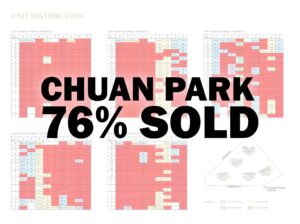

The August 12-13 weekend sales data paints a subdued picture, with 53 units sold across three prominent projects: The Arden, Orchard Sophia, and TMW Maxwell.

Among these projects, The Arden stood out as the most successful performer, having managed to sell 27 out of its 105 units during the weekend, constituting a respectable 26% of its available inventory. Orchard Sophia followed closely, with 18 out of its 78 units sold, reflecting a sales rate of 23.08%. Unfortunately, TMW Maxwell’s performance was less encouraging, with a meagre six units sold out of its 324 available units, translating to a mere 1.85% of its total inventory.

% Sold on Launch Day

%

The Arden

%

Orchard Sophia

%

TMW Maxwell

Factors Behind the Decline in Sales

Seasoned industry experts attribute this decline in sales to several significant factors:

- A surge in new launches over the past months, with nine new projects introduced since July, coupled with more upcoming releases in the pipeline. This abundance of options has led buyers to thoroughly explore their choices and deliberate before making purchase decisions.

- Heightened selectiveness among buyers due to the imposition of additional buyer’s stamp duty (ABSD) means each real estate purchase requires careful consideration, as buyers aim to optimize their investment in the short term.

- Elevated mortgage interest rates and uncertainties in the broader macroeconomic landscape contribute to a cautious approach among potential buyers.

Evaluating Individual Projects

The Arden: Affordable Option with Growth Potential

The Arden stands out as one of the most competitively priced new launches 2023. Anticipated to experience an increase in sales as it approaches the receipt of its temporary occupation permit, this development is designed with families seeking permanent residences in mind. Homeowners considering an upgrade, particularly those looking to transition from HDB, may encounter challenges in purchasing a new launch. This stems from the necessity to fulfil the ABSD payment (which can be remitted based on eligibility criteria) within 14 days of signing the S&P agreement for the new property. Additionally, these buyers must prepare a substantial amount of cash and CPF, as they can only secure up to a 45% loan if they are financing an existing loan. While selling their current property enables them to avoid ABSD and secure a higher loan of up to 75%, this would entail arranging alternative accommodation while waiting for The Arden’s completion. Therefore, it becomes pragmatic for them to consider committing to The Arden closer to its TOP, facilitating a smoother transition period.

In our previous evaluation of The Arden, families searching for a new residence will find it a promising option. Particularly, those seeking 3- or 4-bedroom units within the Choa Chu Kang and Bukit Panjang locales could consider The Arden. You can read our analysis of The Arden by clicking the button below.

TMW Maxwell: An Investment Perspective

TMW Maxwell, oriented towards investors, might see potential buyers waiting to launch neighbouring projects such as Newport Residences, Marina View, and Skywaters Residences before committing. A comprehensive analysis suggests that TMW Maxwell might not be a compelling investment opportunity now. We suggest potential investors look for signals such as price adjustments, contrasting launch prices of comparable projects, or an influx of foreign buyers etc., before making decisions. Adopting a wait-and-see stance is recommended for those, not in a hurry to invest.

Orchard Sophia: Await Our Analysis

Our evaluation of Orchard Sophia is in progress. To receive our analysis when it becomes available, we invite you to sign up for our mailing list or follow us on Facebook to receive prompt alerts.

Insights from Weekend Sales

In light of the recent sales data and the intricate market dynamics observed across The Arden, Orchard Sophia, and TMW Maxwell projects, there are insightful actions that potential buyers and investors can consider.

The Arden is attractive for those seeking a family-friendly, competitively-priced option with growth potential. Its impending receipt of the temporary occupation permit suggests a likely increase in sales, making it prudent for prospective homeowners to monitor its progress and make informed decisions as the development nears completion. Buyers aiming to upgrade from HDB homes may find it beneficial to time their commitment closer to the TOP date, ensuring a smoother transition period.

Investors exploring opportunities in the market, especially considering TMW Maxwell, are advised to adopt a cautious and strategic approach. Given the prevailing circumstances and the possible impact of neighbouring projects’ launches, a patient “wait-and-see” stance might be prudent. Investors can watch for indicators such as price adjustments, comparative launch prices, or shifts in buyer demographics before making investment decisions.

As for Orchard Sophia, awaiting the forthcoming analysis is a wise move for those interested in this project. Signing up for the mailing list or following us on Facebook can provide timely insights and assist potential buyers in making well-informed choices.

In navigating the complex real estate landscape presented in the article, individuals are encouraged to gather information, stay attuned to market trends, and seek professional advice where needed. By considering these strategic actions, readers can position themselves for more informed and successful decisions in the ever-evolving real estate market.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.