There has been a lot of discussion going around cooling measures in the Singapore property market and therefore we thought about adding our point of view to the discussions.

Before we begin our discussion on cooling measures there are three important questions that we need to ask:

- Is the Singapore property market growing too fast?

- Is there enough land supply?

- Is the land supply enough to cool prices?

These are the very important questions that we need to ask first before we jump to the conclusion that there is a cooling measure or not.

Q1: Is the Singapore property market growing too fast?

We hear from the media every now and then that property prices have gone up a lot and there are impending cooling measures. They highlight their points using very sensational headlines. The media also say that the government is also concerned about the about property price rise beyond economic fundamentals.

Past Data Vs Present Data

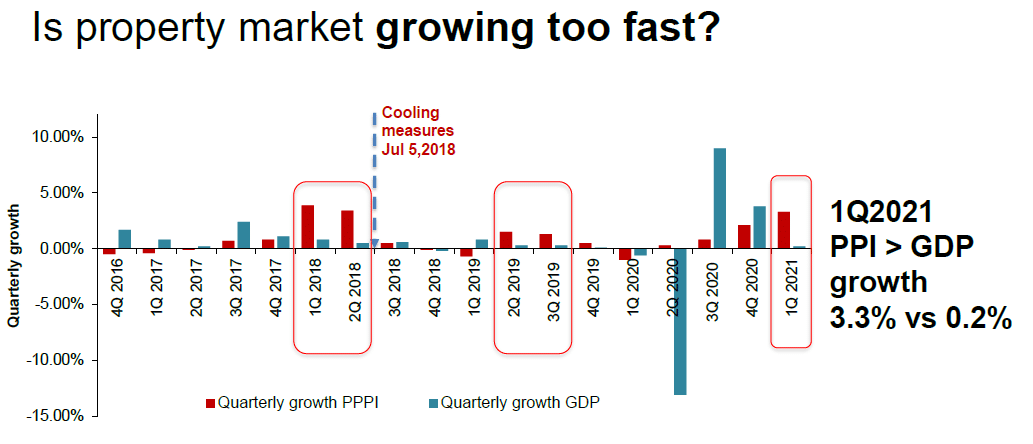

Let’s scrutinize the past property prices growth versus the economic growth. If we compare the property price growth and economic growth in the past, we see that if the property price growth was much higher than the economic growth, then whether cooling measures were implemented or not.

Reference to the chart below where each quarter is filled with information on the PPI growth and GDP growth. PPI (blue bar) is the property price index that represents the property price market and the other one is GDP (red bar) which is representing Singapore’s economic growth.

We can observe that in the first quarter of 2018 and second quarter of 2018 where the PPI exceed GDP, cooling measures were quickly introduced on July 5, 2018. This would likely imply that if there were two straight quarters where PPI performed much better than the GDP, cooling measures will be introduced.

But wait!

Why is there no cooling measures introduced after the third quarter of 2019 when the second quarter and third quarter of 2019 has PPI performed much better than GPD?

Here’s why.

Our Observations

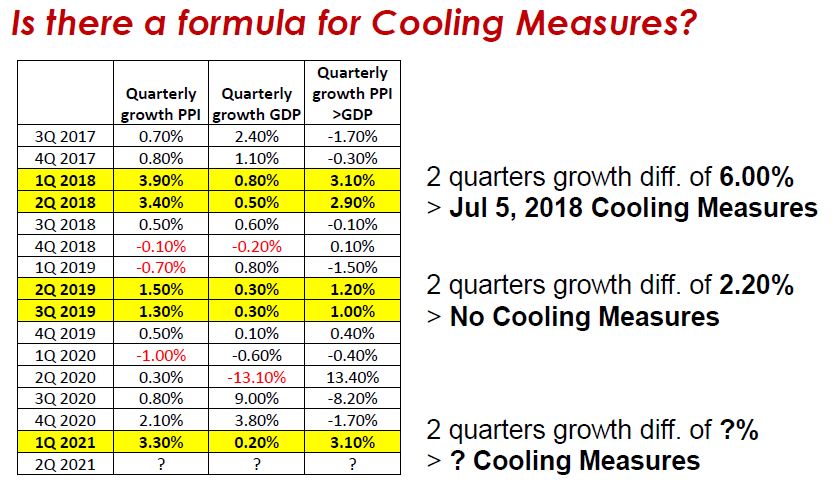

We observed that when there were two straight quarters of growth difference of 6%, cooling measures are likely to be introduced. Let us explain in details.

From the statistics above, there was a growth difference of 3.1% in quarter one of 2018 and 2.9% in quarter two of 2018. That adds up to a total of 6%. But during the first and second quarter of 2019, the growth difference only adds up to only 2.2%, so no cooling measures were introduced back then.

So, right now, in the first quarter of 2021, the growth difference is 3.1%. And we need another 2.9% growth difference in the second quarter of 2021 to get a total growth difference of 6%.

If quarter two 2021 growth is not more than 2.9% then there might not be any cooling measures introduced.

So, yes there is a chance that there will be cooling measures introduced by the government but that is not 100% yet.

Q2: Is There Enough Land Supply?

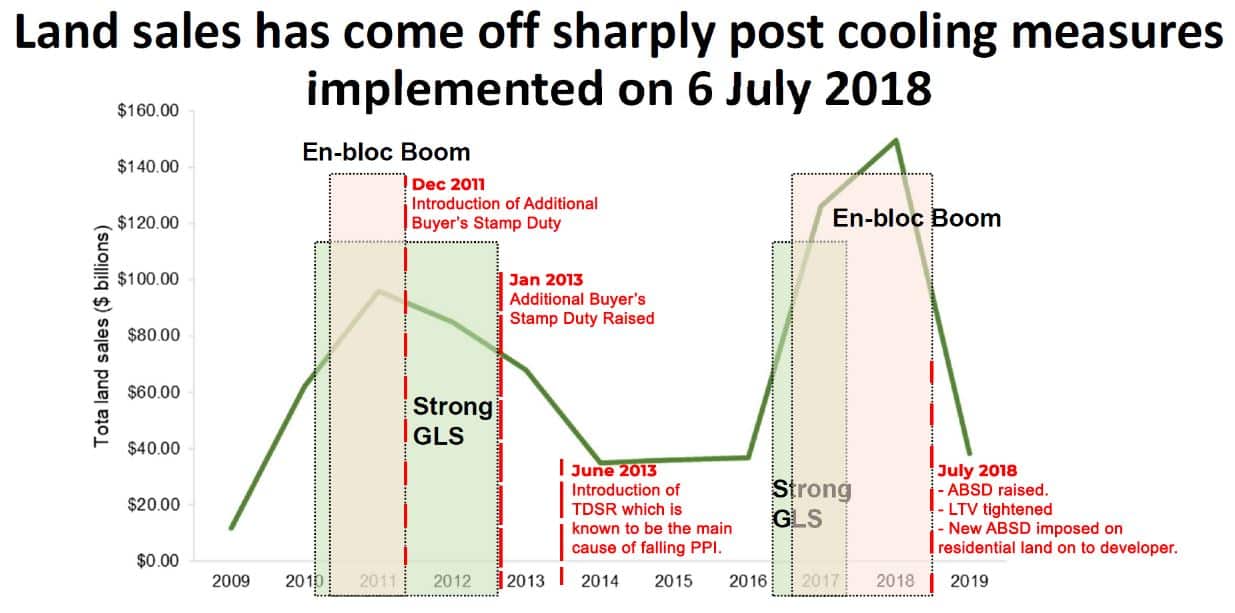

The amount of land left in the inventory is another indication of impending rising prices and usually, when prices start to rise, the government starts releasing land to cool the prices before implementing any cooling measures.

During the onset of Covid-19 in 2020, the government has cut its land supply.

Despite the rising prices, the government has yet to increase land supply in the first quarter of 2021. In fact, the land sales back in 1st half of 2019, there was a lukewarm response for the site of The Commodore and The Watergardens at Canberra, there were only 5 and 4 bids respectively.

Q3: Is The Land Supply Enough To Cool Prices?

As we are aware, the market is heating up and prices are escalating.

[Sidetrack: If you are still thinking if you should enter the market now, you can read our article on ‘Property prices have increased since circuit breaker, will the trend continue?‘ to decide if it is time for you to enter the market.]

Again, to cool the property prices, increasing government land sales supply is usually the first means to cool the prices. In the event, that government land sales are not sufficient to cool the market, en-bloc sales will kick in. Only when the amount of land supply through government land sales and en-bloc block fails to satisfy the land-hungry developers and causes the prices to charge upwards, then there will be the possibility of new cooling measures.

Taking a cue from the past in year 2011, Additional Buyer’s Stamp Duty was first introduced after the strong GLS and En-Bloc boom fails to temper off the heating market. In fact, Additional Buyer’s Stamp Duty were raise in Jan 2013 and TDSR, known to be the hard brake which really cool the market, was introduced.

Again, in July 2018, a slew of cooling measures (ABSD raised, LTV tightened, ABSD on residential land) were introduced to cool the market.

So, the question is, are we experiencing strong GLS and En-Bloc activities now?

Conclusion

In a nutshell, is there a possible cooling measure in the second half of 2021?

Firstly, the question we have to ask is, is there a price growth more than economic fundamentals which is economic growth? If the answer is YES, then for how many quarters? Is it for two quarters and if it is for two quarters, then was there a growth difference? Is it more than a substantial number? Since quarter two has not come to an end yet, we don’t know the growth difference. In phase two, we believe that the price growth will not be as high as the first quarter.

The second question, we have to ask is, “Is there more GLS currently?” The answer is NO. Currently, we still don’t have a lot of GLS and we still don’t have a lot of Enbloc sales. But things are taking a turn now, we are in the early stage as we have just witnessed the aggressive bidding that took place at Ang Mo Kio Avenue 1 and Tengah Garden walk where 15 and 7 bids were received respectively. Side note, you may keep track of the latest en bloc and government land sales here.

To your final questions, is there a looming cooling measure at this moment, the answer is MAY NOT.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.