For quite some time, Singapore’s real estate market has attracted investors, and the Core Central Region (CCR) stands out as the central and captivating area. While it has shown slightly slower growth compared to RCR and OCR in recent comparisons, CCR remains an attractive choice for astute investors. During a recent conversation with a client, we unearthed intriguing hidden opportunities within this enigmatic region.

This article will examine the data and trends that back CCR’s investment potential and explore the factors that influence the choice between resale and new launch condos.

Understanding the Price Gap

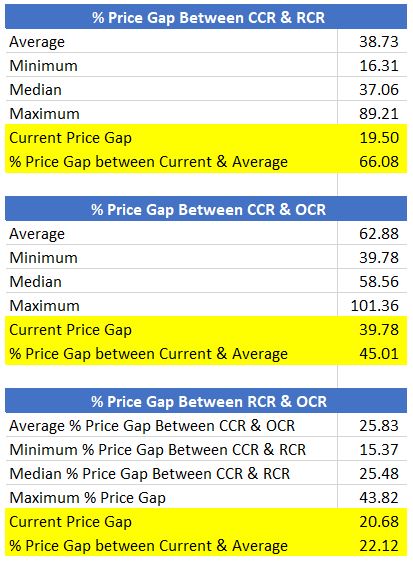

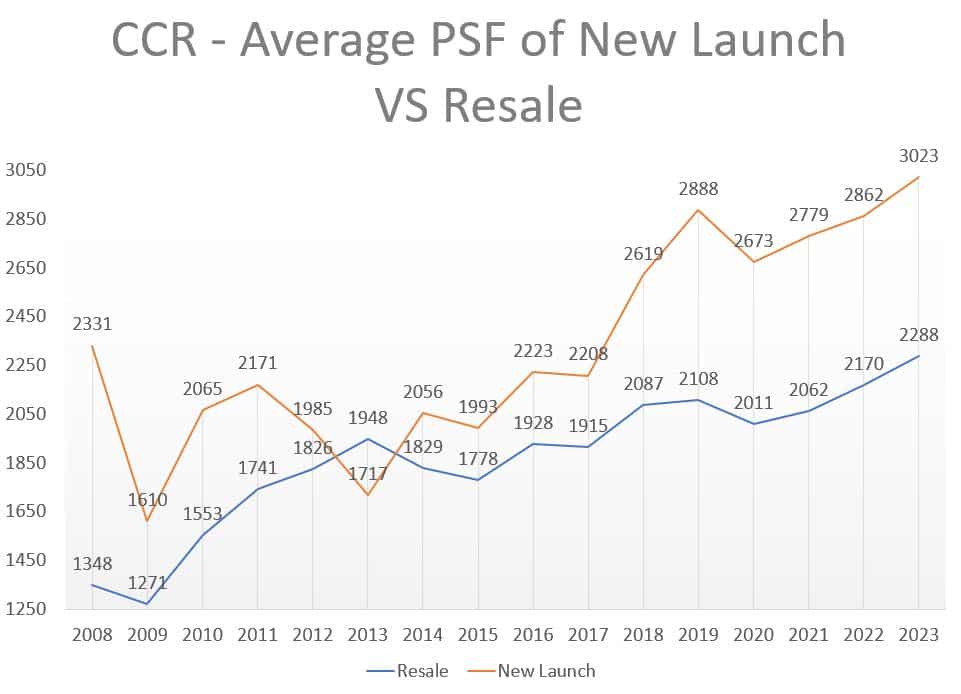

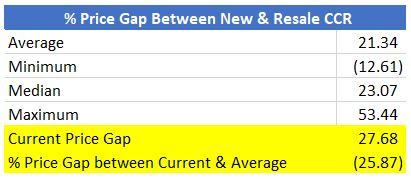

One of the key metrics used in assessing the investment potential of CCR properties is the price gap analysis.

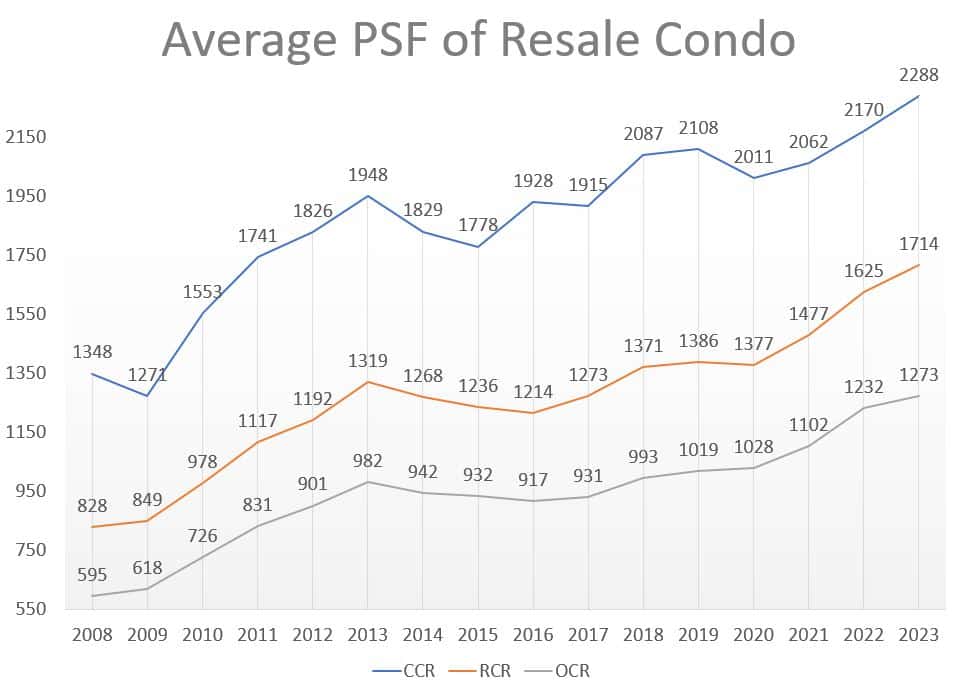

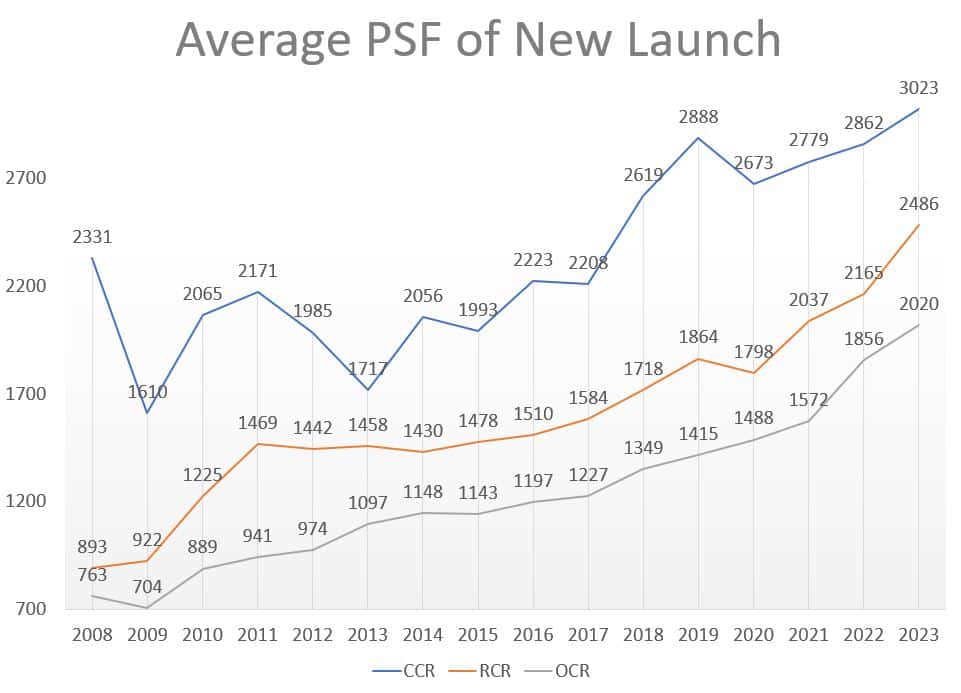

By comparing the average price per square foot (PSF) trends for resale condos in CCR, Rest of Central Region (RCR), and Outside Central Region (OCR) over a 15-year period, valuable insights can be gained.

Resale Market

Over time, the average price difference between resale private condos in the Core Central Region (CCR) and the Rest of the Central Region (RCR) has been 39.11%, whereas the difference between CCR and Outside Central Region (OCR) has been a more significant 66.79%. However, the recent surge in property prices, primarily fueled by local demand from border control measures, has led to faster price increases in RCR and OCR compared to CCR. As a result, the price gap has now narrowed to 28.69% between CCR and RCR and 57.01% between CCR and OCR.

Primary Market

The price gap between CCR and RCR is notably more substantial in the primary market, which includes new launches. The difference stands at 19.50%, which is lower than the 15-year average of 38.73%. Likewise, comparing CCR to OCR, the 15-year average price gap has been 62.88%, while the current narrowing gap is 39.78%. These figures suggest considerable potential for investment gains in the primary market, particularly in new launch properties within the Core Central Region.

Opportunity in CCR

With the ongoing trend of prices in RCR and OCR narrowing the gap to CCR, a potential opportunity emerges for investors in the Core Central Region. As the prices of properties in RCR and OCR draw nearer to those in CCR, prospective buyers are likely to shift their focus to the latter, increasing prices. Consequently, it is reasonable to anticipate that prices in CCR will align more closely with their fair value, rendering it an attractive investment prospect.

Resale vs. New Launch

For those considering investing in CCR, another critical aspect to address is the choice between resale and new launch condos. Analyzing the price gap for both segments can offer valuable insights.

When considering options between resale and new launch properties in CCR, it seems that resale offers slightly better value compared to new launches.

Factors to Consider

The price gap analysis in CCR reveals promising investment opportunities, but it is crucial to consider individual preferences and requirements before making a decision.

- Urgency: If immediate occupancy is a priority, resale condos might be a better option since new launch projects tend to have longer completion timelines.

- Preference: Understanding whether you lean towards the appeal of brand-new properties or the unique charm of older resale condos can help guide your decision.

- Investment Horizon: Consider your plans for the property’s holding period. If it’s a short-term investment (less than five years), it can influence the suitability of resale or new launch condos for your needs.

The Core Central Region of Singapore continues to present promising investment opportunities in the real estate market. Clients can make well-informed decisions on whether to invest in resale or new launch condos through a comprehensive analysis of the price gap and consideration of individual preferences and investment goals. As always, seeking professional advice and conducting thorough research before venturing into any investment opportunity is essential. Investing in CCR properties can be a rewarding and potentially lucrative venture with the right approach.

Edwin Goh

With his love for numbers and data, Edwin has provided valuable insights to his clients and readers to empower them to make better-informed real estate decisions.