On 19 Feb 2018, the ministry of finance announced the increment of buyer stamp duty by 1% for residential property exceeding S$1,000,000 in value.

Here are the changes:

| Before 20th Feb Buyer Stamp Duty (Old Rate) | After 20th Feb Buyer Stamp Duty (New Rate) | |

| First S$180,000 | 1% | 1% |

| Next S$180,000 | 2% | 2% |

| Next S$640,000 | 3% | 3% |

| Remaining Amount | 4% |

As an illustration, for a property of value S$1,500,000, a buyer has to pay S$39,600 based on the old rate and $44,600 based on the new rates. That is, a buyer now has to pay $5,000 more in buyer stamp duty with the introduction of the new rates.

As a side note, you may visit our partner’s site to use the buyer stamp duty calculator to work out the buyer stamp duty payable for the property you plan to purchase.

The higher stamp duty, which has not been changed since 1996, is meant to make it more progressive to be in line with Singapore’s tax system, that is, it is not meant as a property cooling measure.

But does this 1% not affects the property market?

HDB Market

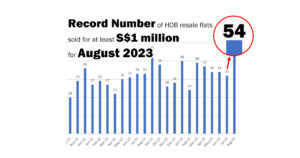

For HDB market, the impact will be negligible given that only a handful of HDB transacted over a million dollar.

Private Home

According to the views from the industry veterans, given that the 1% point hike in the top marginal buyer’s stamp duty rate on the portion of a residential property’s value exceeding S$1,000,000 will be applicable for big-ticket purchases and bulk of residential property deals (around 36% of private properties are transacted below S$1,000,000 & another 30% at between S$1,000,000 to S$1,500,000) are below S$1,500,000, the change to BSD is expected to have only mild impact on the property demand.

And with the projection that the private home prices are expected to increase by 10% this year, it will overshadow the 1% point hike easily, and demand for private home is likely to remain healthy.

Furthermore, recent new launches have a higher proportion of smaller units with prices less than S$1,500,000. In other words, the impact on demand for new private home by the 1% point hike is likely to be minimal.

As for collective sales, the momentum is likely to continue too. For every S$200 million worth of property value acquired by the developer, the BSD increases by a mere S$1.99 million from S$5.99 million to S$7.98 million. And as en-bloc activities continue, in the short term, the displaced owners of this en-blocs development will add on to the existing demand for private homes, further pushing the prices of private home upwards.

So if you are planning to buy a private residential property now, it is time for you to start planning to buy your new private home as soon as possible, before the prices head further northwards.

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.