Singapore’s Government Land Sales (GLS) programme for the first half of 2024 presents a well-calibrated approach to residential development. The Ministry of National Development (MND) has unveiled plans to release sites capable of yielding approximately 5,450 private residential units, including 710 executive condominium (EC) units and 515 long-stay serviced apartments. This marks a 5.6% increase from the 5,160-unit supply in the second half of 2023, the highest since H2 2013.

Diverse and Strategic Site Offerings

- Varied Locations: The programme includes ten new sites, with eight on the confirmed list and two on the reserve list, featuring locations like Great World MRT station, Jalan Loyang Besar, and Tengah estate.

- Key Sites:

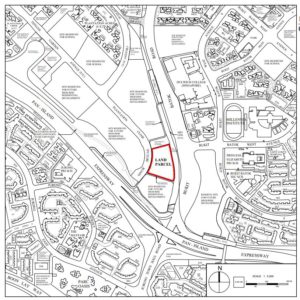

- River Valley Green Plot: This 0.93-hectare plot is expected to yield around 380 homes, benefiting from its proximity to the Orchard shopping belt.

- Margaret Drive Parcel: Covering 0.95 hectares, this site can generate 460 homes and is notable for being the first land sale in the area since 2017.

- Executive Condominiums: The Jalan Loyang Besar EC site, spanning 2.84 hectares, is poised to yield about 710 units, attracting significant interest due to its strategic location.

- Mixed-Use Developments: The Tampines Street 94 site, a mixed-use development, is set to offer the only major mall within 800 meters, catering to a growing residential population.

- Reserve List Sites: Notably, the Bayshore Road site on the reserve list is expected to yield 480 units, with its proximity to East Coast Park and the upcoming Bayshore MRT

Schedule of Confirmed List Sites (1H 2024)

Schedule of Reserve List Sites (1H 2024)

Government’s Strategic Planning and Market Dynamics

- Balanced Supply Increase: The GLS programme’s 5.6% increase in supply represents a strategic moderation aimed at catering to market demand while ensuring stability.

- Responsive Approach: The MND is committed to monitoring economic and property market conditions, adjusting future land sales to meet housing demand and promoting market stability.

- Developer Sentiment: Despite the increase in supply, developers have shown caution due to economic uncertainties and recent cooling measures.

Advice for Prospective Homebuyers and Investors

For those seeking homes for occupation or rental income, it’s advisable to consider past new launches. These properties will likely be priced more competitively than the newer ones and will be completed earlier, offering a quicker return on investment. However, if none of the past launches meet your needs, staying informed about upcoming projects from these new land sales is crucial.

Join Our Mailing List for Latest Updates

Join our mailing list to ensure you don’t miss these exciting opportunities. You’ll receive alerts about project launches, giving you the advantage of being among the first to explore these new offerings. Whether you’re a homebuyer or an investor, these updates can be invaluable in making informed decisions in Singapore’s dynamic property market.

Conclusion

The H1 2024 GLS programme is a testament to Singapore’s forward-thinking approach to residential development. Balancing the need for more housing with market stability, the programme offers a diverse range of residential, commercial, and mixed-use sites. With strategic planning and various options, it caters to the needs of developers, homebuyers, and investors alike, making it a pivotal moment in Singapore’s property landscape.