Private new home sales in August saw a significant drop following a strong performance in July. Developers sold 208 new units (excluding executive condos), representing a sharp 64% decline from the 571 units sold in July. Compared to August 2023, sales were down 47%, with 394 units sold the same month last year. Year-to-date, 2,668 units have been sold.

The steep drop in sales was due to a lack of new project launches and the lunar Ghost Month, a traditionally slow period for property sales. Buyers and developers alike tend to hold back during this time. In August, developers launched only 272 units, starkly contrasting to the 616 units launched in July.

Sales by Region

Sales in the Outside Central Region (OCR) led the way, accounting for 59% of total transactions. Developers sold 123 units in the OCR, a significant 72% drop from July’s performance. Top-selling projects included Hillock Green (17 units at a median price of $2,108 psf), Lentoria (15 units at $2,217 psf), and Hillhaven (14 units at $2,153 psf).

In the Rest of Central Region (RCR), sales totalled 65 units, down 39% from July. The top performer was Tembusu Grand, which sold 30 units at a median price of $2,455 psf. This project has sold 74% of its total 638 units since its April 2023 launch. The upcoming launch of Emerald of Katong may have spurred additional interest in this area.

Meanwhile, Core Central Region (CCR) sales remained steady, with 20 units sold—only slightly down from 21 in July. Key projects like One Bernam (6 units), 19 Nassim (5 units), and Watten House (5 units) dominated sales in this prime area. The priciest unit sold in August was a $14.7 million, 4,198-square-foot unit at 32 Gilstead.

Executive Condo (EC) Market

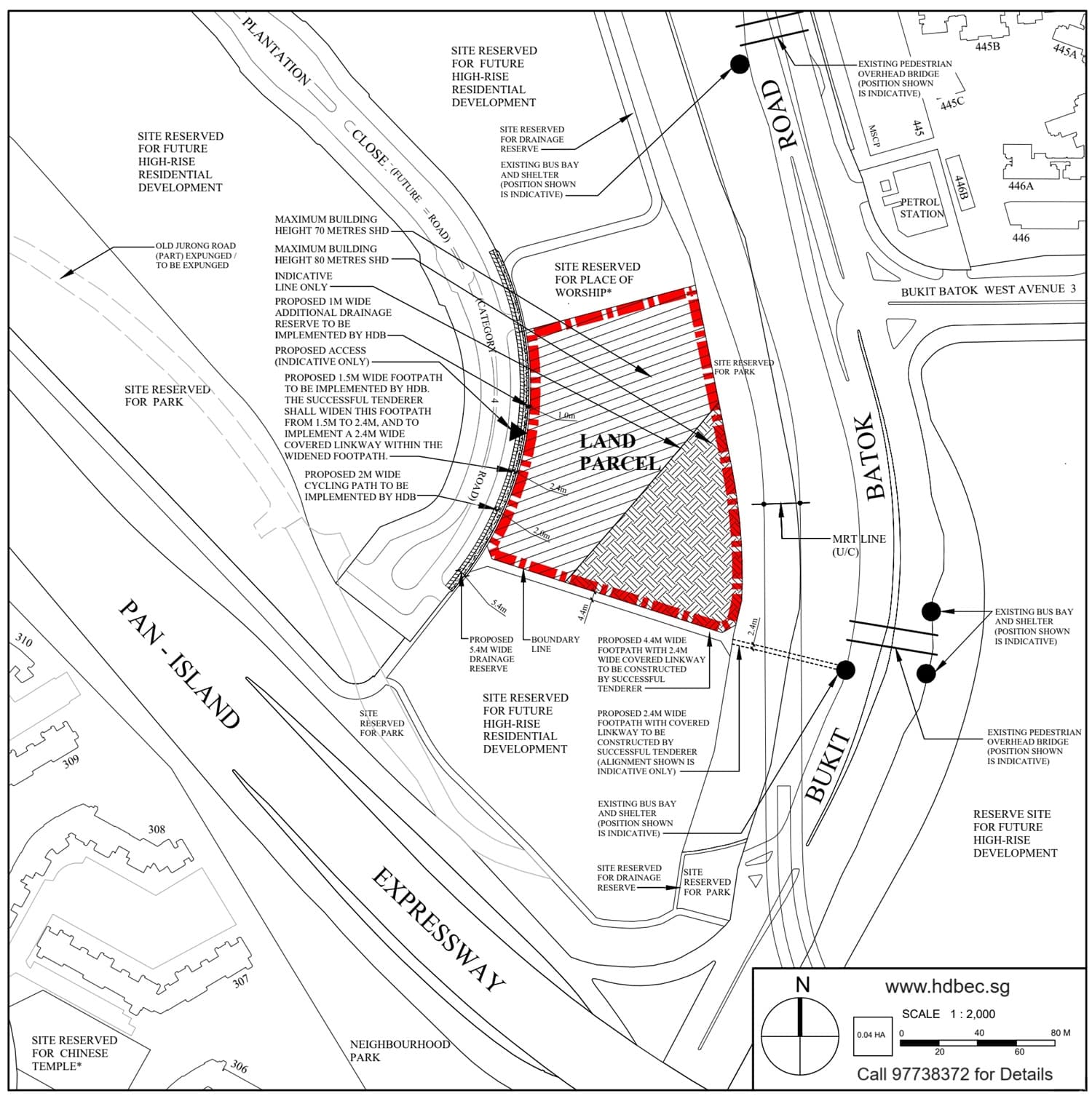

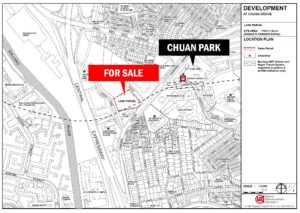

The EC market also experienced a slight dip, with 36 units sold, down 2.7% from July. North Gaia EC in Yishun led the way with 24 units sold at a median price of $1,306 psf. With EC stock dwindling to just 200 unsold units, the market anticipates the launch of Novo Place EC in Plantation Close, Tengah, later this year.

Buyer Demographics

Foreign buyer interest increased slightly, with non-permanent residents accounting for 2.4% of sales in August, up from 0.9% in July. These buyers were drawn to prime projects such as 19 Nassim and Tembusu Grand. Singapore permanent residents accounted for 8.6% of sales, while Singaporean buyers made up the majority at 88.5%, up from 87.2% in July.

Price Trends

Despite the sales slowdown, the median price for new non-landed private homes rose 4.2%, reaching $2,238 psf. This uptick was driven by fewer lower-priced units and a larger share of transactions above $1.5 million. In July, 40% of new homes sold were priced below this threshold, compared to just 6% in August.

Market Outlook

New home sales were sluggish in August, largely due to the lack of new project launches and the seasonal lull of the Ghost Month. However, the market is expected to pick up in September with the launch of 8@BT, a 158-unit development near Beauty World MRT station. Additional launches, including Meyer Blue, Union Square Residences, Emerald of Katong, and Norwood Grand, are anticipated later this year.

A potential interest rate cut by the U.S. Federal Reserve could also boost buyer confidence, making borrowing more affordable and improving sentiment. PropertyNet.SG remains optimistic about the outlook for new home sales in the last few months of 2024, with a steady pipeline of new projects expected to attract discerning buyers.

Looking for more new condo launches? Explore the latest listings and find your dream home on our website! Discover new condo developments across Singapore with key details and exclusive offers.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.