited page, “List of New Private Condo Launches,” and plan your next move carefully.

Stay in the Know with PropertyNet.SG

Are you eager to stay at the forefront of Singapore’s dynamic property market? Explore PropertyNet.SG, your premier destination for the latest trends, exciting launch updates, and invaluable expert tips. Subscribe to our newsletter for exclusive insights that will be delivered right to your inbox, keeping you informed and empowered.

Join our lively community on WhatsApp and Telegram to receive real-time updates, connect with passionate property enthusiasts, and ensure you never miss a pivotal moment in the market. Don’t just follow the market—be a part of it!

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.