Ever thought of getting a landed home as your next ideal home?

Is buying a landed home a good investment if one is considering buying real estate?

We’ll begin with some quick numbers to get you up to speed.

Limited Supply, Growing Demand

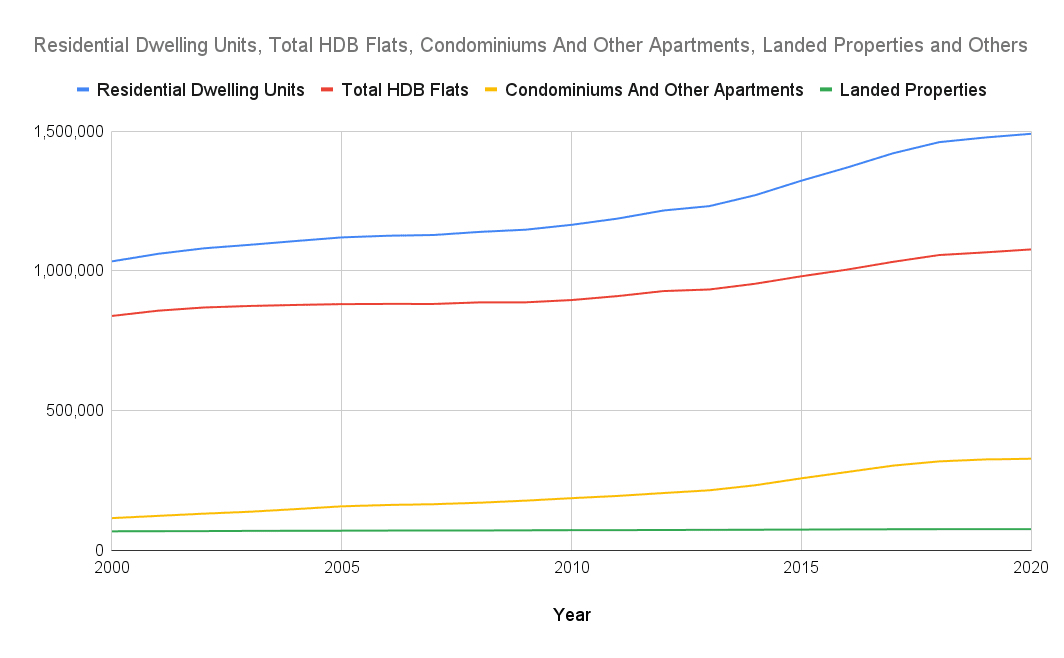

Source: https://www.singstat.gov.sg/publications/reference/ebook/industry/building-real-estate-construction-and-housing

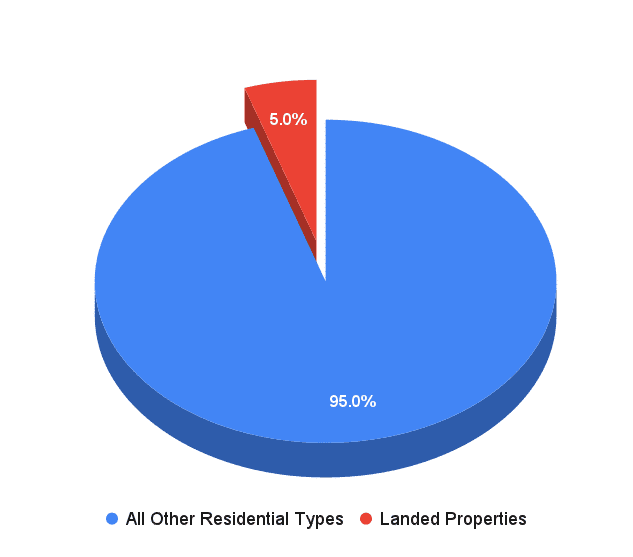

The total number of landed properties in Singapore as of June 2020 is 75,185 units. With the landed housing making only 75,185 out of the 1,490,946 residential dwelling units in Singapore, the landed segment only occupies a mere 5.04% of the total residential units in Singapore.

Rare? Definitely!

Importantly, supply is highly limited in the landed segment.

And if we look at the trend, the supply of landed homes in the past 20 years barely moves.

Looking back at the 5 & 10 years timeframe from Jun 2020, landed home supply only increased by a miserable 2.37 and 5.37%.

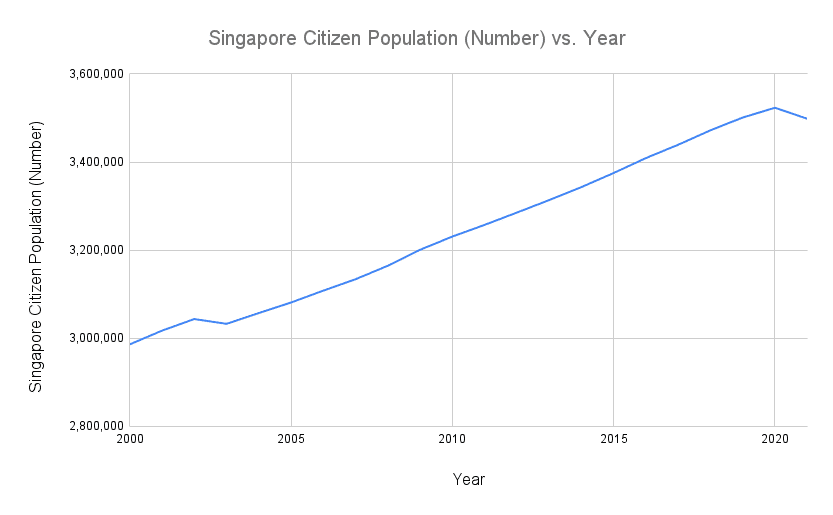

If the population of Singaporeans keeps growing and demands for landed homes increase proportionately, what do you think would happen to the prices?

OK. There’s a slight blip in the growing number of Singaporeans from 2020 to now. Let’s hope that the Covid-19 situation does get better and does not obliterate the Singaporean out of this world.

Note: Only Singaporeans can buy landed property, and Permanent Residents need to apply to the Land Dealings Approval Unit (LDAU) of SLA LDAU for approval to purchase landed property. It’s a privilege as a Singaporean to own a piece of Singapore land!

Is it a good store of value as touted?

Yes, the population is growing, but the growing population may not be interested in landed housing. True?

Let’s dive into the price trend of landed housing by looking back 15 years from 2006. We will also be using resale condominiums as a yardstick for assessing the landed housing.

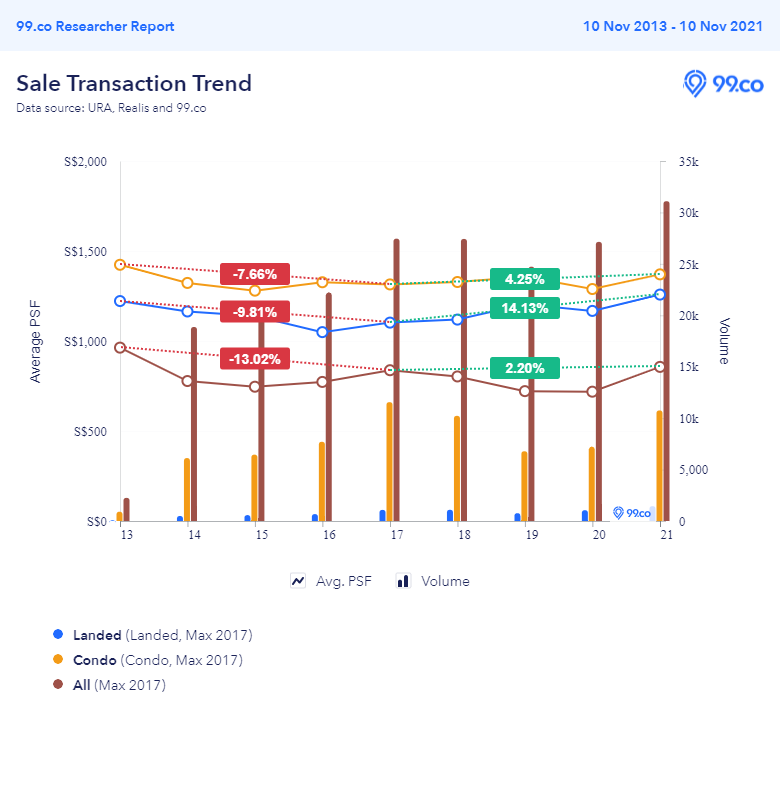

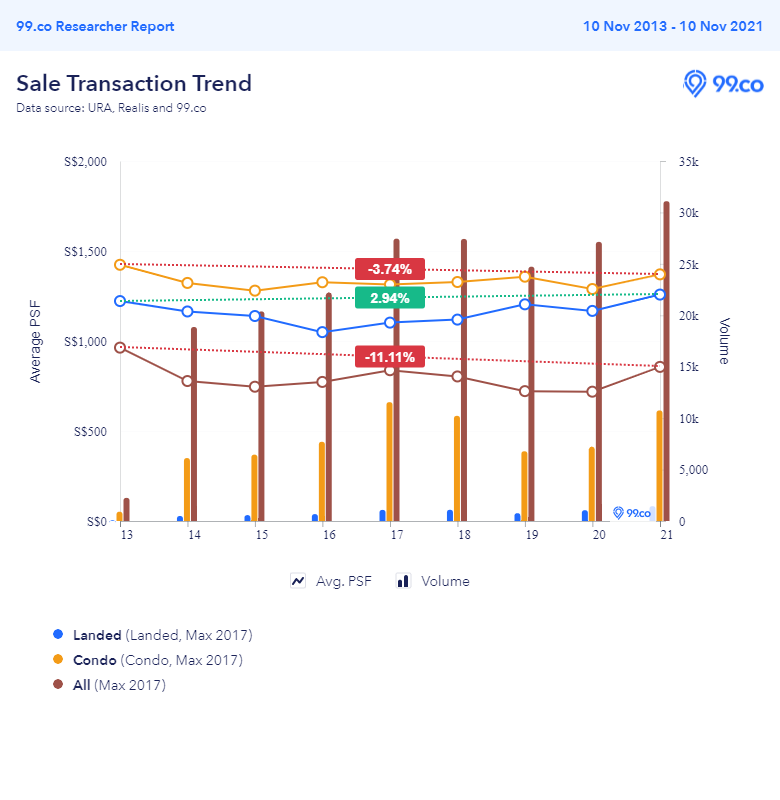

Due to the limitation of 99.co analytic system, we filtered the resale condo by only considering condos built by 2017 and broke the chart into two timelines, 2006 to 2013 and 2013 to 2021, for discussion.

Between 2006 to 2013, we experienced the subprime crisis where asset value tumbled from 2007 to 2008. And between 2008 and 2013, prices shot through the roof, triggering the onset of several sets of cooling measures.

During the tumble, the entire property market dived -25.82%, resale condo saw its Average PSF dipping by 9.88%. Interestingly, landed home held its fort, bucked the trend and saw a gradual appreciation in its average PSF by 6.24%.

When times were good, the landed homes outperformed its peer; between 2008 to 2013, its average PSF rose by a whopping 83.7%, while the market as a whole rose by 70.20%, and the resale condo rose at half its pace at 48.49%.

After the implementation of cooling measures, the market cooled by 13.02%. Disappointingly, landed homes fell at a higher degree of 9.81% compared to the 7.66% of the resale condo.

However, landed homes showed who’s the boss when the market picked up.

While the market rose by 2.2% and resale condos rose by 4.25%, landed homes almost triple the pace of growth of resale condos with a 14.13% uptick in its average PSF between 2017 and 2021.

In the resale market, landed homes surpassed the previous high in 2013, leaving its peers in the dust.

WAIT!

Before you plunge into getting a landed home after hearing the upside of landed home, remember that not all landed are created equal. There are landed homes that made losses. There are particular districts where prices of landed homes have been lacklustre. There are homes where its district is performing well, but a particular locality within the district is underperforming. It can also be that the house itself has its unique issue among the whole cluster.

So, before you head out to get a landed home, it is highly recommended that you seek the assistance of a trusted real estate advisor who has experience in landed homes or keep a lookout for my next article on how to identify a good landed home.

Andy Seng

Living and breathing landed, Andy Seng has provided valuable insights and real estate services to his clients regarding landed homes.

Enjoy what you have been reading? Join our mailing to get valuable insights delivered to your inbox today.