Condo sales in August saw a noticeable dip compared to July’s impressive performance. Specifically, developers reported a 72% decrease, selling 394 units, compared to the 1,412 units transacted in July. Year-on-year, this represents a 10% drop from the 438 units moved in August 2022.

A significant factor contributing to this decline was the five fresh condo launches in August. These included Altura in Bukit Batok and four other private residential projects – Orchard Sophia, TMW Maxwell, The Lakegarden Residences, and The Arden. These launches sold 133 units, about 34% of August’s monthly condo sales.

Detailed Analysis by Region:

- Outside Central Region (OCR): OCR led the condo sales in August. Despite the dominance, it recorded a sale of 192 units, a 61% drop from July. The best-sellers in this region were The Lakegarden Residences, Lentor Hills Residences, and The Arden.

- Rest of Central Region (RCR): Condo sales in RCR experienced a significant decline of 87%, with 106 units sold. Key projects like Grand Dunman and One Pearl Bank, which bolstered July’s figures, had a quieter August.

- Core Central Region (CCR): The CCR condo market had a more positive outcome, registering a 9% increase in sales from July. Orchard Sophia emerged as the top project, followed closely by One Bernam, indicating a renewed interest possibly influenced by the new launch of TMW Maxwell in the RCR.

EC Segment Update:

The Executive Condominium (EC) sector experienced a boom, driven mainly by the launch of Altura EC in Bukit Batok. The project dominated EC sales, moving 225 units out of the 255 total sales recorded.

With five new condo launches and an array of unsold units available, potential buyers display a trend of deliberation, contrasting the rush seen in earlier months. Developers listed 590 new condos in August, a significant decrease from the 2,156 units in July.

“The incredible condo sales in July set high expectations for August. Yet, market trends during the Hungry Ghost month, signs of market moderation, and other external economic factors created a more complex environment for condo sales.”

– Wong Siew Ying, Head of Research & Content at PropNex Realty

She further notes the discernment of condo buyers, indicating a careful evaluation of multiple projects before deciding. This trend is evident in the sales patterns of Liv @ MB and One Bernam. Wong adds, “Given the recent launches and available units, many condo buyers are in no rush. The PropNex Home Buyers’ Sentiment Survey 2023 indicates that buyers seek proximity to transport, pricing, space, and proximity to primary schools and workplaces.”

Looking Ahead

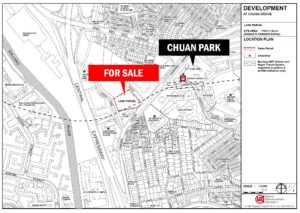

August’s numbers underscore the cautious sentiment surrounding condo investments. However, there are thrilling prospects on the horizon. Upcoming condo launches, like Hilllock Green in Lentor Central and J’Den in Jurong, promise to further rejuvenate the market. These launches bring forth new design paradigms, modern amenities, and strategic locations that prospective buyers and investors should be keen to monitor.

To ensure you don’t miss out on these enticing opportunities, it’s crucial to stay ahead of the curve. By signing up for our mailing list, you’ll be the first to receive updates, exclusive previews, and expert analyses on these new condo projects. This will empower you to make informed decisions, positioning you ideally in this dynamic condo market.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.