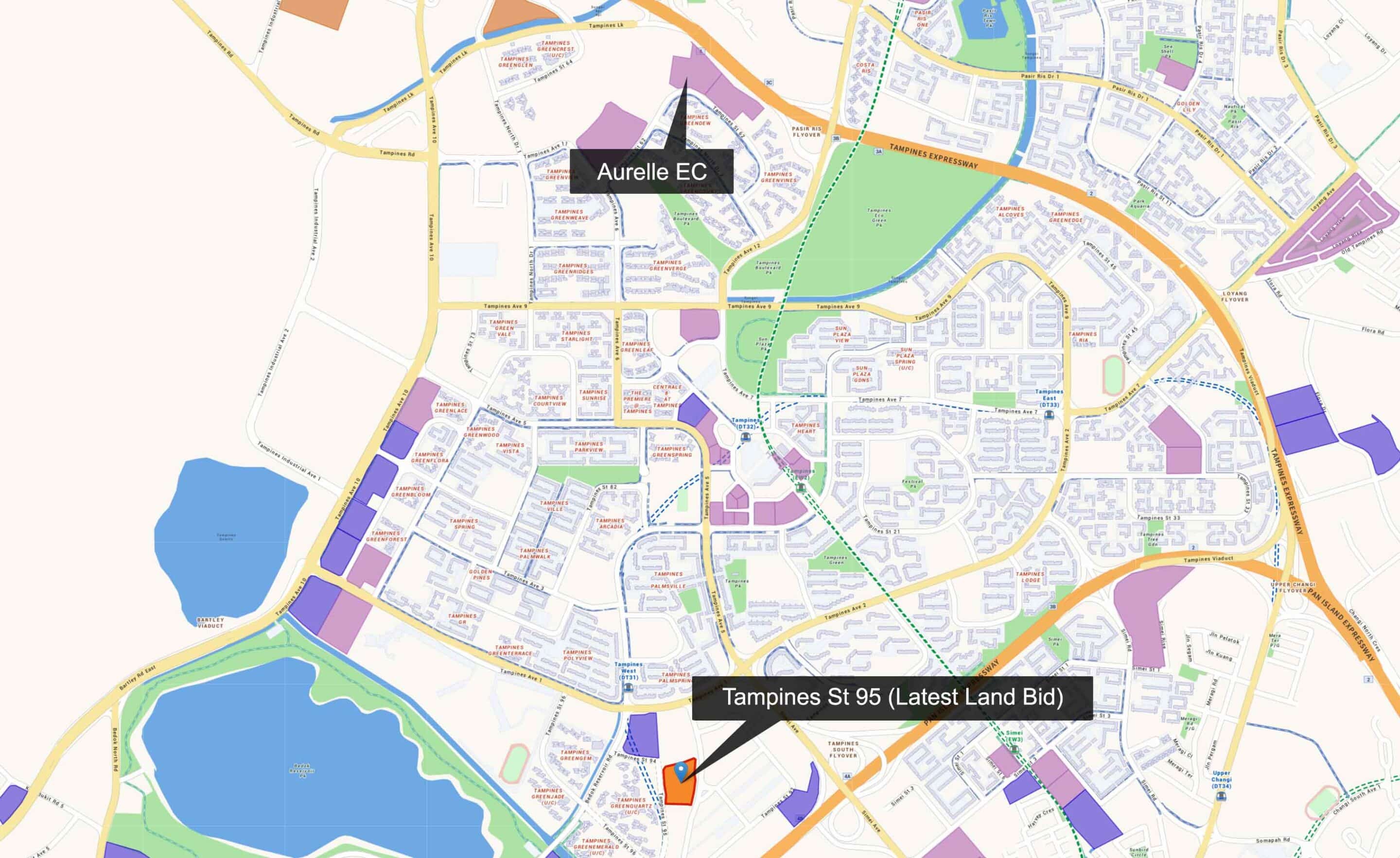

Recently, Sim Lian Group set a new record by securing a plot at Tampines North with a bid of $768 per square foot per plot ratio (psf ppr). This record-setting price has left many wondering about its implications for the Executive Condominium (EC) market and what potential buyers should consider. Let’s dive deeper into the significance of this new high bid and what it means for you as a prospective EC buyer.

A New Record for EC Land Prices: What’s the Big Deal?

Sim Lian’s latest bid of $768 per square foot per plot ratio (psf ppr) significantly exceeded previous benchmarks, setting a new record for Executive Condominium land prices. To give some context, the previous high was set at the Jalan Loyang Besar site, which was awarded in August 2024 to a joint venture between CNQC International (the parent company of Qingjian Realty), China Communications Construction Company, and ZACD. They won the site with a bid of $729 psf ppr. Sim Lian’s $768 psf ppr bid represents a 5.1% increase over this previous high, indicating that developers are willing to pay a premium for well-located EC sites in established areas with good amenities and future growth potential.

High Demand for ECs: A Strong Market with Guaranteed Capital Gains

Demand for Executive Condominiums remains robust in Singapore, driven by their unique appeal. ECs are a bridge between public and private housing, offering the affordability of public housing with the amenities of private condos. The biggest draw for many buyers is the almost guaranteed capital gain after fulfilling the Minimum Occupation Period (MOP) of 5 years. EC owners often find themselves able to sell their homes for a tidy profit soon after hitting this milestone.

For a detailed breakdown of why new ECs outperform private and resale condominiums, you can check out this case study article on PropertyNet.sg. The article explains the factors contributing to the consistent capital appreciation of ECs and why they remain a reliable investment choice.

Limited EC Supply: Only Two Launches in 2024

Adding to the appeal of Executive Condominiums is the limited number of new launches each year. For instance, there were only two EC launches in 2024: Lumina Grand at Bukit Batok and Novo Place at Tengah. With a tight supply and increasing land costs, new ECs are becoming more sought after. Developers like Sim Lian are willing to pay a premium to secure land in well-developed, high-demand areas like Tampines North.

What Does This Mean for Buyers?

Evaluate Your Budget

Given rising land costs, it’s crucial to carefully assess your financial capacity before making an EC purchase. One effective way to do this is by using PropertyNet.sg’s Affordability Calculator. This tool will help you check your maximum loan eligibility by considering your income, debts, and other financial factors, enabling you to confidently determine your budget.

Think Long-Term

When it comes to long-term investment, ECs have a proven track record of appreciating in value after just 5 years. In fact, it’s rare for EC owners to experience losses after the MOP—historically, new EC owners have not seen losses since the 1997 Asian Financial Crisis, which was 27 years ago. This long track record of consistent capital gains highlights why ECs are considered a low-risk and rewarding investment option.

Aurelle of Tampines: Sim Lian’s Next Big Launch

While the new record-bid site at Tampines North is still in its planning stages, Sim Lian is also preparing to launch Aurelle of Tampines, another EC project in the same area. This new development is expected to launch around January 2025, as it must fulfil the mandatory 15-month waiting period from the date the land was purchased or when the foundation is completed—whichever is earlier.

Aurelle of Tampines will offer around 760 units with layouts ranging from 3 to 5 bedrooms. This project promises great connectivity and convenience for families. It is located near the future Tampines North MRT station on the Cross Island Line (CRL) and the upcoming Tampines North Integrated Transport Hub.

Why All Eyes Are on Tampines North

Both the new high-bid EC and Aurelle of Tampines are located in Tampines North, an area that is undergoing extensive development and infrastructure improvements. The government has planned new amenities, schools, and parks, making it an attractive neighbourhood for families and investors alike. Investing in an area with strong growth potential can lead to even higher returns, and Tampines North is shaping up to be one of the most promising locations in Singapore.

Don’t Want to Wait? Explore Other Options

If waiting until early 2025 for Aurelle of Tampines doesn’t align with your timeline, you might want to explore existing ECs with unsold units. You can find a detailed List of Executive Condominiums with Unsold Units on PropertyNet.sg. This list provides alternative options for securing a home sooner, especially given the limited launches this year.

Wrapping Up: Key Takeaways for Buyers

Sim Lian’s record-setting bid at Tampines North signals developers’ confidence in the EC market and the sustained demand for well-located projects. While rising land costs may push launch prices higher, the appeal of Executive Condominiums remains strong due to government subsidies, deferred payment schemes, and proven capital appreciation.

For buyers, the decision comes down to your budget, long-term investment goals, and timeline. Whether you wait for the record-bid EC, explore Aurelle of Tampines, or look at other unsold units, staying informed about market trends and upcoming launches will help you make a well-informed decision for your next home or investment.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.