With Rising Inflation rates, the occurrence where the older folks are getting caught off guard and finding themselves without sufficient cash to meet even daily necessities is becoming painfully common.

How do they then Unlock Capital in their HDB so they can get back to living their golden years comfortably?

Saving For a Rainy Day

Singapore is among the countries where the ageing population is increasing rapidly. From 2020 to 2021, the rate of increase in the population 65 years and above was 4.0%, and this rate is expected to rise to 5.6% by 2022. With a median age of 41.8 years, the number of retirees is projected to be at an all-time high in a matter of two decades.

In such times having a retirement plan is critical. Many individuals feel that their provident fund or whatever retirement package they receive from their employment will be enough, but that is not always the case. While your CPF may be able to meet your daily expenses in old age, there is no telling when a windfall loss may occur. You may need to get surgery or pay for repairs to your home. Relaying on retirement benefits alone is not financially sound. You must start saving for such unforeseen circumstances by acquiring assets instead.

The Process of Asset Progression

Assets represent a store of value. Real estate is the perfect asset when it comes to saving for the future since its value generally tends to remain stagnant or, more likely, grow. While money loses value due to inflation, real estate generally does not.

It is rather good to have the ability in your latter years should you need to access capital.

In recent years, there’s been more and more elderly, in their 70s or later, realizing their CPF is insufficient to cover their everyday expenses or have simply run out of. Perhaps not factoring enough Inflation or just not having enough to stretch out for 30-40 more years of their lives.

They are only left with their HDB apartment. And will have to look at options of how to access the intrinsic capital of their HDB Flats.

Unlocking Hidden Capital-The Case Of a 4 room Bishan Flat of a 70 yrs old couple

The Case:

– 99 years leasehold from 1987

– Currently listing is about $580-650psf

– 893 sq/ft apartment

– 64 years left on the lease

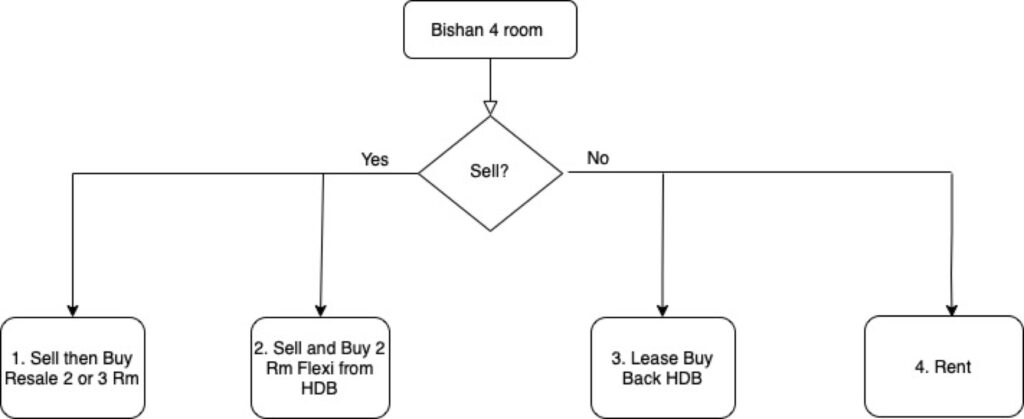

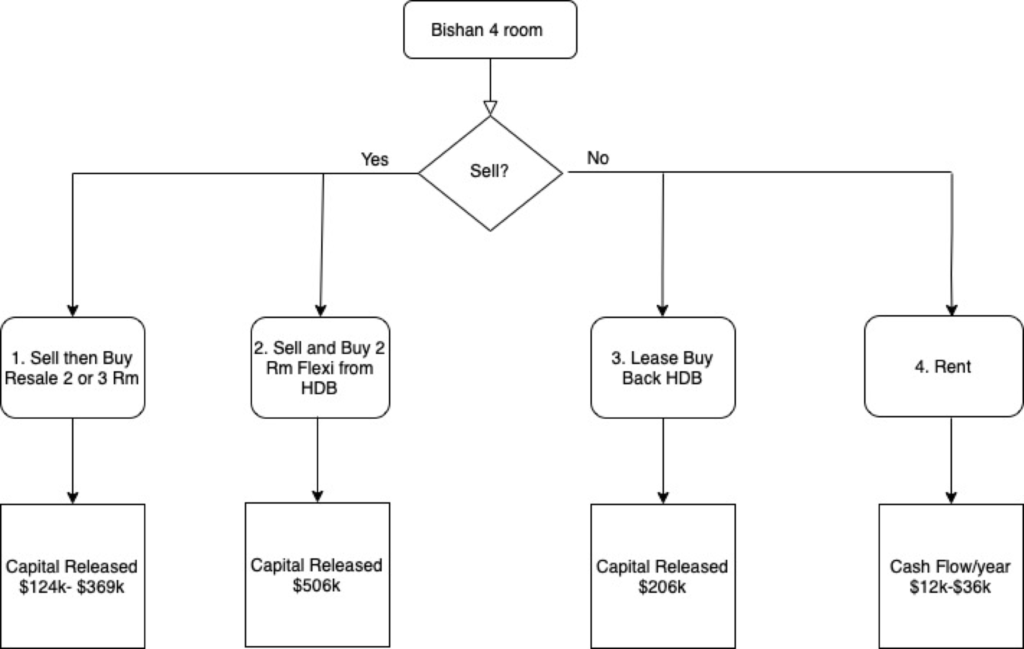

The options at a glance:

1. Sell Bishan HDB and Buy A Resale HDB

The first option is to sell your existing property and buy a smaller resale apartment. For this example, let’s use the options of Selling Bishan and Moving to a smaller unit in Bishan, Toa Payoh or Ang Mo Kio.

The graph above shows how the price for Bishan flats is higher than those in Toa Payoh and Ang Mo Kio. This price difference represents capital gains that can be ‘assessed’ if you sell your Bishan flat and buy a resale in either Toa Payoh or Ang Mo Kio.

The table above further shows the variation in average buying prices in each of the three flats. Estimated cash out is higher for Toa Payoh and Ang Mo Kio when compared to Bishan for the same types of flats.

This option provides the seller with access to the full market value of the HDB flat. Doing this will give you access to cash out, as indicated by the table. Furthermore, if you are a Singaporean citizen over the age of 55, you can benefit from the Silver Housing Bonus (SHB), a top-up of a maximum of $30,000 to your CPF.

Conclusion of Option 1: You can access possibly between $124k- 369k

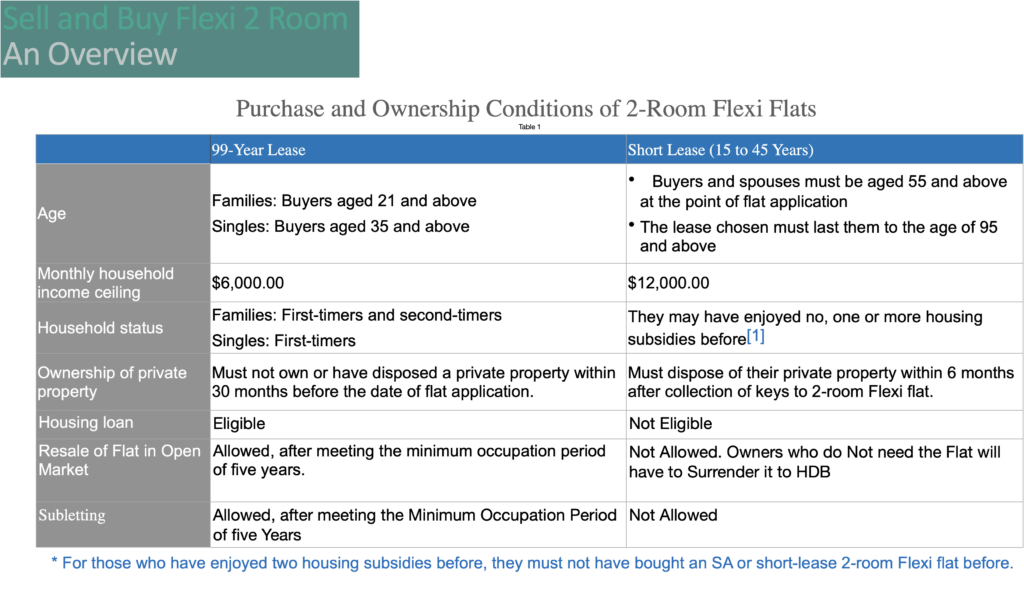

2. Selling And Buying A 2-Room Flexi HDB

If you are 70 yrs old, you can buy a 2 Room Flexi but you need to buy a minimum lease of 25 year or up to a minimum age of 95. Depending on the area you buy the 2 Room, whether it be in Matured estates or a newer one, it does offer a much less expensive option.

Here’s a summary of some of the conditions.

Assuming 2 room Flexi flat on average costs $100,000, so if you sell a 4-room flat with a regular lease, the average cost for which can be $607,240, you can get a cash-out of $507,240 straight away.

Current price of 4 room Bishan HDB – 2 Room Flexi = $607,240 – $100,000 = $507,240

Here is a brief overview of a 2-room Flexi flat. Take a look to see how the flat looks if you decide to opt for it at any point in the future.

The 2-room Flexi flat option is designed specifically for the elderly who can sell off their property and still get access to HDB grants. This results in quick access to cash that can add to their CPF and ensure that they live a comfortable retired life.

Conclusion Option 2: you can access possibly between $507k

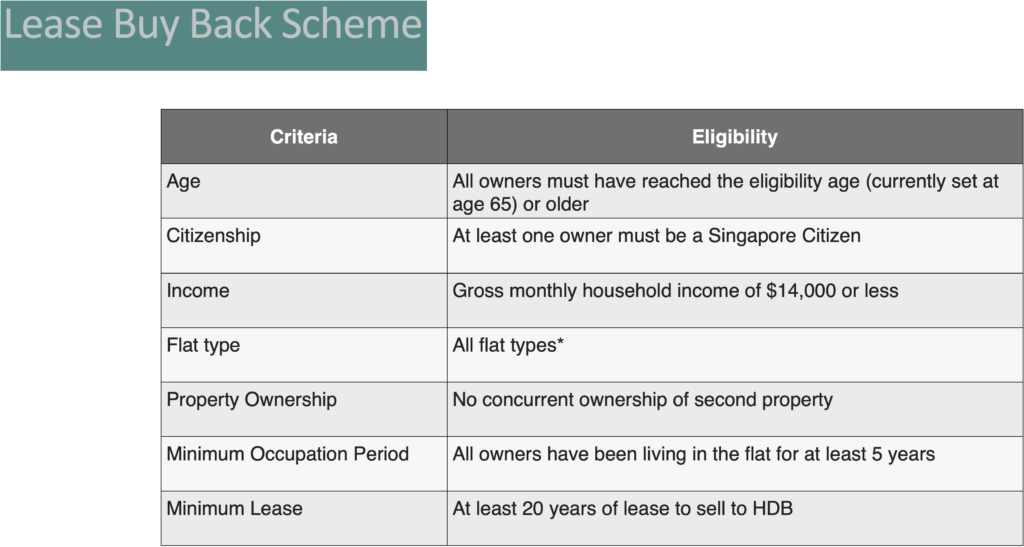

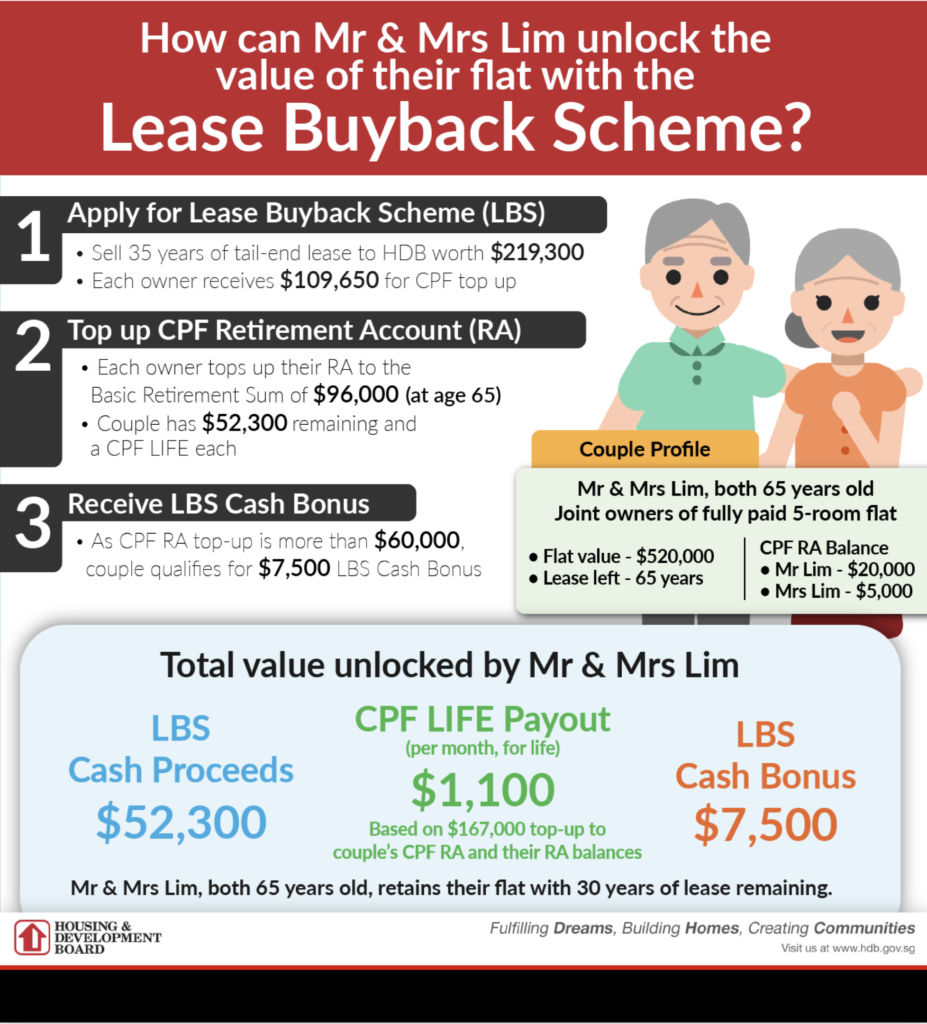

3. Lease Buyback

Here is the lease buyback scheme in a nutshell

Here’s another useful info graph of what can be done.

The lease buyback scheme gives owners the choice of determining the length of the lease they wish to retain. They can then sell the tail-end lease to HDB. By doing so, owners can top up their CPF and even receive access to cash proceeds from the HDB while still qualifying for HDB grants like the Silver Housing Bonus.

A lease buyback scheme is a lucrative option, so eligibility criteria are quite stringent. Only 65 years or above with a monthly income of $14,000 or less can apply. One of the owners must be a Singaporean citizen, and the lease must have at least 20 years left before it can be sold to HDB.

But for the value of the lease buyback, it’s only possible to be calculated accurately by HDB Branch. For the purpose of this exercise, we’re estimating about $206k in this case. Also, note that a certain amount needs to go to CPF Life.

And applicants can also have access to Silver Housing Bonuses!

HDB Number: 1800 866 3066

Branch: 1800 225 5432

Conclusion: you can access possibly between $206k

4. Rental of property

Instead of buying or selling, you can rent your 1) HDB flat and rent a smaller flat or 2) Rent out rooms within your HDB. Another way to unlock the value of your HDB Flat.

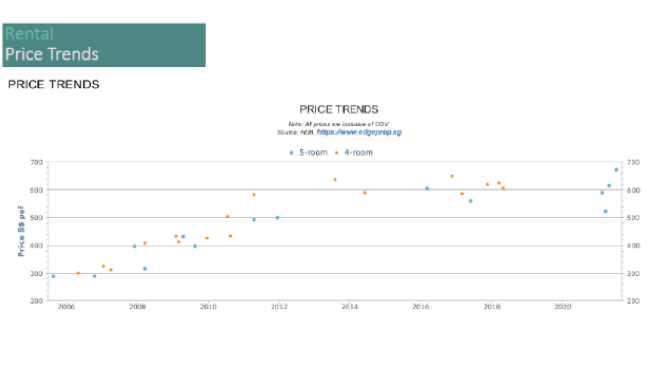

Below is a chart indicating the trend in the rental property market

There are basically 2 options for this.

Rent out your 4 room HDB. Judging from the rental trends, this will give you about $3k/mth in rental yield.

Or renting out individual rooms. This can possibly give you rental yields of about $800-$1200 a month.

Conclusion: The potential cash flow for this is between $12k-36k

4 Options at a Glance

This diagram basically summarizes the potential of each one of these outcomes.

Although in this example, the best option appears to be the selling of the current HDB and the buying of a 2 room Flexi from HDB, there are also many other conditions to consider.

This is especially even more true when the variables are changed, if you owned a 5 room instead of a 4 room, or if you live in Punggol instead of Bishan. The variations are almost always particularly special to everyone or anyone.

Being Smart in The Present to Secure Your Future

There are plenty of options you can choose from when it comes to making financial decisions about your future. The most important thing, however, is to start the planning process well in advance so you can realize your retirement goals.

Buying real estate and following the principle of asset progression is very helpful. There are plenty of HDB schemes designed specifically for the elderly that you can benefit from to secure your future but nothing beats clever planning.

For the purpose and scope of this article, we used the example of a 70 yr old couple in a 4 room Bishan flat. In real life, there are no one size fits. Every case will be different.

But we hope this article has helped and it gives you a better idea of some of the options available. Need Some help with doing the Math on your property and how you can retire on it? Reach out to Charlie today.

Charlie Giang

A long time entrepreneur at large and Splitting his time between Silicon Valley and Singapore, Charlie’s not only familiar with investments in technology but has been an active investor in real estate in both countries.

Taking his unique background, he gives insights into real estate quite unlike another. A different and perhaps fresh perspective investing in Singapore’s real estate.

Get in touch with Charlie today.

You may also like...

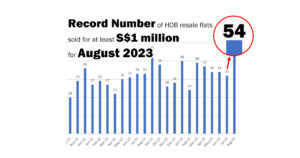

August Shatters Records: 54 HDBs Sold for Over a Million Each!

August Shatters Records: 54 HDBs Sold for Over a Million Each!

Decoding The Arden: Unveiling Potential Surprises Along the Way

Decoding The Arden: Unveiling Potential Surprises Along the Way

Proceed with Caution: Unveiling TMW Maxwell – Navigating Investment Prospects in District 2

Proceed with Caution: Unveiling TMW Maxwell – Navigating Investment Prospects in District 2

Hungry Ghost Festival: Does It Truly Spook Buyers in the Property Market?

Hungry Ghost Festival: Does It Truly Spook Buyers in the Property Market?

New Low for Weekend Launch on Aug 12-13, 2023

New Low for Weekend Launch on Aug 12-13, 2023

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.

Appreciate to receive latest news estate planning.