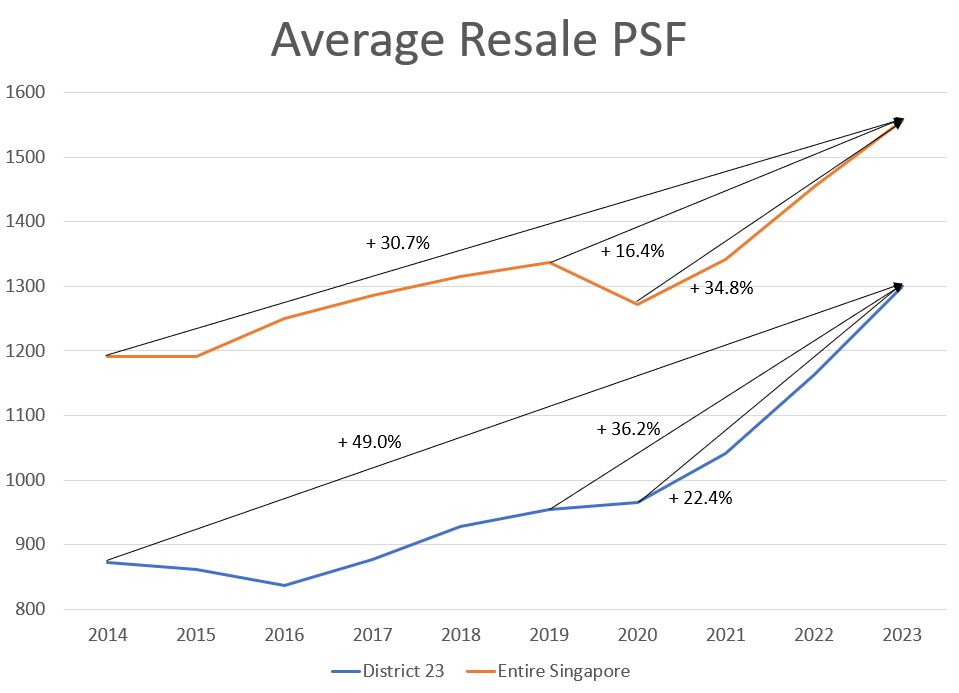

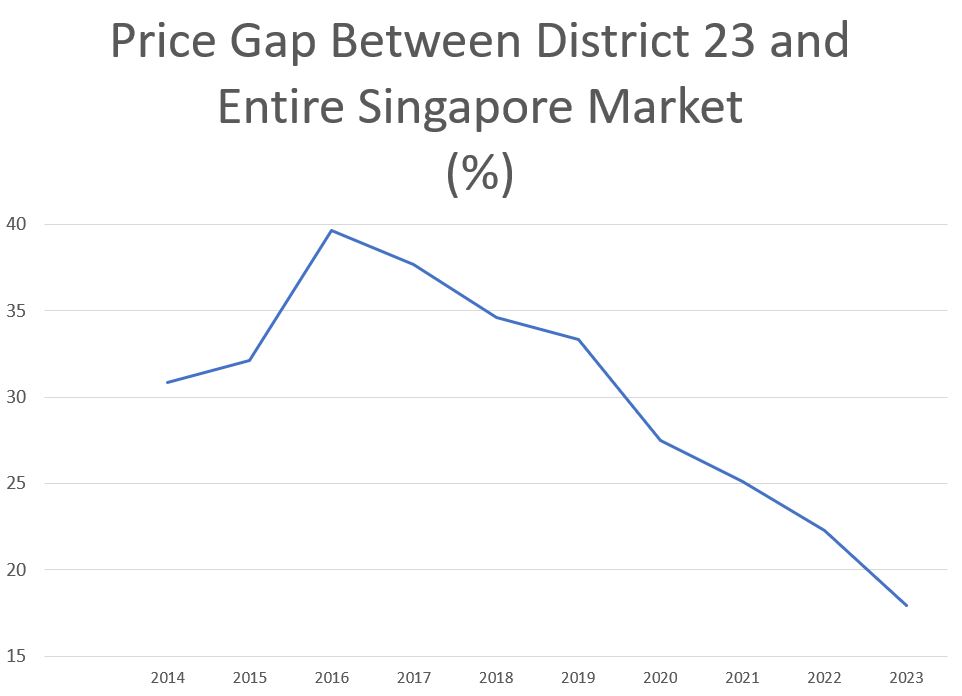

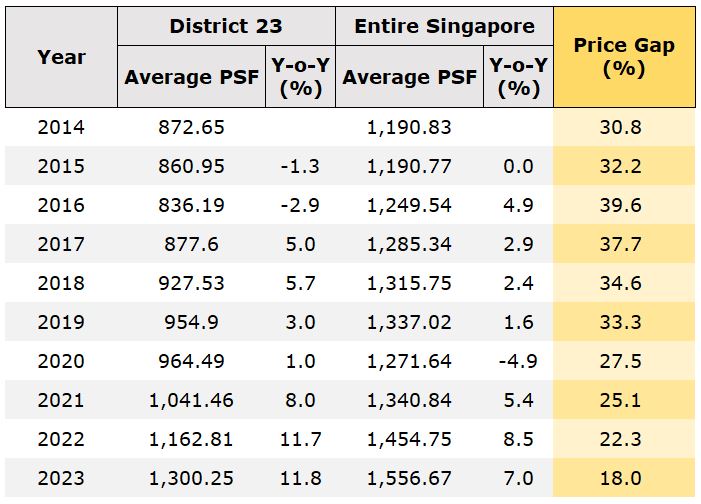

District 23’s Growth Trajectory

Decoding Peer Performance: Analyzing The Arden’s Neighbors

Charting the Landscape: Normalized Price Analysis

Note

- The concept of Normalized Average PSF involves adjusting the lease duration back to 99 years, thereby allowing a fair comparison among projects as if they were all launched in the same year. Nevertheless, this approach doesn’t account for the element of novelty in newer developments. Newer projects often come equipped with updated facilities and advanced technology, which could impact the per-square-foot (PSF) price. Thus, it’s essential to recognize that these modern amenities might contribute to a higher PSF in more recent developments. Beyond this, conventional factors like location, construction type, unit mix and other characteristics can also exert influence on the pricing of a development.

- In the case of The Arden, please be aware that we are referencing the indicative starting PSF instead of the average PSF for our analysis.

A Personalized Path Forward: Making an Informed Decision

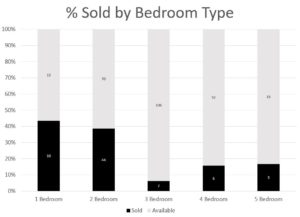

However, suppose one is looking to purchase it for own stay, especially getting a 3 and 4 bedroom. In that case, it is worthwhile to put in the extra effort to conduct further analysis on quantum price, resale velocity, specific unit of interest, broader market etc., to assess if The Arden 3 and 4 bedroom is a viable option.

Lastly, feel free to contact me for a personalized assessment to decide if The Arden suits you and any other options that could align with your real estate needs. Otherwise, feel free to explore The Arden by clicking on the button below.

Edwin Goh

With his love for numbers and data, Edwin has provided valuable insights to his clients and readers to empower them to make better-informed real estate decisions.