Resale private property and HDB flat prices continue to surge ahead as demand outstrips supply. Meanwhile, rentals are also on the rise.

Like most first-time property buyers in Singapore, Farhan (not his real name) and his wife are frustrated with the long delays in the construction sector brought about by COVID-19.

The couple got married in 2018 and booked their HDB flat in 2019.

However, when COVID-19 struck, they were informed by HDB there is now a possibility they will have to wait up to seven years for the keys to their flat.

Cancelling their HDB flat is also not an option as they stand to lose $1,000 in their option fee.

“We are stuck in a catch-22 situation. On the one hand, the waiting time of seven years is too long and we do not want to inconvenience my in-laws. On the other hand, prices of HDB resale flats have gone up so much that we have to factor in the cash-over-valuation (COV) which may be up to $50,000. If we include renovation cost, our first home may set us back by up to $100,000,” said Faris.

Construction sector buckled under COVID-19 pressure

Indeed, COVID-19 has impacted the construction sector with several contractors going under due to travel restrictions and high construction costs.

In August 2021, for instance, Greatearth Corporation and Greatearth Construction were among the several contractors that went bust due to financial difficulties.

This has resulted in delays of several Built-To-Order (BTO) projects.

To minimise the impact, HDB has rolled out various measures to support the construction industry and minimise delays to its projects.

“HDB has been working closely with our building contractors, to secure the necessary resources they need to complete their projects, including manpower and material supply. We have also recently introduced additional assistance measures to ease the financial pressures brought about by the pandemic-induced spikes in construction costs, including both manpower and non-manpower costs,” said HDB in a statement.

Faris and his wife are among those affected as they had booked an HDB flat in Woodlands.

“We surveyed around Woodlands where the resale HDB prices are within our budget. However, most sellers are now asking for COV of up to $50,000,” said Faris.

Strong pent-up demand pushing prices upwards for resale HDB and private properties

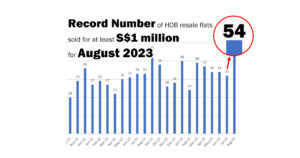

As demand far outstrips supply, this has resulted in record prices in both the HDB and private property markets, surpassing the record prices seen during the peak in the third quarter of 2013.

Data from HDB showed that the Resale Price Index (RPI) for the third quarter of 2021 is now 150.4 points.

This is an increase of 2.9 per cent over that in the second quarter.

Meanwhile, resale transactions rose by 19.4 per cent from 7,063 cases in the second quarter to 8,433 cases in the third quarter of 2021.

When compared to the third quarter of 2020, the resale transactions in the third quarter of 2021 were 8.3 per cent higher.

4-room HDB flats in the central area fetched the highest price on the island, transacting at a median price of $950,000 while those in Sembawang was the lowest (at a median transacted price of $417,000).

Woodlands, where Faris and his wife, were on the lookout for a 4-room HDB resale flat, recorded a median price of $420,000 – the second-lowest median price for a 4-room HDB flat on the island.

Still, as Faris can attest to, the asking price even in the far-flung area of Woodlands is sky-high.

“In hindsight, that cash component could be better utilised for our renovation cost as we do not intend to take a loan. After much discussion, we decided to stay put at my in-laws. Thankfully, they were very understanding,” said Faris.

Meanwhile, data from the Urban Redevelopment Authority (URA), showed that prices of private residential properties increased by 1.1 per cent in the third quarter of 2021, compared with the 0.8 per cent increase in the previous quarter.

Landed properties saw a higher price increase when compared to non-landed properties.

They increased by 2.6 per cent in the third quarter of 2021, compared with the 0.3 per cent decrease in the previous quarter.

Meanwhile, prices of non-landed properties increased by 0.7 per cent in the third quarter of 2021, compared with the 1.1 per cent increase in the previous quarter.

Rentals for HDB flats and private properties are also on the rise

The supply crunch has also seen rentals for HDB flats and condominiums rising.

In the past, one can rent a 4-room HDB flat for below $2,000 per month. However, as third-quarter data from HDB showed, the median transacted price for 4-room HDB flats in most HDB estates are now above $2,000 per month except for Sembawang ($1,900) and Woodlands ($1,900).

In Jurong West, for instance, the median transacted price per month for 4-room HDB flats now stands at $2,150 when it was previously transacted at $2,050 per month in the second quarter of 2021.

Meanwhile, in the private property market, URA’s data showed that rentals for private residential properties increased by 1.8 per cent in the third quarter of 2021, compared with the 2.9 per cent increase in the previous quarter.

This is also something Ed (not his real name), who is also married, can confirm.

He is currently looking for a common room to rent in a condominium was surprised by the high asking price from landlords.

“It does not make any sense as people are losing jobs and we do not have many ex-pats coming in yet rentals are going up,” he laments.

Ed is also looking to buy an HDB flat but is put off by the high asking price and the long waiting period for BTO flats.

“I think I may just rent for one year and wait out till the property market stabilises. However, buying an HDB flat is something definitely on my mind. The timing and pricing are just not right at the moment,” he said.

Another couple, Ali and his wife say their landlord is looking to increase their rent for the 2-bedroom condominium they are currently renting in eastern Singapore from $3,000 to $3,200 a month.

“Our lease is up for renewal soon. We are still deciding if we should stay put or move on. We love this place as it is close to East Coast Beach. Everywhere else that we looked, landlords are similarly asking for between $3,200 to $3,500,” said Ali.

For now, first-time homebuyers like Farhan will have to wait out while rent-seekers like Ed and Ali will have to pay what landlords are currently asking for.

Khalil

Khalil is the former editor of Property Report and has written for PropertyGuru, iProperty.com, Yahoo! Singapore/Malaysia, The Malay Mail, Berita Harian, Real Estate Malaysia, Property Buyer and The Star, among others.

Renowned for his independent views and insights on the property market, Khalil is a highly sought-after speaker in Malaysia and Singapore. He has given talks at various expos and at property launches. He was also on the judging panel of the South East Asia Property Awards (Malaysia). He has written two bestselling books - Get It Right Iskandar and Property Buying for Gen Y.

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.