” Current Phase 2 is a window of opportunity “

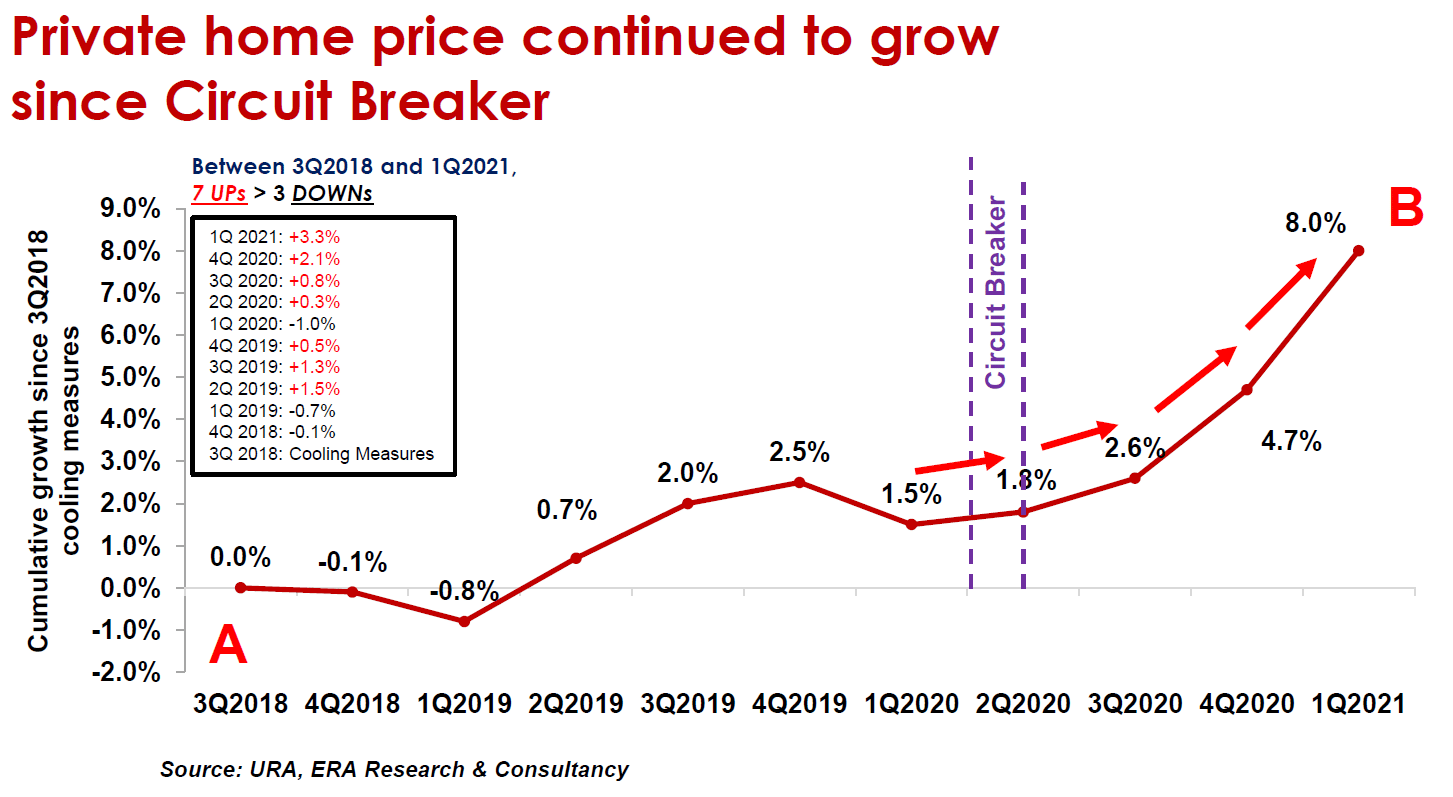

Private home prices have continued to grow since Circuit Breaker

The statistics made by the ERA Research and Consultancy firm shows how the private home prices are going to rise in phase 2. As you can see in the chart below, the real estate prices dipped slightly to 1.5% growth in the first quarter of 2020 from 2.5% growth in the fourth quarter of 2019. But since then it has been steadily growing in an upward trend. Currently it has risen to 8 % in the first quarter of 2021. If you are or have been in the market to buy a new home, you can see the sharp upward trend and you might have to pay more if you continue to wait. Statistics and trend suggest that this could be the second-best time to buy a new home since the first quarter of 2020.

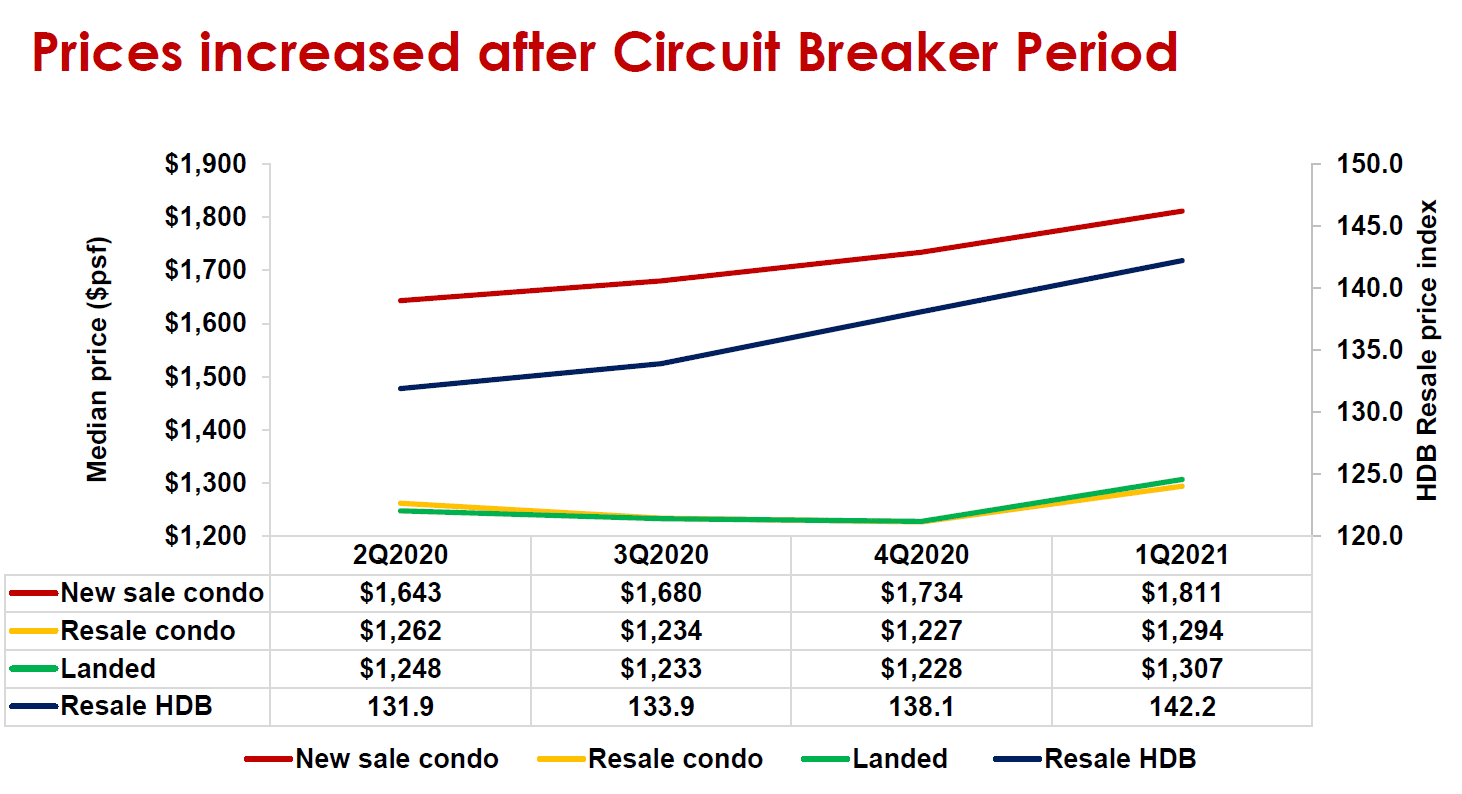

Prices increased after the Circuit Breaker Period.

As you can see from another chart below, you can see the exact price rise from 2nd quarter of 2020 to first quarter of 2021 in per square feet.

Demand for the property will be delayed but not derailed.

People who want to buy their homes but who are sitting on the fence assuming that the property demand may go down further, and the price will drop, we would like to tell them that this might be the right time for them to invest or they would miss yet another opportunity. We do not believe that the demand for the property will be derailed in the future. Yes, currently, people are not ambitious as they should be but this could be an opportunity for you.

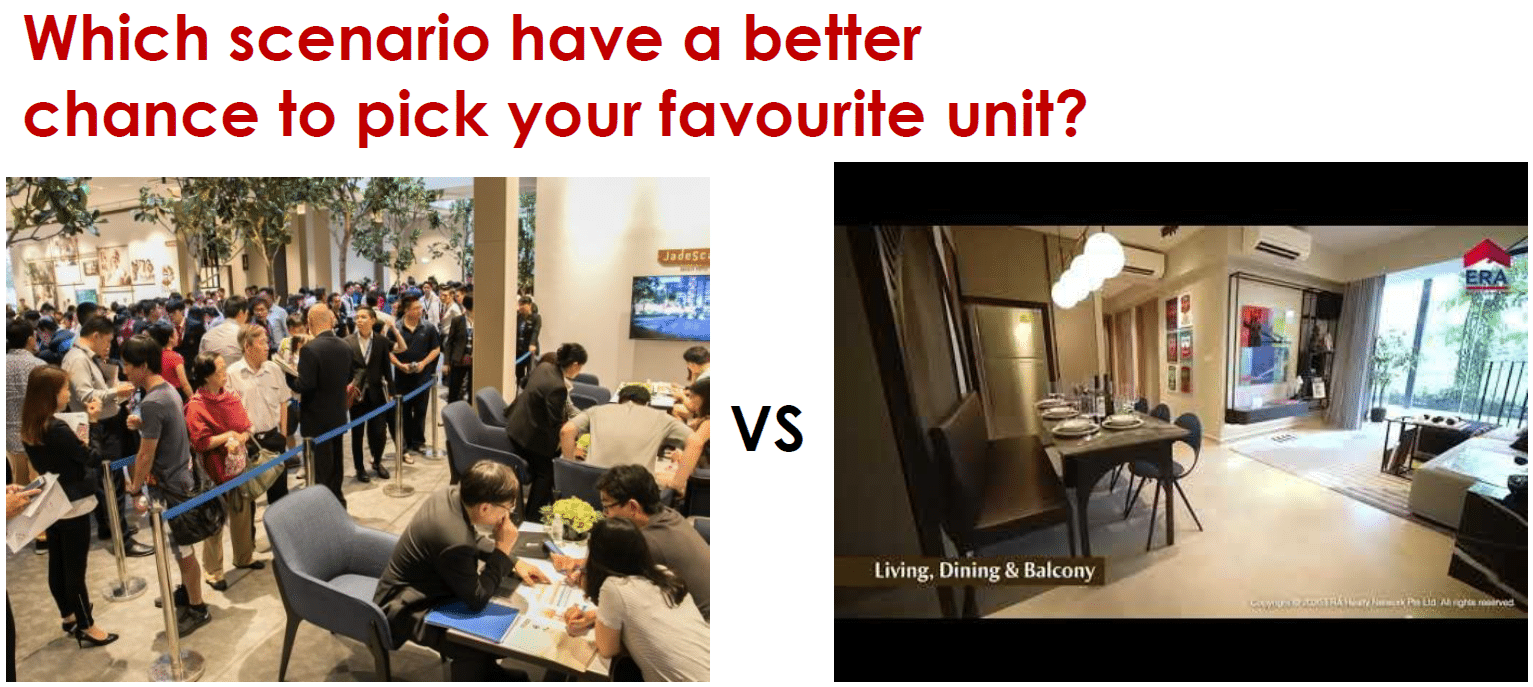

” You don’t have to compete with others “

“Be fearful when others are greedy and greedy when others are fearful” – Warren Buffett

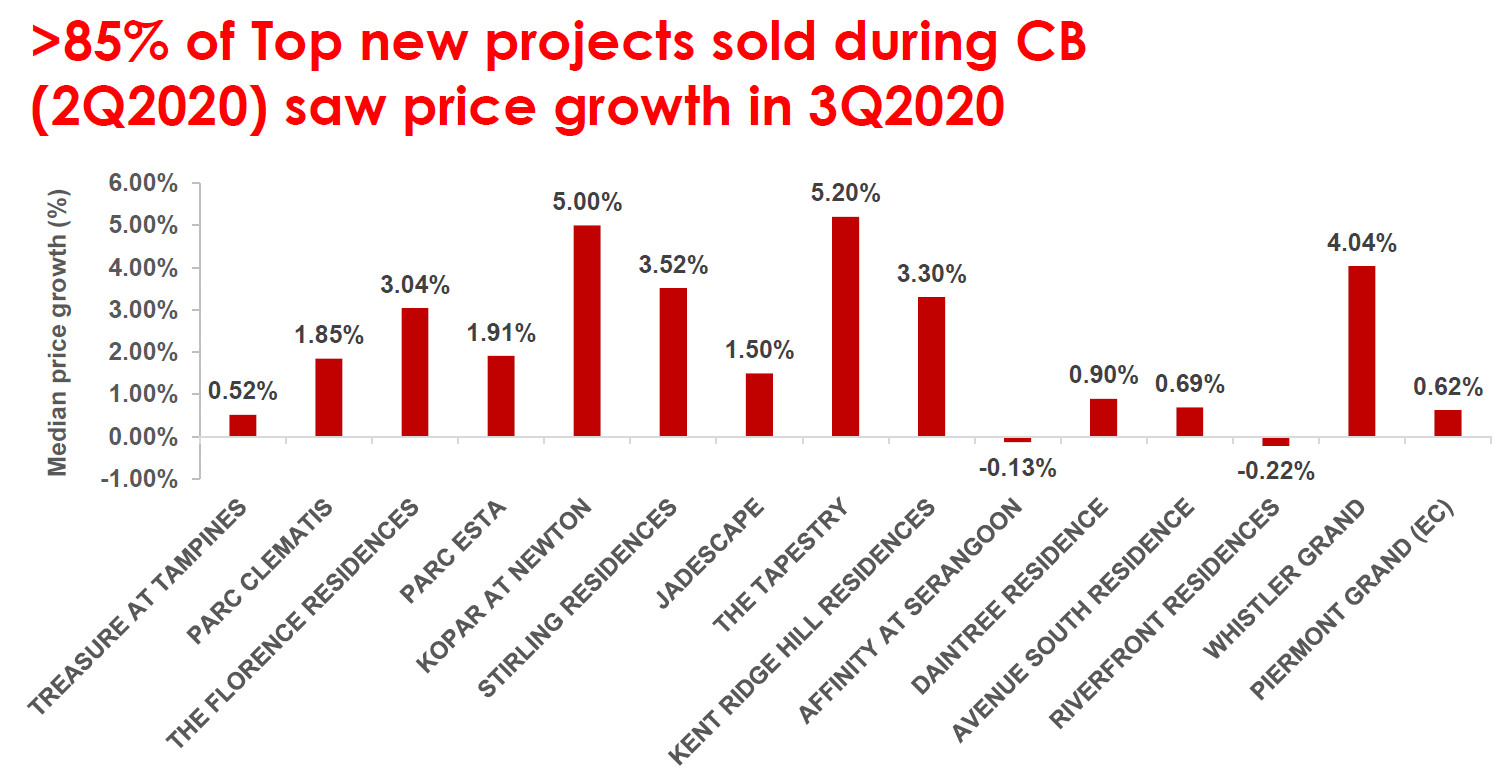

Now, that we have witnessed and evidenced the rising price trend since last Circuit Breaker, we would like to share with you the reasons why you should not be sitting on the fence now and grab your new property at this very opportunity. Do act fast before the price rise any further.

” New launch units are running low. Act fast before the next price rise “

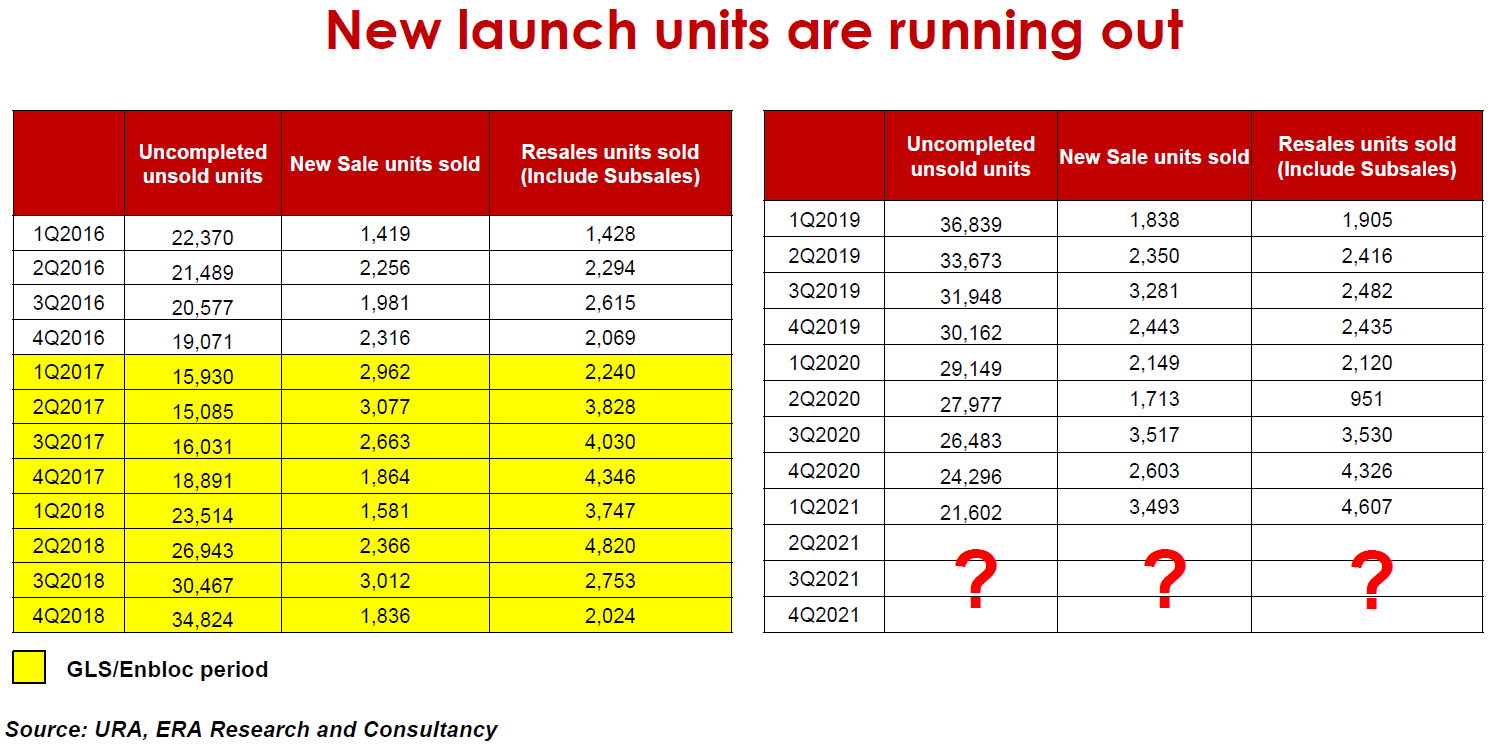

Let’s look at what happened in the 1Q of 2016 through 4Q of 2017.

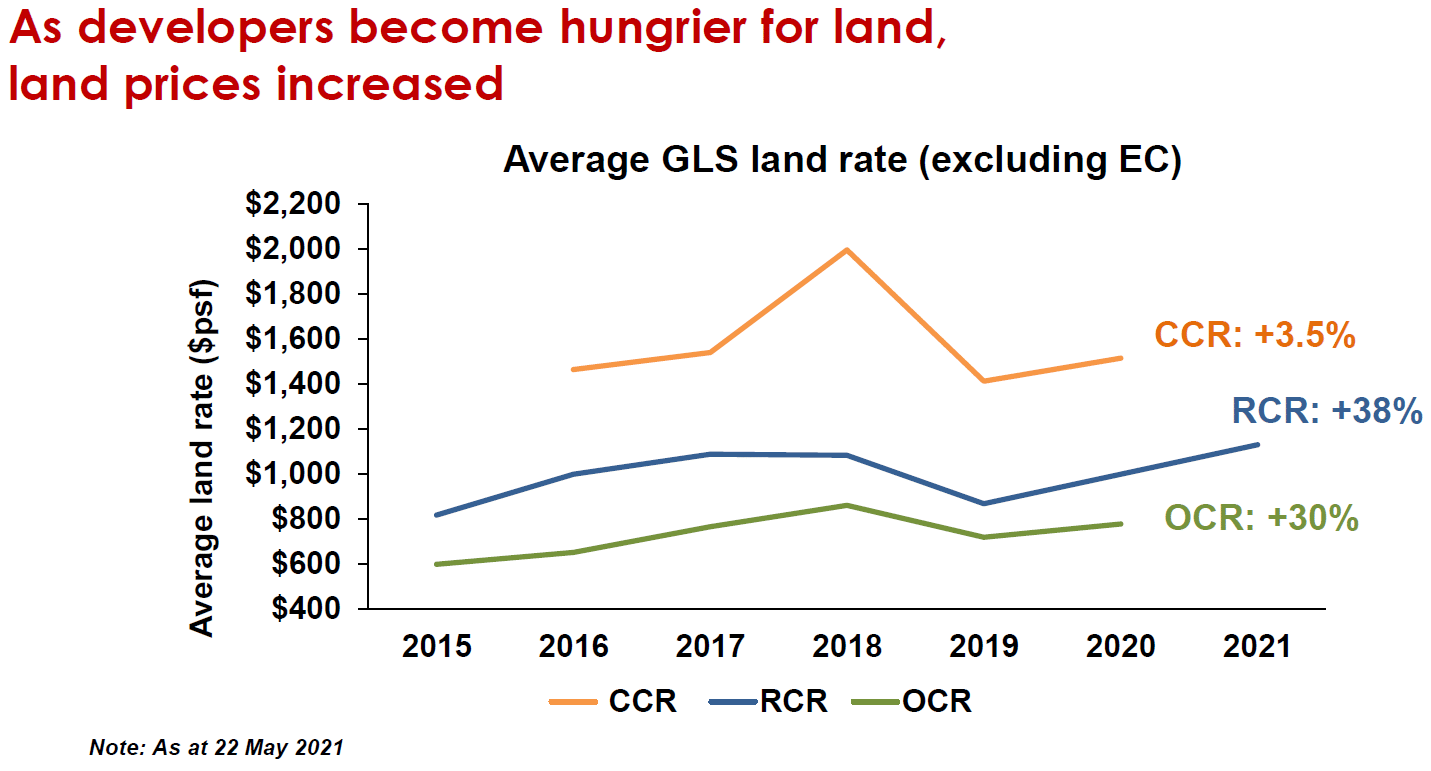

In 1Q2016, 22,370 uncompleted unsold units were recorded. The inventories of uncompleted unsold units were slowly cleared up, leaving 16,031 uncompleted unsold units in 4Q2017. As the inventories were cleared up between 1Q2016 and 4Q2017, correspondingly, we witness a rise in the average land price sold via government land sales. This happened because as the supplies of uncompleted unsold units go down, the developers have to replenish their land back to build more new condos. The natural reflexes of developers made them bid higher to assure themselves new inventories can be added into their pipeline.

Now the question is, with a higher land price, do you think the price of newer launches will fall?

Now, in 1Q2021, the inventories level of 21,602 is similar to the inventory level in 1Q2016. Is there a good chance that history will repeat itself?

Based on the recently completed bidding exercise at Ang Mo Kio Avenue 1 and Tengah Garden walk where 15 and 7 bids were received respectively, this shows the hunger for land by the developers. In contrast, back in 1st half of 2019, where the inventories were still abundant at over 33,000 units, the bid for the two land parcels at Canberra was lacklustre. There were only 5 bids for the site of The Commodore and 4 bids for the site at The Watergardens. And before we move on, on The Commodore and The Watergardens, as the developers bought the land at an attractive price, and if the developers were to pass on the “savings” to the market, it may be worthwhile for you to consider them. You may register your interest at our partnering sites to get updates on their launch prices and more.

The Commodore: https://thecommodore.officialpage.co/

Watergardens at Canberra: https://watergardens.officialpage.co/

For more new launches: https://propertynet.sg/new-launches-private-condo-executive-condo/

Now, we are in a situation where the unsold uncompleted units stand at 21,000. And at 21,000, we are getting close to 15,000 marks. And with the experience of 2017 to 2018, we believe in the second half of this year, 2021, if the release of government land sales is not fast enough to fulfil the hunger of developers, en-bloc sales may seep into the market again, and once again, we would witness another rise in the property prices.

“Curb in foreign workers affects construction cost and developers’ margin”

To manage the Covid-19 situation in Singapore, the supply of foreign works have been reduced due to border controls. Additional safety measures have also be put in place to prevent a future outbreak. This has led to a 20 to 30% increase in tender prices by labour supply sub-contractors. Worse, material cost which typically account for 30 to 50% of a total project’s cost for the contractor, according to Specialists Trade Alliance of Singapore Executive Director Eddy Lau, the building materials like bricks and rebars has increased by 20$ to 40%. For instance, the bricks have risen from $02.5 per piece to $0.35 per piece. This has led to reducing profit margin for the contractors with some turning in losses, implying that the mid-to-long-term impact would be even higher building and construction cost. With that in mind, where do you think the prices of property will be heading? Up or down?

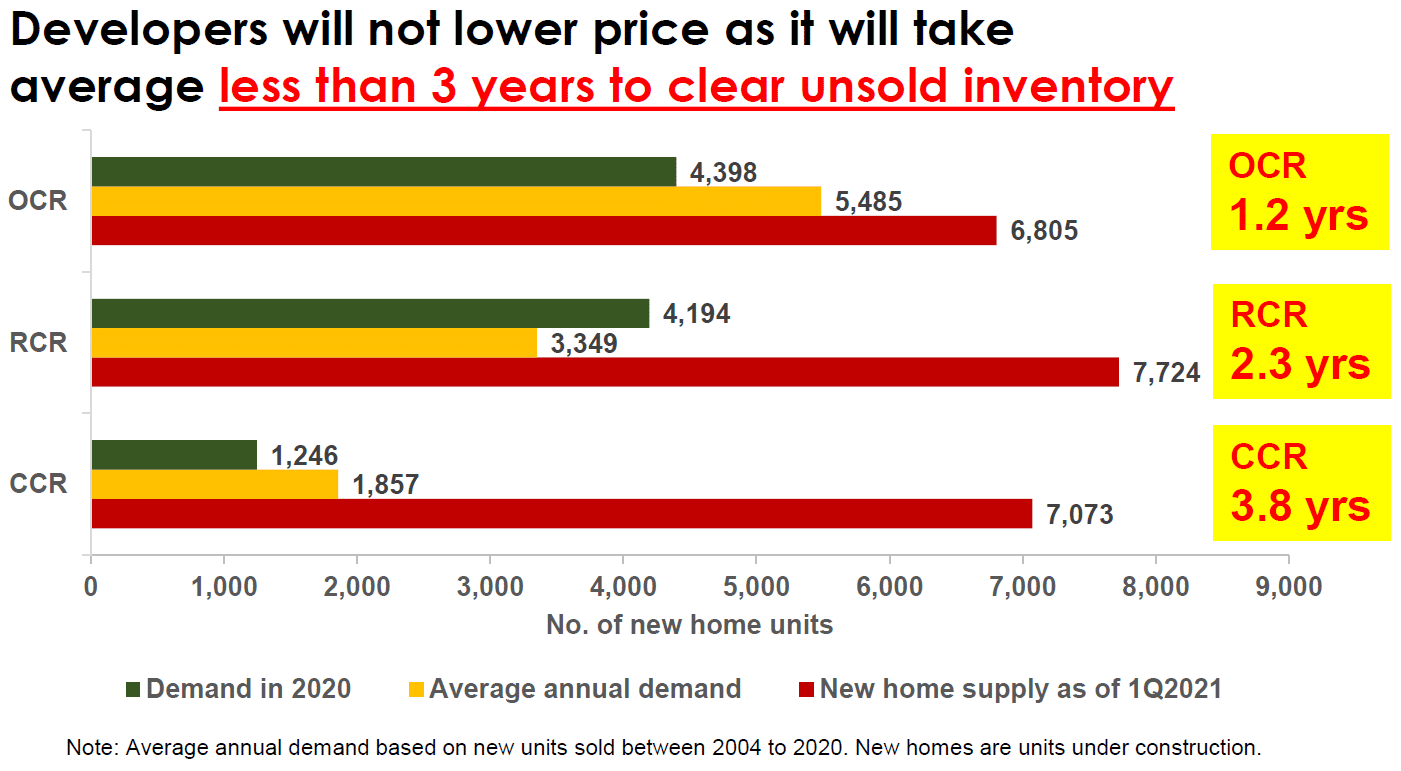

Less than 3 years to clear remaining inventories

If you are thinking that developers will lower prices when they are approaching their ABSD deadline, think again. For those uninitiated, if the developers fail to sell all available units before their ABSD deadline, which is 5 years from the date they acquired the land, they would not be able to be given a remission (i.e. rebate) of their ABSD paid during the acquisition of the land, which is 25% of the land price. And that 25% is a huge amount!!! Back to why it is unlikely that the developer will not lower prices… Breaking down the property segment into the 3 regions (CCR, RCR, OCR) as shown in the chart below. It will take less than an average of 3 years for the developer to clear their unsold inventory. If you are planning on getting a property in the OCR region, act fast. In approximate 1.2 years, the stocks in OCR are likely to be cleared based on the average annual demand of 5,485 homes per annum with stocks of 6,805 left. For both RCR, it will take less than 3 years. For CCR, around 4 years for the stocks to be clear. There are chances developer may not fulfill the ABSD deadline but based on recent take-up rates, the chances are very low.

Conclusion:

With impending rising land, labour and material cost, coupled with falling inventories, the chances of property prices heading north is very high. If you have missed the golden period presented to you during the circuit breaker, don’t miss another opportunity presented to you during this heightened alert phase, it may never come back again. So, grab this opportunity by contact your trusted real estate salesperson today or give us a call at 61001344 and our team will be glad to assist you in your journey to be a real estate millionaire.

Edwin Goh

With his love for numbers and data, Edwin has provided valuable insights to his clients and readers to empower them to make better-informed real estate decisions.

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.

Thanks for posting,

Really an awesome article,

love reading this as it was very attractive and helpful.

Please keep posting such a nice article.