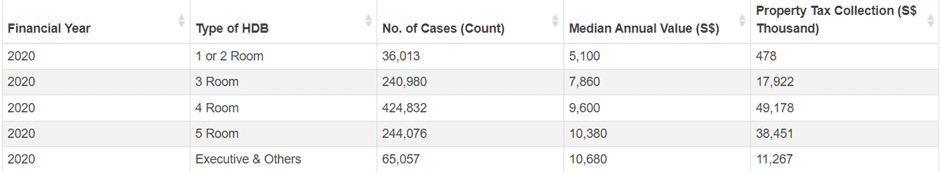

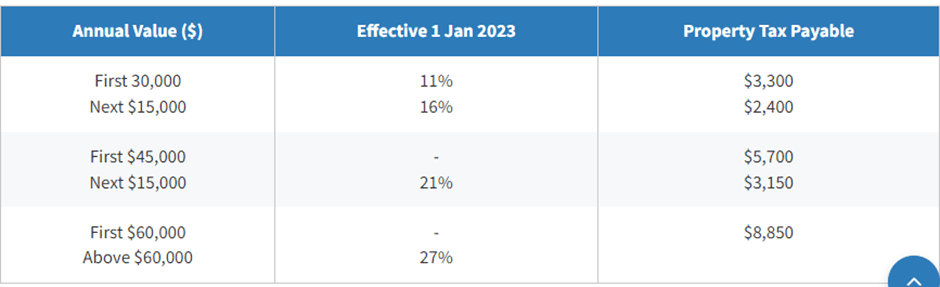

Non-Owner-Occupied Residential Properties:

Most of the impact will be felt by this group of homeowners by the nature of this “Wealth Tax”. This form of tax is derived from the value of your home.

For example,

- Properties with annual value at S$30,000: The property tax payable will be as follows – S$3000 (Before 31st Dec 2022), S$3300 (1st Jan 2023) and S$3600 (1st Jan 2024). The increase will be a difference of $600 which may be palatable to most owners.

- Properties with annual value at S$60,000: The property tax payable will be as follows –S$6900 (Before 31st Dec 2022), S$8850 (1st Jan 2023) and S$10,800 (1st Jan 2024). The increase will be a difference of S$3,900 by 2024.

- Properties with annual value at S$90,000: The property tax payable will be as follows – S$12,000 (Before 31st Dec 2022), S$16,950 (1st Jan 2023) and S$21,600 in (1st Jan 2024). The difference will be S$9,600 annually by 2024.

If you’re wondering how the figures above are derived, here’s a quick calculation to show you: if you have a property with annual value at $90,000 on 1 Jan 2023, we use S$8,850 (First S$60k annual value) + S$30k x 27% (Remaining S$30K annual value) = $16,950

Useful information to note:

- Annual property tax is calculated by multiplying the Annual Value (AV) of the property with the Property Tax Rates that apply to you.

- Non-residential properties such as commercial and industrial buildings and land are taxed at 10% of the Annual Value. Owner-occupied tax rates do not apply to non-residential properties even if you have bought the properties for your own use/occupation.

- Vacant residential property will be taxed at the non-owner occupied residential tax rates and vacant non-residential property will be taxed at 10% of the annual value.

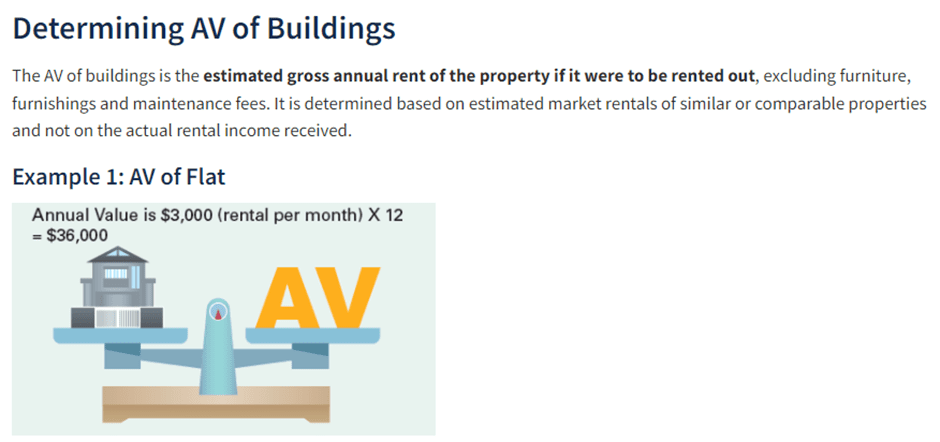

- If you’re wondering how the Annual Value of your property is calculated, here is an example. Alternatively, you can check your property’s Annual Value via the IRAS website.

IRAS in this case will rely on market rentals of similar or comparable properties in the development to determine the AV of the property. E.g. if the development’s monthly rentals are ranging from S$4000-5200, the AV of the property may be derived at S$36,000 ($3000 x 12), after deduction for furniture, furnishing and maintenance fees.

Conclusion with a twist!

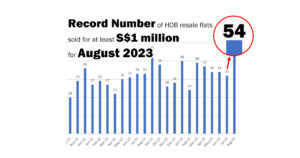

This latest increase in property tax is seen as a “national fund rebuilding event” rather than another set of cooling measures that we have seen at the end of 2021. Property assets have proven to be a good wealth hedge that rides with inflation and the increase in property tax alone will not hamper the current buoyant property market. In the case of non-owner occupied properties, the increase in property taxes is likely to be passed on to potential tenants as rental costs. However, that doesn’t seem to dampen the demand for rental units. As an active Realtor in the rental market, I have personally seen many residential rental units taken up in a few days even without actual physical viewings. A well known local developer has also cited that their existing rental inventory is depleting at an extremely fast rate in 2021/22.

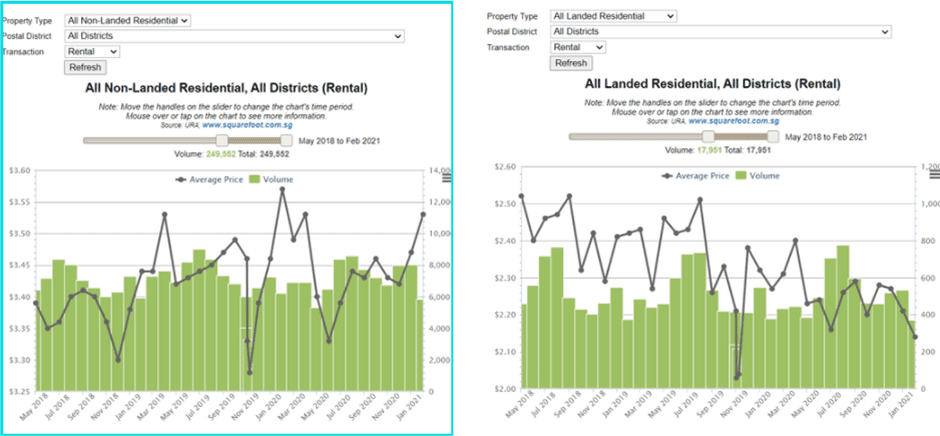

I would like to end off by assuming that the high-end residential (non-owner occupied) investors will still be extremely bullish in their investment and will successfully pass on some of the cost to their tenants. Interestingly, many of the rental pricing for these landed residential units are actually dropping during the COVID period. While volume is still maintained, the rental pricing is actually dropping (see above right chart). The work from home effect and cost of maintenance is likely to push the available group of tenants towards bigger size condominium units instead of as these units provide the convenience of condominium facilities. The cost of maintenance during this period is also a contributing factor. The maintenance fee in a condominium is borne by Landlord while on the other hand, non-structural maintenance in landed or higher-end luxury homes is taken care of by the tenant.

In closing, without first considering other drivers, buyers of such high-end luxury homes who will be occupying them as residential homes will not be hampered. If you’re someone who belongs in the pure investor group and you’re holding back to further evaluate your costs / still worried about the changes, feel free to contact Joshua for a free no-obligation consultation where you can discuss your options in a more in-depth manner.

Joshua Cheong

Joshua comes with a wealth of property underwriting experience having worked for over 10 years in several top global and Fortune 500 companies serving clients such as Samsung, LG Electronics and other homegrown companies such as SIA, Ascendas etc

Joshua is a dedicated and detailed Real Estate Realtor and together with his Property knowledge, he has successfully served many Clients in their property progression journey.

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.