In the fast-paced world of real estate, the tides are ever-shifting, and the latest wave has brought some interesting developments to Singapore’s private home sales market. In September 2023, developers saw a tepid performance in their sales, which wasn’t entirely unexpected. The market sentiment had softened, and the absence of major project launches considerably impacted the numbers.

A Dip in Sales Volume

The numbers don’t lie. New private home sales, excluding executive condos, dipped to 217 units in September. This marked a substantial 44.9% decline from the 394 units sold in the previous month, August. Moreover, it marked the second consecutive month of contraction in sales volume. The decline was palpable, and it all boiled down to a lack of significant project launches during this period.

Nine Months Low

It’s not just a minor blip; it’s a nine-month low. The last time we saw such a drop in sales was in December 2022, when only 170 units changed hands. The impact is even more striking when we compare it year-on-year. In September 2022, the real estate market was thriving, with 987 units sold. Fast forward to 2023, and there was an astonishing 78% decrease in sales volume.

Declines Across All Sub-Markets

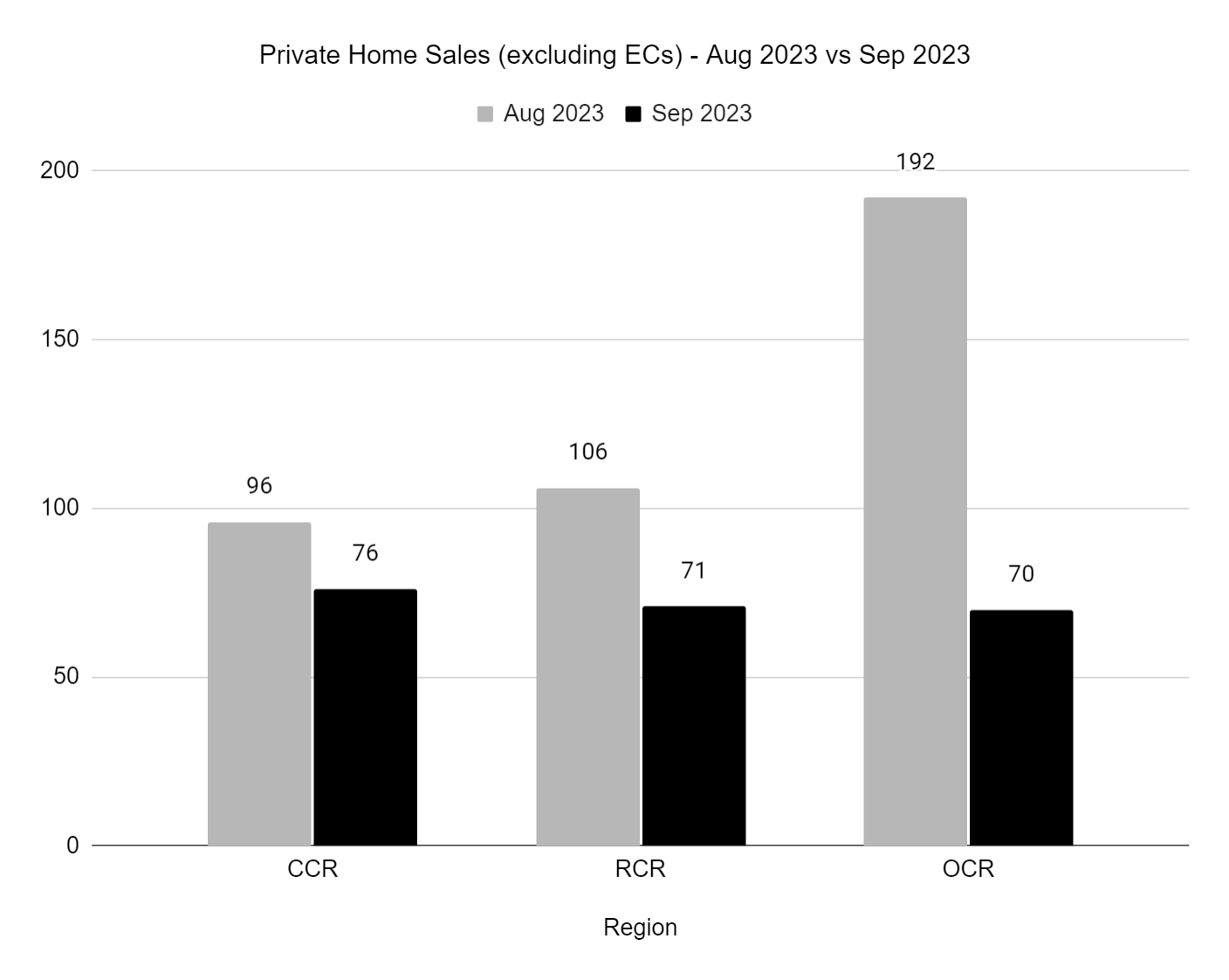

The story doesn’t end here; all sub-markets experienced declining home sales during September. The Outside Central Region (OCR) took the hardest hit, with a staggering 64% month-on-month drop to 70 units. This sharp decrease could be attributed to a higher base in August when a couple of new projects, including The Arden and The Lakegarden Residences, pushed sales numbers up. However, one project that stood out in OCR was Lentor Hills Residences, which launched in July and became the best-selling OCR project in September. It managed to transact 17 units at a median price of $2,231 per square foot (psf). In comparison, the newly launched The Shorefront sold only three units at a median price of $1,902 psf.

Moving to the Rest of the Central Region (RCR), the lack of new launches weighed heavily on sales. New home sales in this region were down by 33% month-on-month to 71 units in September, compared to 106 units sold in August. Some of the top-selling RCR projects in the month included Grand Dunman, which sold 16 units at a median price of $2,571 psf. The Reserve Residences, with 11 units sold at a median price of $2,446 psf; and The Continuum, transacting ten units at a median price of $2,790 psf.

The Core Central Region (CCR) Faces Headwinds

The Core Central Region (CCR) managed to maintain its lead in sales for September, with 76 units changing hands. However, this represented a significant 20.8% month-on-month decline from August. This decline marked the lowest monthly new home sales in the CCR over two years, dating back to February 2021. The CCR is often seen as a proxy for high-end homes but has faced headwinds due to recent cooling measures. The increased additional buyer’s stamp duty (ABSD) rates for foreigners and investors have deterred home investment demand. Additionally, the lack of major launches in this sub-market also hurt transactions. Pullman Residences Newton was the standout project for September, transacting 21 units at a median price of $3,258 psf.

Moderation in Executive Condo (EC) Sales

The executive condo (EC) segment also experienced moderation, dropping sales from 255 units in August to 118 new EC units in September. Altura played a significant role in these numbers, transacting 100 units at a median price of $1,473 psf, accounting for approximately 85% of the monthly EC sales. By the end of September, Altura had already sold 316 out of its 360 units, with only 319 unsold new EC units remaining, mostly in North Gaia.

Fewer New Units on the Market

Developers didn’t introduce as many new units (excluding ECs) to the market in September. There were only 68 new units for sale, a significant drop from the 590 units launched last month. No new ECs were launched in September. This reduction in new projects hitting the market was partly due to the traditional Hungry Ghost month, which occurred from mid-August to mid-September. Developers tend to hold back on new launches during this period because sales are historically slower.

Insights from Wong Siew Ying

Wong Siew Ying, Head of Research & Content at PropNex Realty, offered valuable insights into this situation. The decline in sales in September was not entirely surprising. Developers’ sales are heavily influenced by supply, and without significant project launches, it’s challenging to boost transaction numbers. With private home prices at their peak and an abundance of unsold units in the market, coupled with high-interest rates and cautious sentiment, buyers are evaluating their options.

A Forecast for 2023

With 5,407 new private homes (excluding ECs) sold in the first nine months of 2023, the overall forecast for developers’ sales for the year is expected to range between 6,500 and 7,000 units. In comparison, developers sold 7,099 new units (excluding ECs) in 2022. It’s worth noting that the last time annual new home sales exceeded 7,000 units was from 2014 to 2016, when cooling measures implemented in 2013 had dampened housing demand.

Price Movements

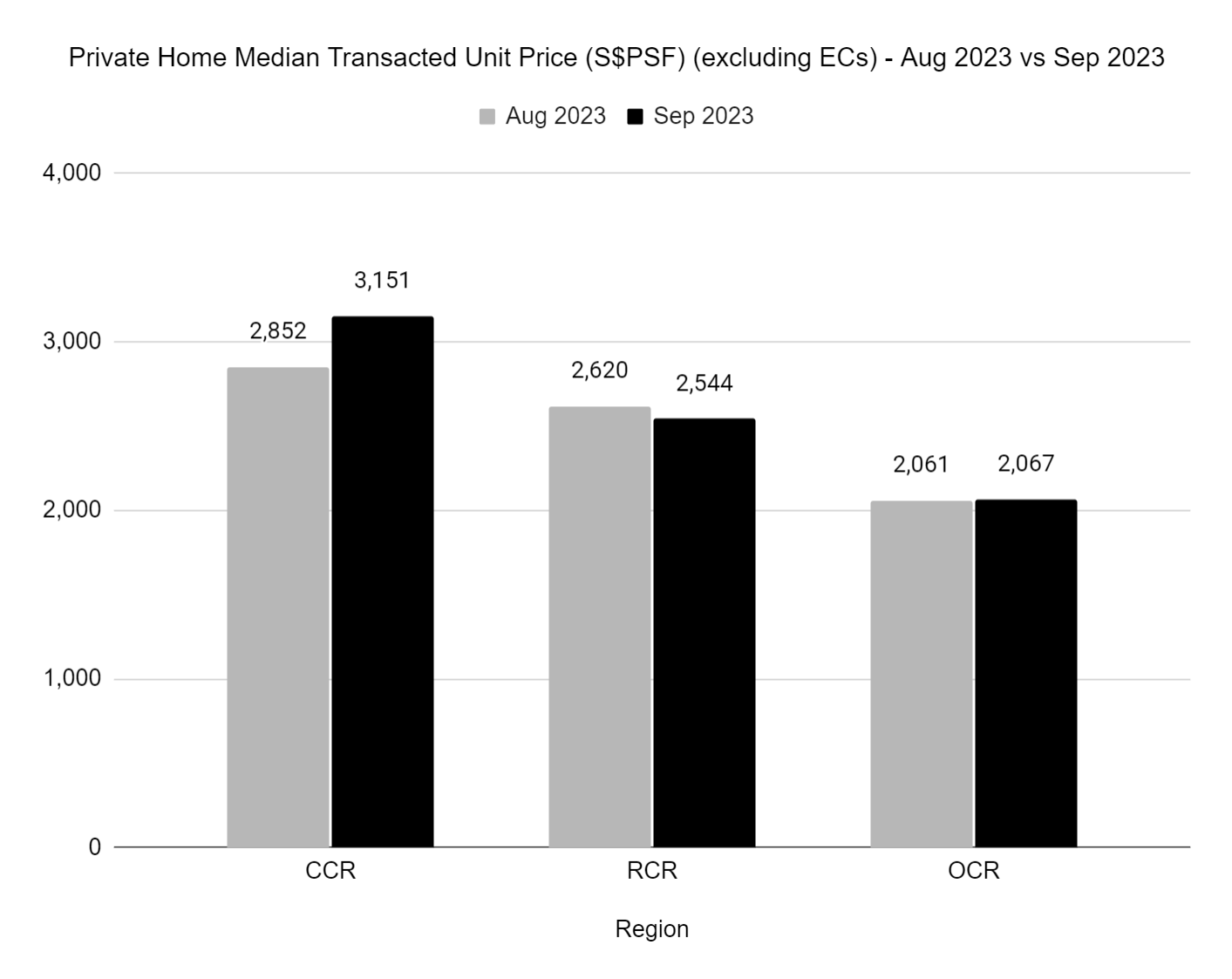

The changing dynamics of the market are also reflected in the median transacted unit prices. In the Core Central Region (CCR), there was a 10.5% month-on-month increase to $3,151 psf in September. This surge could be attributed to projects with higher median prices during the month, including Midtown Bay, Midtown Modern, Perfect Ten, Leedon Green, and Orchard Sophia.

The Outside Central Region (OCR) also witnessed a median price increase, rising by 0.3% month-on-month to $2,067 psf in September. Prices at projects like Lentor Hills Residences, The Myst, The Botany at Dairy Farm, and The Arden supported this. Meanwhile, the Rest of Central Region (RCR) saw its median price decline by 2.9% month-on-month to $2,544 psf. This drop can be attributed to a lack of transactions at some projects that had helped maintain the median price in August, including TMW Maxwell and One Pearl Bank.

In summary, September 2023 brought a significant decline in new private home sales in Singapore. A lack of major project launches, cautious market sentiment, and buyer fatigue contributed to this situation. The real estate market shows signs of moderation, with changes in sales volume and pricing trends across different regions. As the year progresses, it will be interesting to see how the market adapts to these challenges and if any surprises are in store.

FAQs

1. What caused new private home sales to decline in September 2023?

The decline in new private home sales in September 2023 can be attributed to a lack of major project launches, cautious market sentiment, and buyer fatigue. Without significant new developments to stimulate transactions, sales numbers dropped significantly.

2. How did different sub-markets in Singapore perform in September 2023?

In September 2023, all three sub-markets in Singapore experienced declines in home sales. The Outside Central Region (OCR) saw the most substantial drop, followed by the Rest of Central Region (RCR) and the Core Central Region (CCR).

3. What is the forecast for developers’ sales in 2023?

The forecast for developers’ sales in 2023 suggests a range of around 6,500 to 7,000 units. This projection considers the current market conditions, with private home prices at their peak and an abundance of unsold units.

4. How did the median unit prices change in different regions in September 2023?

In September 2023, the Core Central Region (CCR) saw a significant increase in median unit prices, while the Outside Central Region (OCR) also witnessed a rise. In contrast, the Rest of Central Region (RCR) experienced declining median prices.

5. What role did Altura play in the executive condo (EC) segment sales in September 2023?

Altura played a significant role in the executive condo (EC) segment sales in September, accounting for about 85% of the monthly EC sales. It transacted 100 units at a median price of $1,473 per square foot (psf).

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.