Since 2013, when we first started promoting Executive Condominiums, we have been hearing clients mentioning that Executive Condos are expensive and getting expensive. Can you buy it or not?

Today, we shall review the performance of those “expensive” Executive Condos we have marketed and hope our findings will help you make a better decision in your real estate journey.

“Expensive” Executive Condo

For this study, we will be looking into Executive Condos that obtained their MOP in 2020 and 2021.

Here are the condos and their respective TOP date and estimated Launch PSF:

| Project | TOP Date | Average Launch PSF |

|---|---|---|

| Lakelife | 30-Dec-16 | 895.36 |

| The Amore | 28-Nov-16 | 798.71 |

| Sea Horizon | 7-Oct-16 | 806.45 |

| Ecopolitan | 29-Aug-16 | 785.7 |

| SkyPark Residences | 10-Aug-16 | 802.81 |

| Lush Acres | 30-Jun-16 | 806.7 |

| Forestville | 1-Apr-16 | 739.83 |

| The Topiary | 22-Mar-16 | 722.29 |

| Twin Fountains | 14-Mar-16 | 736.17 |

| Citylife@Tampines | 3-Feb-16 | 787.3 |

| Waterbay | 27-Jan-16 | 740.31 |

| Waterwoods | 1-Dec-15 | 805.41 |

| Heron Bay | 7-Oct-15 | 733.56 |

| 1 Canberra | 19-Sep-15 | 673.45 |

| Twin Waterfalls | 2-Jun-15 | 732.57 |

| The Rainforest | 6-Mar-15 | 778.27 |

| The Tampines Trilliant | 6-Feb-15 | 765.26 |

Over 99% of EC Transactions Made Profit

Based on 1,780 resales transactions of the 17 Executive Condos analyzed, an astonishing 1,773 transactions made a profit, and a mere seven resales transactions made losses.

In other words, 99.61% of the transactions made a profit, and a mere 0.39% made losses.

| Project | Profitable Transaction | Loss Transaction |

|---|---|---|

| Lakelife | 28 | 1 |

| The Amore | 51 | 1 |

| Sea Horizon | 54 | 0 |

| Ecopolitan | 88 | 2 |

| SkyPark Residences | 88 | 1 |

| Lush Acres | 60 | 0 |

| Forestville | 119 | 0 |

| The Topiary | 186 | 1 |

| Twin Fountains | 82 | 0 |

| Citylife@Tampines | 82 | 0 |

| Waterbay | 107 | 0 |

| Waterwoods | 82 | 0 |

| Heron Bay | 118 | 1 |

| 1 Canberra | 167 | 0 |

| Twin Waterfalls | 195 | 0 |

| The Rainforest | 113 | 0 |

| The Tampines Trilliant | 153 | 0 |

Decent Profit

All of the 18 projects analyzed earn a decent average profit of at least S$200,000 with an average annualized return of at least 3.03%. Over 80% of the resale transactions made a profit of at least S$200,000, and 78% of the resale transactions have at least an annualized return of 3%.

Based on the average of the 1,773 profitable transactions, the average profit is S$292,699, and the average annualized return is a remarkable 3.72%.

Fun Fact:

Citylife @ Tampines has the highest average profit of S$406,198 and the highest profitable transaction at S$1.376 million! The Amore has the highest average annualized return of 4.63%.

| Project | Average Profit | Average Annualized Return |

|---|---|---|

| Lakelife | 265,554 | 3.84 |

| The Amore | 265,963 | 4.63 |

| Sea Horizon | 269,593 | 3.47 |

| Ecopolitan | 336,136 | 4.12 |

| SkyPark Residences | 362,107 | 4.41 |

| Lush Acres | 290,516 | 3.59 |

| Forestville | 222,635 | 3.03 |

| The Topiary | 340,656 | 4.42 |

| Twin Fountains | 209,500 | 3.12 |

| Citylife@Tampines | 406,198 | 4.1 |

| Waterbay | 305,660 | 3.77 |

| Waterwoods | 238,004 | 3.26 |

| Heron Bay | 292,953 | 3.36 |

| 1 Canberra | 245,083 | 3.33 |

| Twin Waterfalls | 298,438 | 3.82 |

| The Rainforest | 277,713 | 3.45 |

| The Tampines Trilliant | 306,424 | 3.74 |

Negligible Losses

For the 0.39% resale transactions that made zero profits or losses, four units made “zero profit”, and three were sold at a loss of not more than S$17,500. Those “zero profit” transactions have a holding period of fewer than three months, which may imply invalid transactions.

As for the three loss-making transactions, for your reference, here are their losses:

| Project | Address | Profit (S$) | Days |

|---|---|---|---|

| Lakelife | 2 Tao Ching Road #09-XX | 0 | 13 |

| The Amore | 55a Edgedale Plains #10-XX | 0 | 108 |

| Ecopolitan | 128 Punggol Walk #04-XX | -10,512 | 2,986 |

| Ecopolitan | 130 Punggol Walk #10-XX | -17,500 | 750 |

| Sky Park | 19 Sembawang Crescent #13-XX | 0 | 56 |

| The Topiary | 11 Fernvale Lane #23-XX | -9,855 | 1,516 |

| Heron Bay | 63 Upper Serangoon View #15-XX | 0 | 14 |

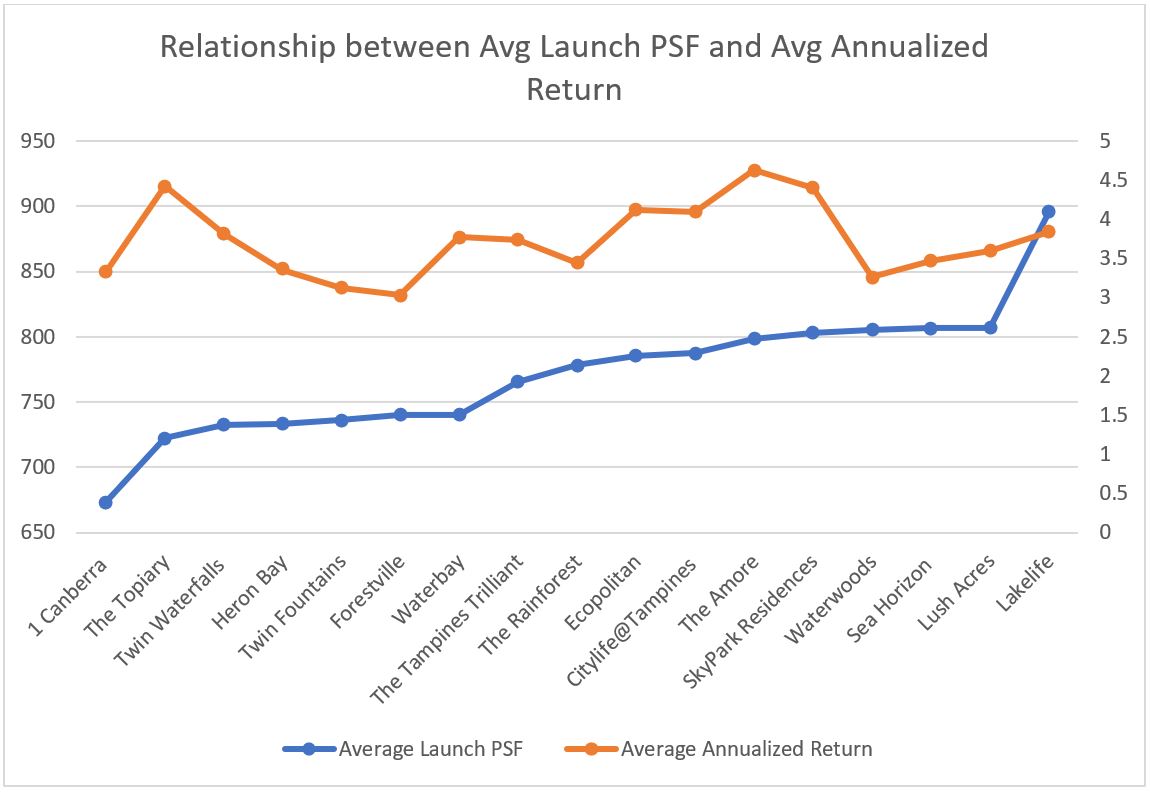

Does higher PSF affect the profitability of the Executive Condos?

Lining up the average launch price against their average annualized return, we cannot observe any special relationship between launch PSF and the average annualized return of the Executive Condos.

Lake life, which has the highest launch PSF (also the newest EC in this study), has an average annualized return of 3.84%, which ranked it as one of the top 6 Executive Condos with the highest average annualized return.

Try our ROI Calculator to project potential returns on your property.

Another point we can note from the findings above is that despite higher PSF, the average annualized return is maintained at above 3%.

Moving Forward

Today, the launch PSF of Executive Condos are higher than in previous years. But it is important to note, the fundamental reasons why Executive Condominiums remain an attractive choice remain intact.

You may review our previous sharing on why Executive Condos are an attractive choice:

- Case Study: New Executive Condo vs Private Condo / Resale EC

- Executive Condo (EC) or BTO? A Money Matters Approach

- Numbers showing why EC is a good buy

- ECs are like an upmarket Lexus car at the much lower price of a Toyota Corolla

Henceforth, for buyers eligible to purchase a brand-new Executive Condo, who can wait out the building time and have plans to stay for more than 5 years in the Executive Condo, we strongly recommend you to consider Executive Condominium. You may keep track of the available and upcoming EC at https://propertynet.sg/list-executive-condominiums-unsold/.

And you are welcome to reach out to us with any matters relating to Executive Condos. We are always happy to share.

🚀 Stay Ahead in the Property Market!

Be the first to receive exclusive updates, launch reviews, insider deals, and real-time alerts — directly on your preferred app.

👉 Join our community now:

🌐 Spread Knowledge. Share with Others.

Click any of the icons below to share this content with those who may benefit from it.

Edwin Goh

With his love for numbers and data, Edwin has provided valuable insights to his clients and readers to empower them to make better-informed real estate decisions.

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.