TMW Maxwell, which debuted recently as a new condominium, occupies a prime position in a prestigious Singapore district, District 2. The prevailing perception of this locale is that it serves as a prime hub for real estate investment, primarily due to its status as Singapore’s renowned central business district.

However, is this perception genuinely aligned with reality?

Let’s delve into the intricacies of this specific district and conduct an in-depth assessment to determine whether TMW Maxwell truly stands as an unmistakable and attractive investment property.

District-Level Insights: Unveiling District 2’s Market Dynamics

Beginning our analysis at the district level, we will focus on District 02 in Singapore, home to TMW Maxwell. Our primary focus will be comparing District 02 to the entirety of Singapore, with a specific emphasis on resale transactions. This holds particular relevance for potential sellers like you. Furthermore, due to TMW Maxwell’s exclusive offering of 1 and 2-bedroom units, our data analysis will be confined to these specific unit types.

Let’s delve into the findings.

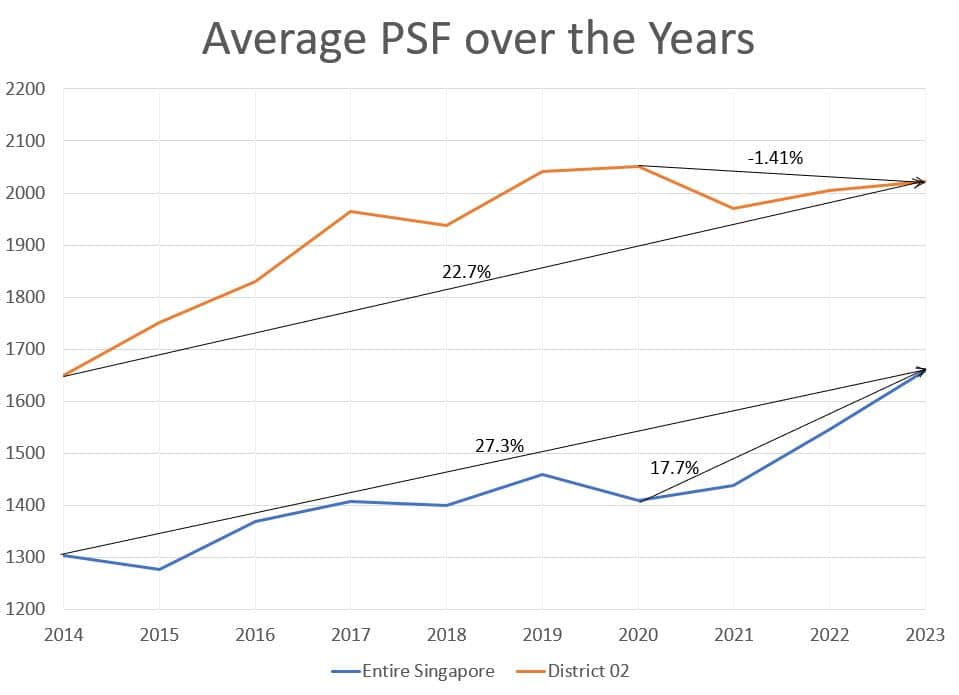

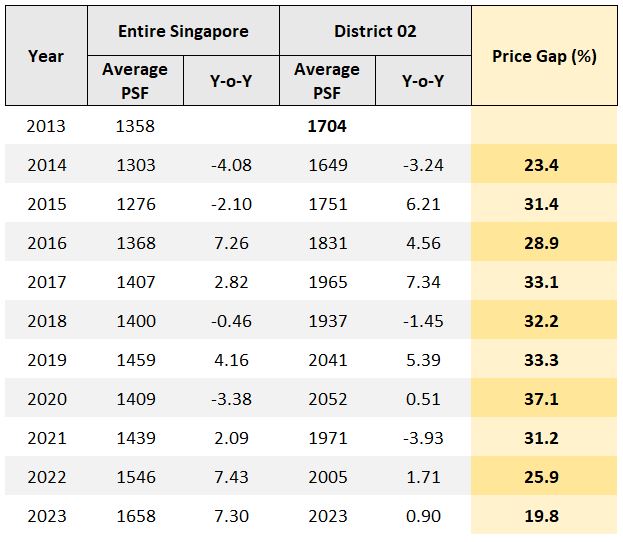

Over the past decade, both District 02 and the entire of Singapore have experienced notable capital appreciation. Between 2014 and 2023, the average price per square foot (PSF) in District 02 increased by 22.7%, while the broader Singapore market saw a 27.3% increase. However, it’s worth noting that District 02’s performance slightly trailed the overall market by approximately 4.56%.

In a rather unexpected twist of events, during the buoyant market phase from 2020 to 2023, District 02 experienced a decline of about 1.41% in average PSF. In contrast, the general market exhibited a remarkable surge of 17.7% within this concise three-year span. Upon closer inspection of the trend, District 02 might have been trailing the broader market until around 2021, after which its average PSF displayed a potential acceleration. Unfortunately, this appreciation tempo subsequently aligned with the broader market’s slowdown.

Examining the price differential across the years suggests that District 02 could accommodate further capital appreciation if the market experiences an upward trajectory. This proposition is substantiated by the price gap percentage of 19.8 between District 02 and the entirety of Singapore, compared to a historical median price gap of approximately 31.3%. This hints at the potential for District 02’s prices to catch up if market conditions favour an upward shift.

Evaluating Neighbouring Project Profitability: Lessons for TMW Maxwell

Let’s now delve into evaluating the performance of projects situated within a 500-meter radius of TMW Maxwell, aiming to forecast the potential profitability of TMW Maxwell itself. For this analysis, we will focus exclusively on projects less than a decade after they obtained their Temporary Occupation Permit (TOP).

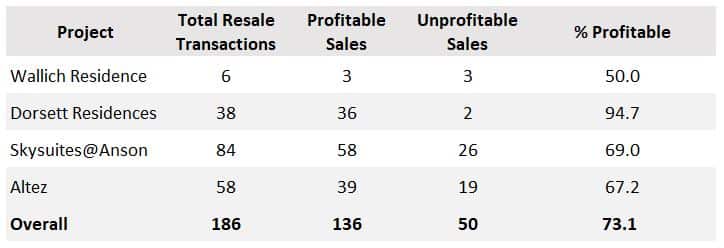

When we assess the performance of TMW Maxwell’s counterparts—Wallich Residence, Dorsett Residences, Skysuites @ Anson, and Altez—it becomes evident that exercising caution is prudent when considering an investment in TMW Maxwell. The data reveals that the percentage of profitable resale transactions among its peers is around 73.1%, implying that 1 out of every 4 resale transactions could result in a loss.

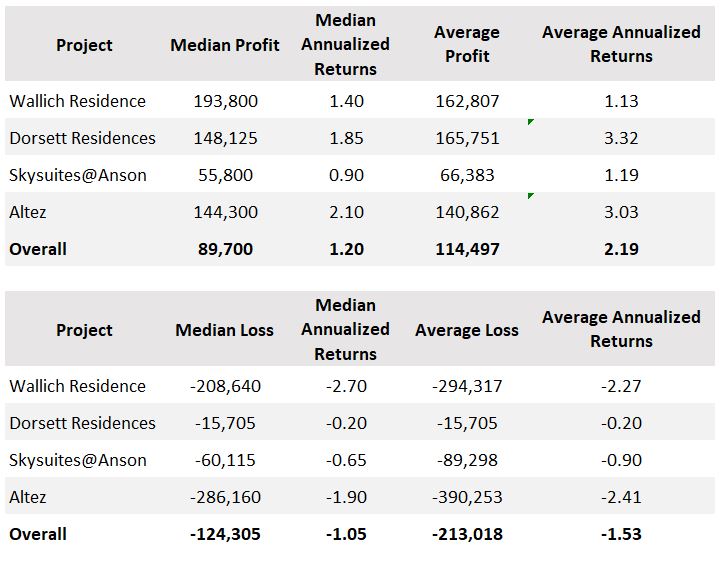

Moreover, the potential monetary loss, reaching S$124,000, surpasses the potential profit of S$98,741. However, it’s worth noting that the median annualised returns stand at a positive 1.2% for profitable transactions, which contrasts with loss-making resale transactions exhibiting a median annualised return of -1.05%. Despite this, an annualised return of 1.2% might not be deemed attractive by investors, especially considering the less than 75% profitable rate.

Try our ROI Calculator to project potential returns on your property.

Comparatively, if we gauge TMW Maxwell against Skysuites@Anson and Altez—both developments sharing similarities in surrounding amenities and approximate distance from the train station—the profitability rate further decreases to around 67.2% and 69%, respectively.

Please note that resale transactions conducted within a one-month timeframe have been excluded for Dorsett Residences (10 transactions) and Altez (2 transactions). This exclusion was necessary to prevent a significant upward distortion of the average annualized return figures.

Considering that TMW Maxwell’s counterparts demonstrate profitable resale transaction rates from 67% to 73%, a notable element of risk is apparent when contemplating an investment in TMW Maxwell. This risk factor suggests the possibility of potential financial loss. This prompts a crucial question: Can TMW Maxwell deviate from this prevailing trend? To delve into this inquiry, we will examine TMW Maxwell’s entry price relative to its peer projects in the upcoming section.

Entry Price of TMW Maxwell: Balancing Potential and Premium

Might TMW Maxwell’s entry price have the potential to unexpectedly position it as a leading contender in the pursuit of profitability? Unfortunately, our assessment, utilising the “normalised average PSF” approach, indicates that TMW Maxwell’s pricing might exceed an optimal range. Even the smallest percentage difference, compared to its peers (excluding Wallich Residence from consideration), is at a notable 21%, surpassing a level that we find comfortably viable. It’s worth noting that Wallich Residence is an iconic development with an exceptionally high price point. Consequently, using Wallich Residence as a benchmark might not effectively reflect the true potential of TMW Maxwell.

Note

- The concept of Normalized Average PSF involves adjusting the lease duration back to 99 years, thereby allowing a fair comparison among projects as if they were all launched in the same year. Nevertheless, this approach doesn’t account for the element of novelty in newer developments. Newer projects often come equipped with updated facilities and advanced technology, which could impact the per-square-foot (PSF) price. Thus, it’s essential to recognize that these modern amenities might contribute to a higher PSF in more recent developments. Beyond this, conventional factors like location, construction type, unit mix and other characteristics can also exert influence on the pricing of a development.

- In the case of TMW Maxwell, please be aware that we are referencing the indicative starting PSF instead of the average PSF for our analysis.

Now, the question to you is: Would you be willing to invest in TMW Maxwell at a premium of over 20%, considering its newer amenities, prime location, construction, thematic elements, and other factors?

Conclusion: A Pathway to Consider

Given that the three levels of analysis have not convincingly positioned TMW Maxwell as a promising condominium option we would readily recommend to our general readers, we will conclude our analysis at this point. It’s worth noting, however, that the above analysis is more tailored toward investors seeking capital appreciation. Suppose you are an investor oriented towards generating rental income. In that case, engaging a real estate consultant for a separate, independent analysis that aligns with your specific goals might be advisable.

Should you continue to identify compelling factors that merit your consideration of TMW Maxwell, it’s crucial to acknowledge that the overall outlook is not entirely negative. Similar to its peer developments, the potential for profitable transactions within TMW Maxwell exists. To increase your chances of making a profitable investment in TMW Maxwell, meticulous research and a discerning approach to selecting a unit within TMW Maxwell are crucial to defy the odds and succeed as an investor in this project. Furthermore, it’s worth noting that the developers might contemplate price adjustments if the sales performance continues to be lacklustre over an extended period, particularly considering their advantageous acquisition cost for the land at S$1603 per square foot per plot ratio.

With that said, we extend our best wishes for your real estate journey. Should you wish to delve deeper into the details of TMW Maxwell, feel free to explore further by clicking on the button below.

Don’t lose hope if TMW Maxwell doesn’t align with your expectations. Here’s a carefully curated collection of new condominium launches, providing you with various options that may better suit your real estate goals:

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.

Edwin Goh

With his love for numbers and data, Edwin has provided valuable insights to his clients and readers to empower them to make better-informed real estate decisions.