However, on the other spectrum, smaller units (one and two-bedder), which are generally more palatable for investors with smaller budgets, are snapped up ferociously at new launches:

- Midtown Modern has 90% of one and two-bedder at Midtown Modern sold during launch.

- Studio, one-bedroom and two-bedroom units account for over 80 per cent of the units at Irwell Hill Residences.

- The Reef at King’s Dock sold all its one-bedder on its first day.

- 80% of units sold at Normanton Park during the launch were one and two-bedroom units.

With that, the million-dollar question will be: How does size affect capital appreciation?

For this research, we will evaluate the in terms of Price Per Square Foot (PSF) and break down the analysis as such:

- How does size in square footage affect capital appreciation?

- How does the number of bedrooms within the properties affect capital appreciation?

Also, we are only looking at resale transactions because this is the market homeowners (non-developers) like you and I are concerned about when we have to realise our profits and losses of our investment properties.

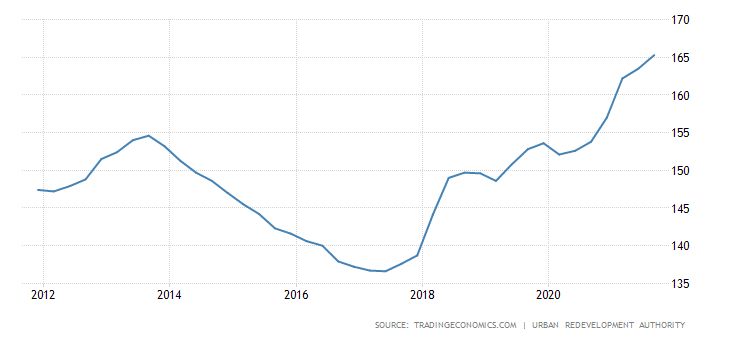

Quick Recap of Singapore Home Price Index

How does size in square footage affect capital appreciation?

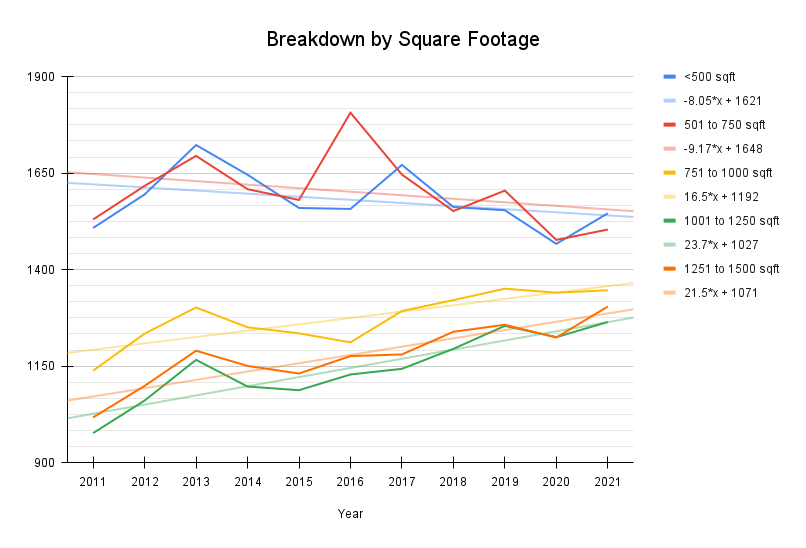

Surprisingly, properties between 501 and 750 sqft saw their value depreciating more than properties less than 500 sqft.

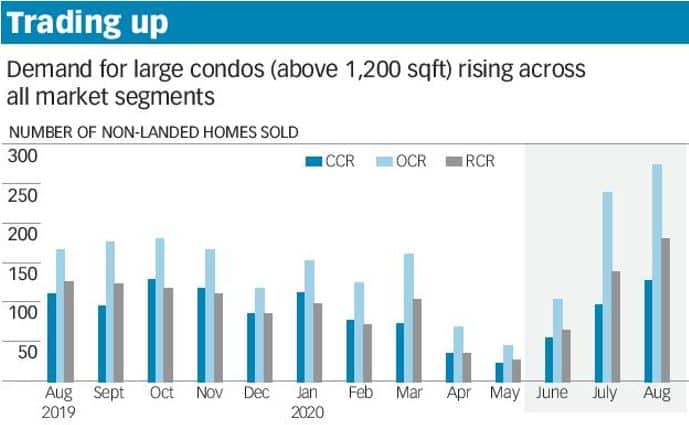

In contrast, larger units above 750 sqft have experienced a steady appreciation in their value.

For the larger units, properties between 1001 and 1250 sqft performed the best, followed by properties between 1251 and 1500 sqft and then between 751 and 1000 sqft.

Resiliency

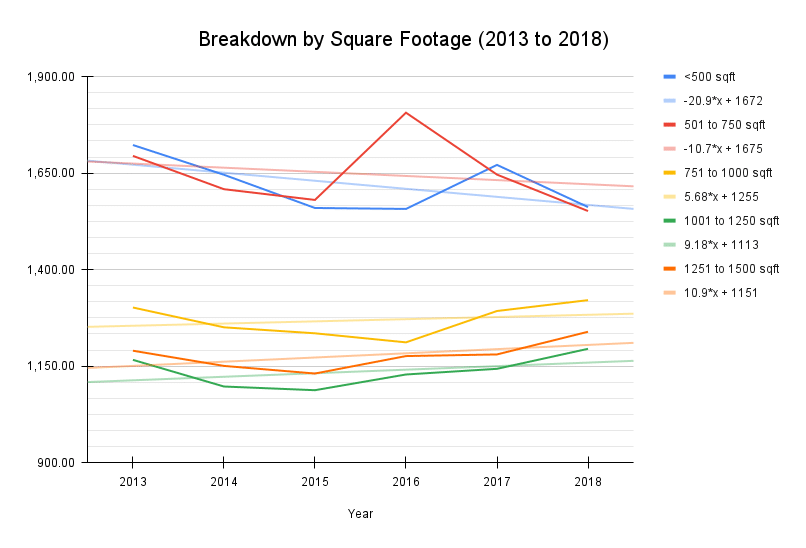

Larger units are also more resilient against downward pressures.

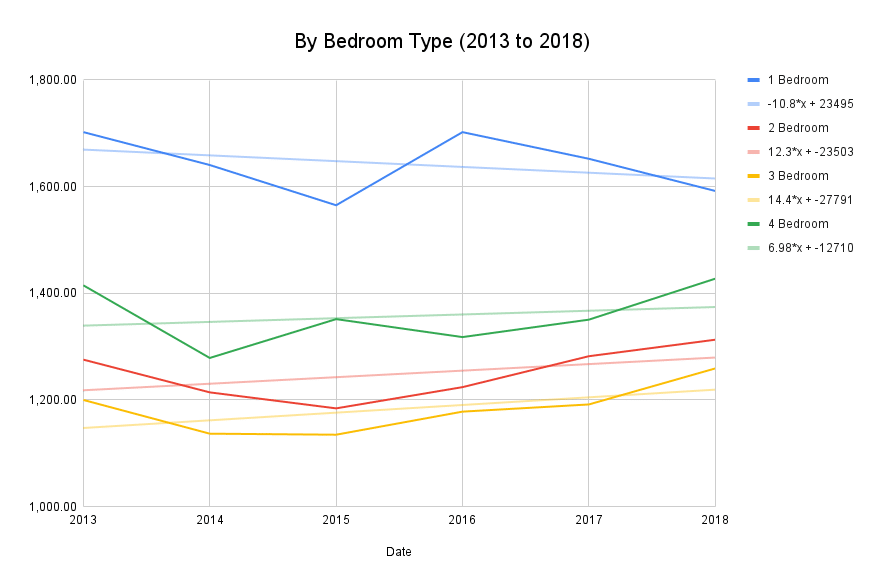

Between 2013 and 2018, when the property market was softening due to cooling measures, larger units recovered to their previous high in 2018. In contrast, smaller units (< 750 sqft) are continuing with their downtrend.

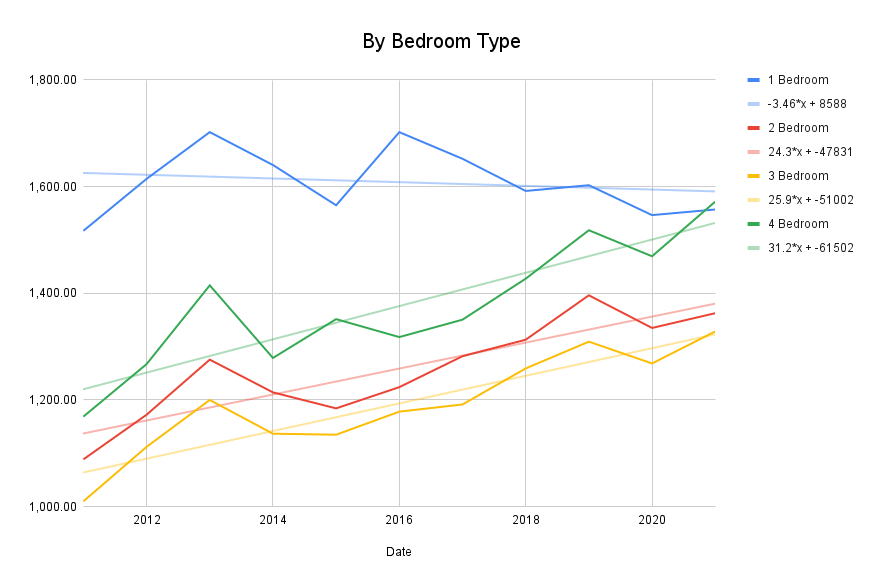

1, 2, 3 & 4-Bedroom – How did they perform?

In line with conventional wisdom, capital appreciation is better for properties with more bedrooms.

Takeaway

The above study has its limitation as it takes into account the general market as a whole. It helps to know that, in general, the larger the units, the higher the chances of enjoying capital appreciation. For those looking to buy larger units for stay, you should be in good shape in the years to come.

For those with a tighter budget or buying smaller units for investment, take extra prudence in assessing the property’s value before committing, in particular, the 1-bedder. A healthy rental income may well justify the investment.

Don’t be despair if you can only afford a 1-bedder. It’s not all dark and gloomy for 1-bedder. The smallest home in Singapore, which is 258 sqft, not larger than two and a half parking lots, has made profits for all its owners to date.

| Sold On | Address | Area (sqft) |

Sale Price (S$ psf) |

Bought On | Purchase Price (S$ psf) |

Profit (S$) |

Days (days) |

Annualised (%) |

| 14 Mar 18 | 70 Lim Ah Woo Road #03-11 | 258 | 1,723 | 28 Jan 11 | 1,637 | 22,000 | 2,602 | 0.7 |

| 1 Oct 13 | 70 Lim Ah Woo Road #02-11 | 258 | 1,966 | 9 Nov 09 | 1,452 | 133,000 | 1,422 | 8.1 |

| 3 Apr 13 | 70 Lim Ah Woo Road #05-11 | 258 | 1,916 | 9 Nov 09 | 1,514 | 104,000 | 1,241 | 7.2 |

| 15 Jun 12 | 70 Lim Ah Woo Road #04-11 | 258 | 1,916 | 11 Nov 09 | 1,494 | 109,000 | 947 | 10.1 |

| 28 Jan 11 | 70 Lim Ah Woo Road #03-11 | 258 | 1,637 | 9 Nov 09 | 1,475 | 42,000 | 445 | 9 |

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.

Edwin Goh

With his love for numbers and data, Edwin has provided valuable insights to his clients and readers to empower them to make better-informed real estate decisions.